Franklin Ohio Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions In Franklin, Ohio, individuals and businesses have the option to borrow money through a promissory note and resolve their financial needs efficiently. A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and other important details. When it comes to borrowing money in Franklin, Ohio, utilizing a resolution form can formalize the process and ensure all parties involved are on the same page. A resolution form, specifically designed for corporate entities, is a written record of a decision made by the company's board of directors authorizing the borrowing of funds using a promissory note. By employing a resolution form in Franklin, Ohio, corporations can enjoy several benefits, including: 1. Clarity and Authorization: A resolution form clarifies the intent of the borrowing, ensuring that it is clearly recognized by all parties involved. It authorizes key individuals, such as the president or CFO of the corporation, to execute the promissory note on behalf of the company. 2. Legal Compliance: Utilizing a resolution form ensures that all legal requirements are met, safeguarding the interests of both the borrower and the lender. This can mitigate potential disputes or complications in the future. 3. Accountability and Transparency: The resolution document provides transparency to shareholders and stakeholders by clearly outlining the details of the loan, demonstrating responsible corporate governance. Types of Franklin Ohio Borrow Money on Promissory Note — Resolution Form— - Corporate Resolutions: 1. Short-Term Borrowing Resolution: This type of resolution form is used when a corporation needs to borrow money for a short period, typically less than a year. It outlines the purpose of the loan, the specific terms, and the repayment plan. 2. Long-Term Borrowing Resolution: When a corporation requires a larger loan with a longer repayment period, a long-term borrowing resolution form is utilized. This document clearly states the purpose, repayment schedule, interest rate, and any collateral provided for the loan. 3. Line of Credit Resolution: This resolution form is suitable for corporations that need ongoing access to credit. It authorizes the borrowing of funds up to a predetermined limit, with the ability to repay and borrow repeatedly within that limit. 4. Equipment Financing Resolution: In cases where a corporation needs to finance the purchase of equipment or machinery, an equipment financing resolution form may be used. It specifies the details of the loan, the equipment being financed, and any applicable terms and conditions. In conclusion, Franklin, Ohio offers various options for corporations to borrow money using a promissory note, and utilizing a resolution form ensures clarity, legal compliance, and transparency in the borrowing process. Whether it's for short-term, long-term, lines of credit, or equipment financing, these resolution forms provide a structured and formal approach to corporate borrowing.

Franklin Ohio Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Franklin Ohio Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Franklin Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Franklin Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Franklin Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions:

- Make sure you have opened the right page with your regional form.

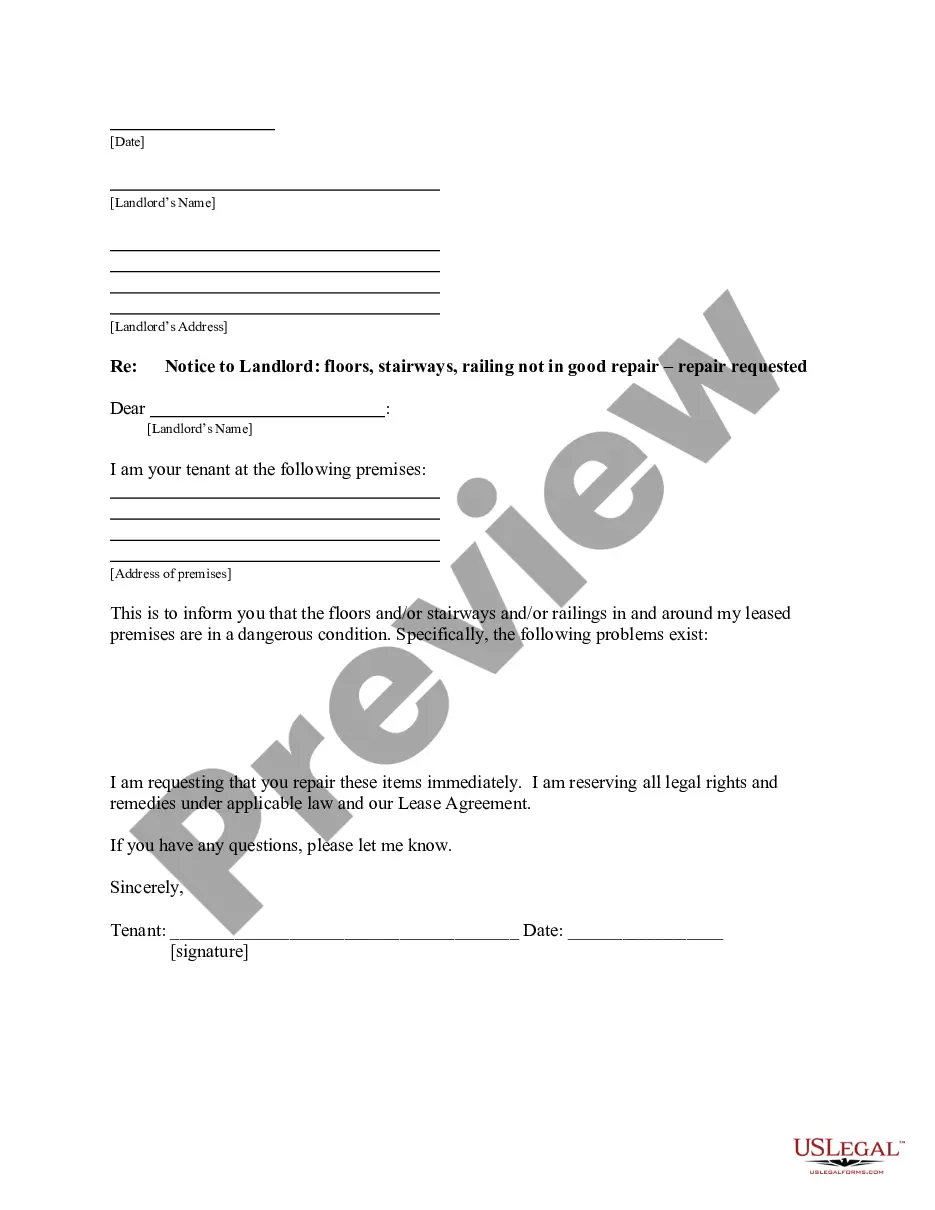

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Franklin Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!