San Antonio, Texas is a vibrant city located in the southern part of the state. Known for its rich history, diverse culture, and thriving economy, San Antonio is a popular destination for tourists and a hub for various industries. One common financial practice in San Antonio is borrowing money on a promissory note, which is often facilitated through the use of a resolution form and corporate resolutions. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, the interest rate, and the repayment schedule. Borrowing money on a promissory note can be done by individuals, businesses, or corporations, and it is a widely accepted practice in the financial world. San Antonio offers numerous resources and financial institutions that provide options for borrowing money on a promissory note. To ensure the legality and transparency of borrowing transactions, individuals and businesses in San Antonio often make use of resolution forms and corporate resolutions. These documents serve as written records of decisions made by the corporate board or entity's management, providing official authorization for borrowing activities. Corporate resolutions can take various forms, depending on the specific requirements and preferences of the involved parties. Some different types of San Antonio Texas Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions include: 1. General Corporate Resolution Form: This is a versatile document used for a wide range of corporate decisions, including borrowing money on promissory notes. It typically includes specific provisions related to the terms and conditions of the borrowing arrangement, ensuring all necessary parties are in agreement. 2. Special Corporate Resolution Form: This type of resolution form is tailored to address unique circumstances or specific requirements associated with borrowing money on a promissory note. It may include additional clauses or conditions specific to the loan transaction at hand. 3. Shareholder Resolution Form: In situations where borrowing involves shareholders or stockholders, a shareholder resolution form may be required. This document outlines the decisions made by the shareholders regarding the loan and is typically used to validate their consensus. 4. Board of Directors Corporate Resolution Form: When borrowing money on a promissory note for a corporation, a resolution form involving the board of directors is often necessary. This document outlines the decisions made by the board members, ensuring the loan transaction aligns with the company's goals and objectives. In conclusion, San Antonio, Texas offers a range of options for individuals, businesses, and corporations looking to borrow money on a promissory note. Corporate resolutions and resolution forms play a crucial role in providing legal authorization and transparency to these borrowing activities. Understanding the different types of corporate resolutions available ensures that all parties involved are in agreement and that the borrowing process is conducted in a legally compliant and efficient manner.

San Antonio Texas Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

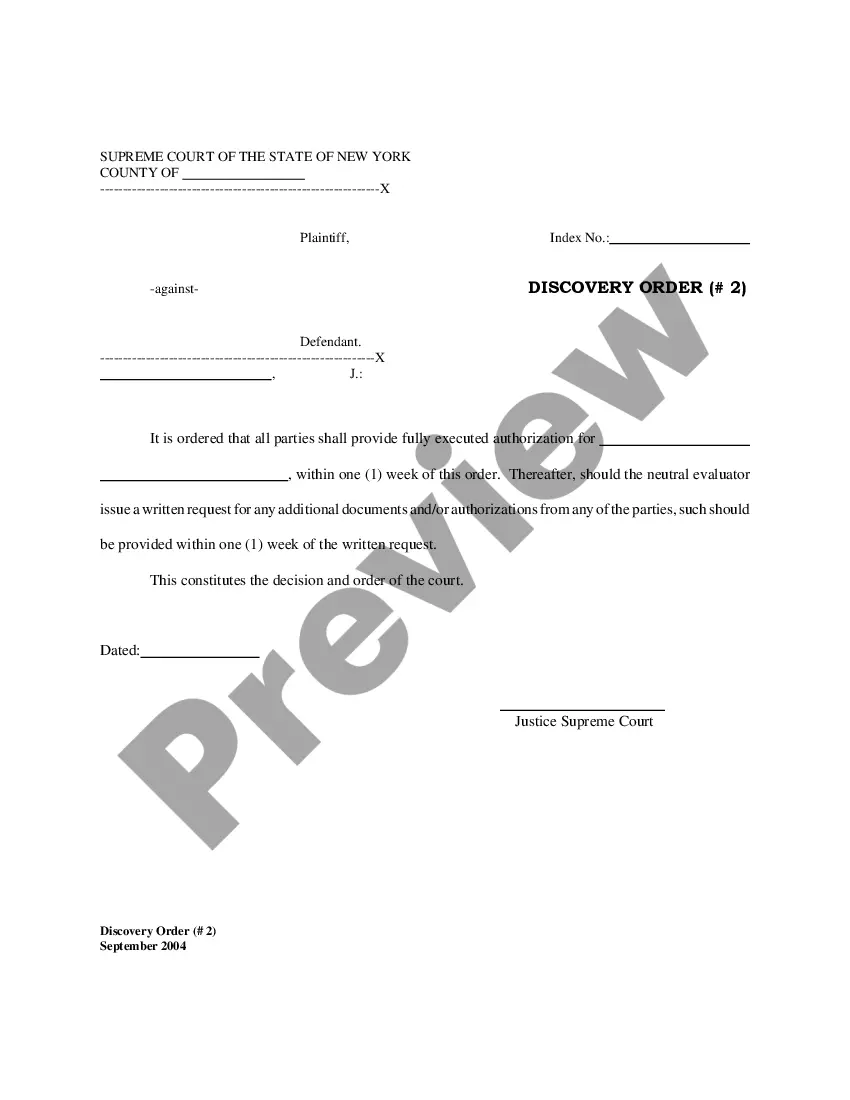

How to fill out San Antonio Texas Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Drafting documents for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate San Antonio Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid San Antonio Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the San Antonio Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions:

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!