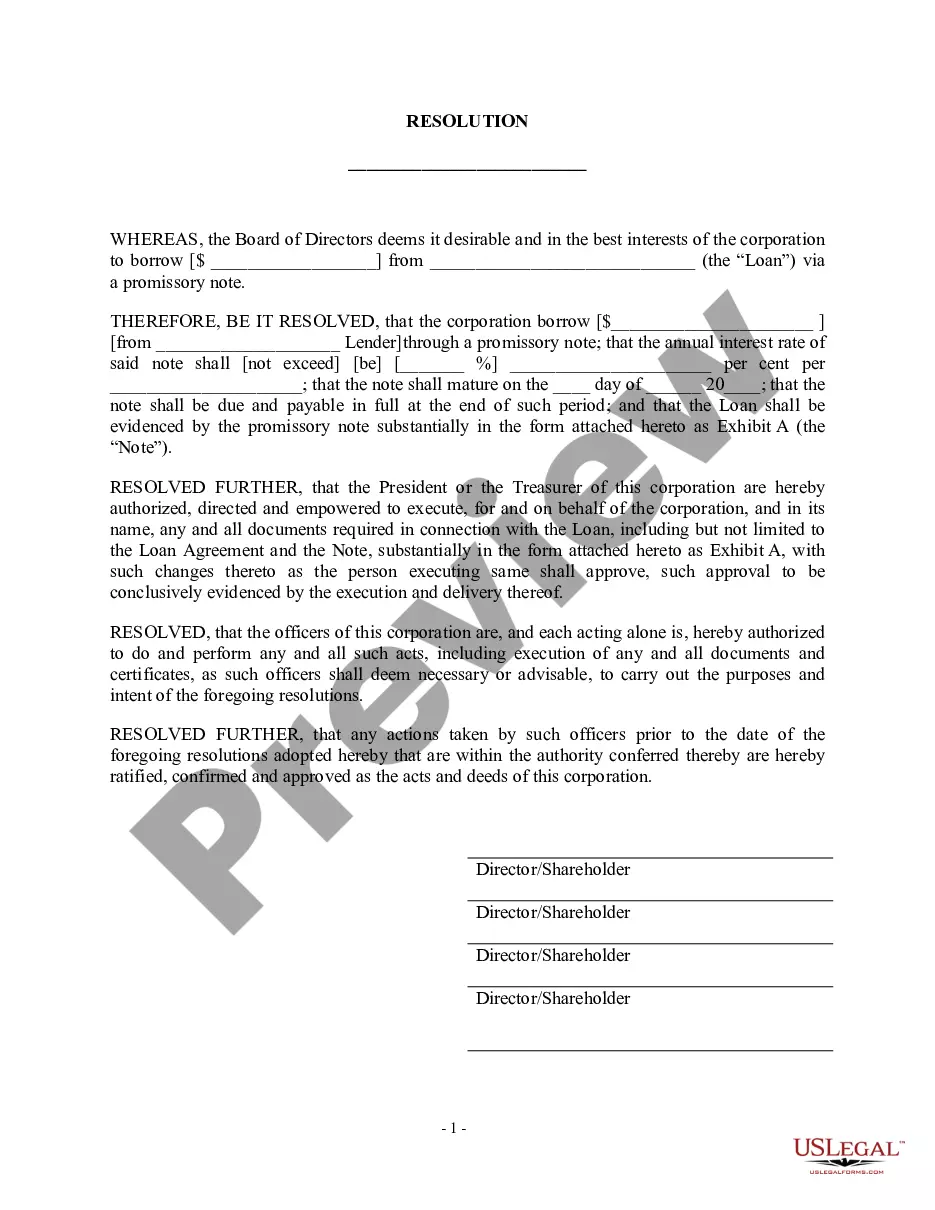

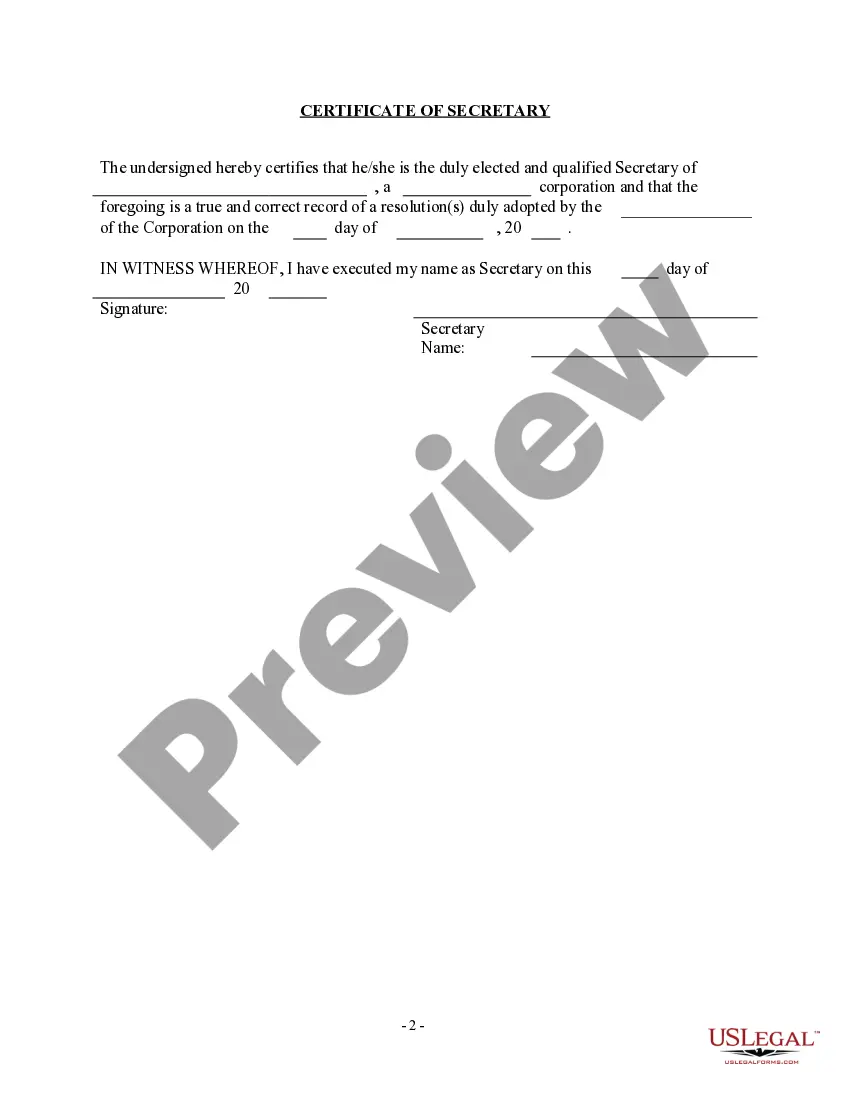

San Jose California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions serves as a legally binding document for companies in San Jose, California, that wish to borrow money using a promissory note. This document outlines the terms and conditions agreed upon by the borrowing company and the lender. The San Jose California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions includes key information such as the names and addresses of both parties involved, the principal amount borrowed, the interest rate, repayment terms, and any collateral provided as security for the loan. It also specifies the responsibilities and obligations of each party. There are several types of San Jose California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions, based on the specific needs of the borrowing company: 1. Traditional Corporate Borrowing Resolution: This type of resolution is commonly used when a company borrows money from a bank or financial institution. It outlines the terms and conditions, repayment schedule, and other relevant details. 2. Shareholder Approval Resolution: In cases where a company needs to borrow money from its shareholders, this resolution is necessary. It ensures that all shareholders are aware of the loan and provide their approval. 3. Board of Directors Resolution: When a company borrows money from external sources, such as private investors or venture capitalists, a board of directors resolution is typically required. This resolution formalizes the board's decision to borrow money on behalf of the company. 4. Internal Borrowing Resolution: In situations where a company borrows money internally, such as from a subsidiary or a related entity, an internal borrowing resolution is needed. This resolution establishes the terms and conditions of the loan within the corporate group. In conclusion, the San Jose California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions provide a clear and legally binding agreement between a borrowing company and a lender. It ensures transparency, protects the interests of both parties, and specifies the obligations and responsibilities related to the borrowed funds.

San Jose California Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out San Jose California Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the San Jose Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Jose Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Jose Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions:

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!