Allegheny Pennsylvania Sale of Business — Promissory Not— - Asset Purchase Transaction is a legal agreement for the sale and transfer of a business's assets in Allegheny County, Pennsylvania. This transaction involves the use of a promissory note as a form of payment. In this type of transaction, the seller agrees to sell their business assets to the buyer, who agrees to pay the purchase price in installments over a specified period of time. The promissory note serves as a written promise to pay the seller the agreed-upon amount, typically with interest, in regular scheduled payments. The Allegheny Pennsylvania Sale of Business — Promissory Not— - Asset Purchase Transaction is a common method utilized by business owners who want to sell their business but do not receive the entire purchase price upfront. This type of transaction allows for a smoother and more flexible transfer of ownership. There are different types of Allegheny Pennsylvania Sale of Business — Promissory Not— - Asset Purchase Transactions based on the specific terms and conditions agreed upon between the buyer and seller. They may include: 1. Installment Sale: This type of transaction involves the buyer making regular installment payments to the seller over an agreed-upon period, usually with interest. The assets are transferred to the buyer upon the initial payment, and the seller retains a security interest in the assets until the note is fully paid. 2. Balloon Payment: In this scenario, the buyer makes smaller periodic payments for a certain period, but a larger lump sum payment, known as the balloon payment, is due at the end of the term. This arrangement allows the buyer to have some time to generate income from the business before making the final payment. 3. Seller Financing: This type of transaction involves the seller acting as the lender and financing the purchase for the buyer directly. The seller becomes the creditor and the buyer becomes the debtor, with the purchase price paid off through regular payments. 4. Secured Transaction: This type of transaction involves securing the promissory note with collateral, such as the business assets being sold or any other asset agreed upon by both parties. The collateral serves as security for the seller's investment until the buyer fully pays off the promissory note. In conclusion, the Allegheny Pennsylvania Sale of Business — Promissory Not— - Asset Purchase Transaction is a legal agreement used to facilitate the sale and transfer of a business's assets in Allegheny County, Pennsylvania. There are different types of these transactions, including installment sales, balloon payment arrangements, seller financing, and secured transactions, depending on the specific terms and conditions agreed upon between the buyer and seller.

Allegheny Pennsylvania Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Allegheny Pennsylvania Sale Of Business - Promissory Note - Asset Purchase Transaction?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Allegheny Sale of Business - Promissory Note - Asset Purchase Transaction, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed resources and guides on the website to make any activities associated with document completion straightforward.

Here's how you can locate and download Allegheny Sale of Business - Promissory Note - Asset Purchase Transaction.

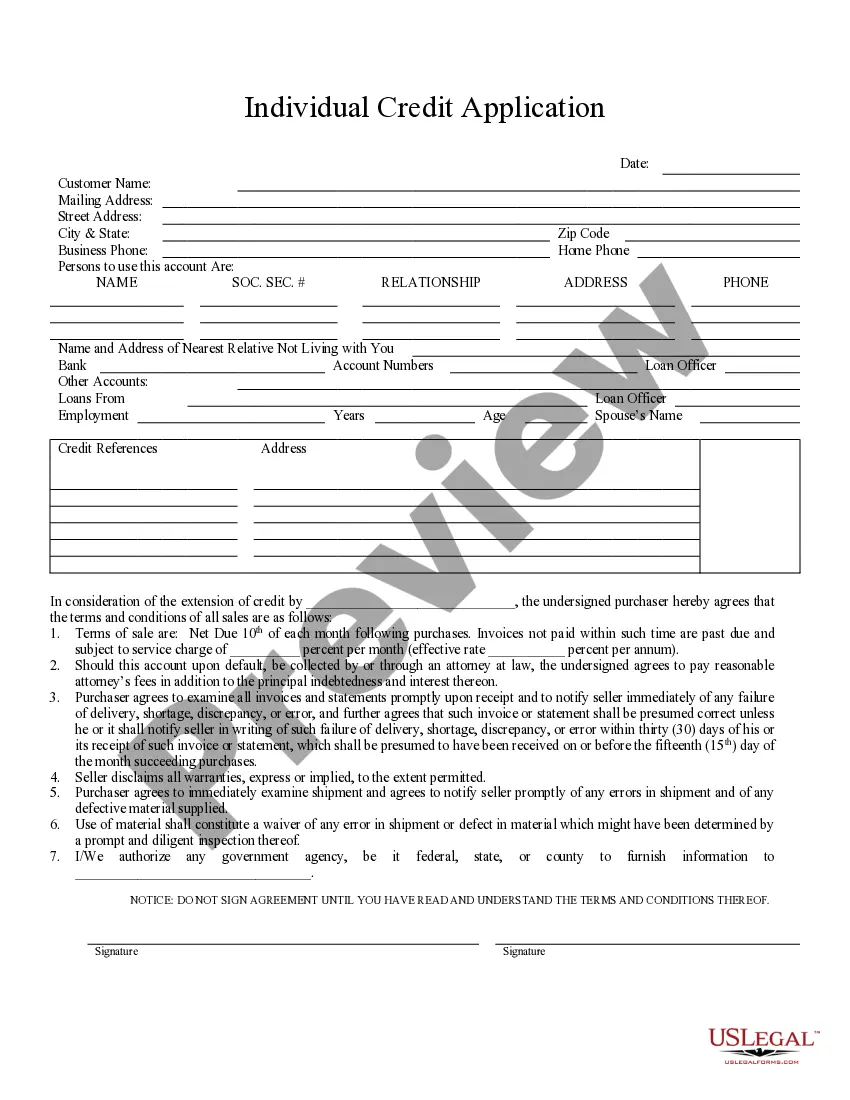

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Allegheny Sale of Business - Promissory Note - Asset Purchase Transaction.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Allegheny Sale of Business - Promissory Note - Asset Purchase Transaction, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you have to deal with an exceptionally complicated case, we advise using the services of an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

An asset sale transaction involves the sale of some or all of the assets used in a business from a selling company to a buyer.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

An asset purchase agreement (also known as a 'business purchase agreement' or 'APA') is an agreement setting out the terms and conditions relating to the sale and purchase of assets in a company.

An asset purchase agreement (APA) is a definitive agreement that finalizes all terms and conditions related to the purchase and sale of a company's assets. It is different from a stock purchase agreement (SPA) where company shares, including title to the assets and liabilities, are being bought/sold.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.