Miami-Dade Florida is a vibrant county located in the southeastern part of the state. Known for its beautiful beaches, diverse culture, and thriving business environment, Miami-Dade offers a wide range of opportunities for entrepreneurs looking to buy or sell businesses through the Sale of Business — Promissory Not— - Asset Purchase Transaction. In a Sale of Business — Promissory Not— - Asset Purchase Transaction in Miami-Dade Florida, the buyer acquires the assets of an existing business while the seller provides financing through a promissory note. This type of transaction allows buyers to acquire established businesses with proven track records, assets, and customer bases, while sellers can receive additional income through the promissory note. There are several types of Miami-Dade Florida Sale of Business — Promissory Not— - Asset Purchase Transactions, including: 1. Retail Business: This type of transaction involves the sale and purchase of retail establishments such as clothing stores, restaurants, cafés, or grocery stores. Buyers may acquire the assets of the business, including inventory, equipment, and customer lists, while the seller may finance the purchase through a promissory note. 2. Service Business: Service-based businesses, such as accounting firms, salons, consulting agencies, or healthcare practices, can also be bought and sold through a Sale of Business — Promissory Not— - Asset Purchase Transaction. Here, buyers acquire the assets necessary to continue providing services to existing clients, while sellers receive payment through a promissory note. 3. Manufacturing Business: Another type of transaction involves the sale and purchase of manufacturing businesses, including factories or production facilities. Buyers can acquire the assets required for production, such as equipment, machinery, or inventory, while sellers have the option to finance the purchase through a promissory note. 4. E-commerce Business: With the rise of online retail, e-commerce businesses have become popular targets for buyers. These transactions involve the purchase of online stores, digital product businesses, or drop-shipping ventures. Buyers acquire the digital assets, websites, customer databases, and intellectual property, with the seller providing financing through a promissory note. In Miami-Dade Florida, Sale of Business — Promissory Not— - Asset Purchase Transactions provide a viable option for both buyers and sellers in a wide range of industries. Whether it's a retail store, service business, manufacturing facility, or e-commerce venture, this type of transaction allows for seamless business transfers, providing opportunities for growth and success in the competitive Miami-Dade market.

Miami-Dade Florida Sale of Business - Promissory Note - Asset Purchase Transaction

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00621

Format:

Word;

Rich Text

Instant download

Description

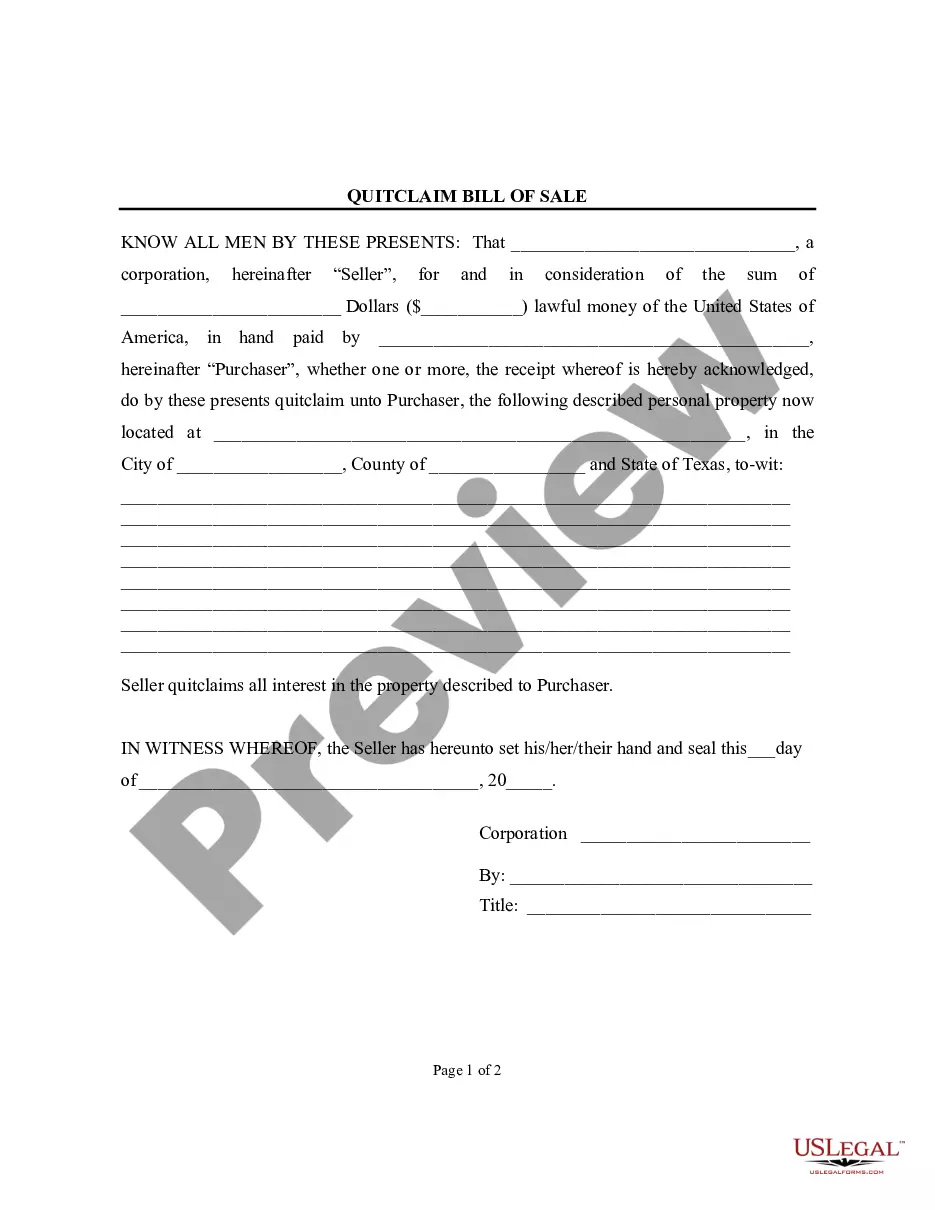

This form is a Promissory Note. The borrower promises to repay the lender, with interest, on a particular loan. The payments will be made in monthly installments and there is no penalty for pre-payment of the loan.

Miami-Dade Florida is a vibrant county located in the southeastern part of the state. Known for its beautiful beaches, diverse culture, and thriving business environment, Miami-Dade offers a wide range of opportunities for entrepreneurs looking to buy or sell businesses through the Sale of Business — Promissory Not— - Asset Purchase Transaction. In a Sale of Business — Promissory Not— - Asset Purchase Transaction in Miami-Dade Florida, the buyer acquires the assets of an existing business while the seller provides financing through a promissory note. This type of transaction allows buyers to acquire established businesses with proven track records, assets, and customer bases, while sellers can receive additional income through the promissory note. There are several types of Miami-Dade Florida Sale of Business — Promissory Not— - Asset Purchase Transactions, including: 1. Retail Business: This type of transaction involves the sale and purchase of retail establishments such as clothing stores, restaurants, cafés, or grocery stores. Buyers may acquire the assets of the business, including inventory, equipment, and customer lists, while the seller may finance the purchase through a promissory note. 2. Service Business: Service-based businesses, such as accounting firms, salons, consulting agencies, or healthcare practices, can also be bought and sold through a Sale of Business — Promissory Not— - Asset Purchase Transaction. Here, buyers acquire the assets necessary to continue providing services to existing clients, while sellers receive payment through a promissory note. 3. Manufacturing Business: Another type of transaction involves the sale and purchase of manufacturing businesses, including factories or production facilities. Buyers can acquire the assets required for production, such as equipment, machinery, or inventory, while sellers have the option to finance the purchase through a promissory note. 4. E-commerce Business: With the rise of online retail, e-commerce businesses have become popular targets for buyers. These transactions involve the purchase of online stores, digital product businesses, or drop-shipping ventures. Buyers acquire the digital assets, websites, customer databases, and intellectual property, with the seller providing financing through a promissory note. In Miami-Dade Florida, Sale of Business — Promissory Not— - Asset Purchase Transactions provide a viable option for both buyers and sellers in a wide range of industries. Whether it's a retail store, service business, manufacturing facility, or e-commerce venture, this type of transaction allows for seamless business transfers, providing opportunities for growth and success in the competitive Miami-Dade market.