Palm Beach, Florida is a popular location for business transactions, including the sale of businesses through promissory note-based asset purchase transactions. These transactions involve a legal agreement between the seller and buyer, where the buyer purchases the assets of a business using a promissory note. In a Palm Beach, Florida sale of business — promissory not— - asset purchase transaction, the seller transfers their business assets to the buyer in exchange for a promissory note. The promissory note outlines the terms and conditions of the sale, including the amount to be paid, the interest rate, and the timeline for payment. There are different types of Palm Beach, Florida sale of business — promissory not— - asset purchase transactions, including: 1. Full Sale: In a full sale, the entire business and all its assets are transferred to the buyer. This type of transaction is commonly seen when a business owner wishes to retire or exit the industry. 2. Partial Sale: In a partial sale, only a portion of the business assets are transferred to the buyer. This type of transaction may occur when a business owner wants to streamline operations or focus on specific aspects of the business. 3. Merger or Acquisition: In some cases, a Palm Beach, Florida sale of business — promissory not— - asset purchase transaction may involve the merging or acquisition of two businesses. This type of transaction allows for the consolidation of resources and expansion of market reach. 4. Franchise Purchase: Palm Beach, Florida is home to several franchises, and the sale of a franchise business through a promissory note-based asset purchase transaction is common. In this type of transaction, the buyer acquires the rights to operate a specific franchise in the area. Overall, Palm Beach, Florida offers a competitive market for sale of business — promissory not— - asset purchase transactions. The region's flourishing economy, attractive lifestyle, and business-friendly environment make it an ideal location for both buyers and sellers to engage in such transactions.

Palm Beach Florida Sale of Business - Promissory Note - Asset Purchase Transaction

Description

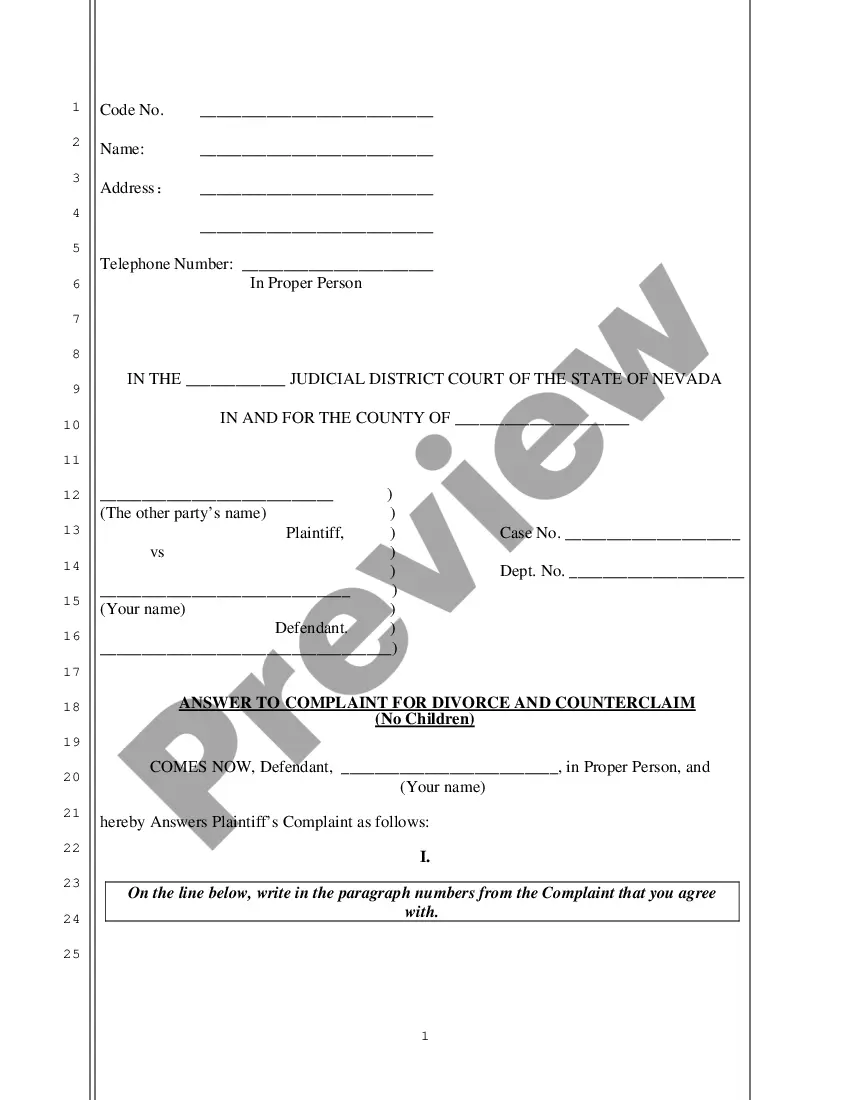

How to fill out Palm Beach Florida Sale Of Business - Promissory Note - Asset Purchase Transaction?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Palm Beach Sale of Business - Promissory Note - Asset Purchase Transaction, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Palm Beach Sale of Business - Promissory Note - Asset Purchase Transaction from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Palm Beach Sale of Business - Promissory Note - Asset Purchase Transaction:

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset purchase agreement (also known as a 'business purchase agreement' or 'APA') is an agreement setting out the terms and conditions relating to the sale and purchase of assets in a company.

This is because an asset purchase enables a buyer to pick exactly which assets they are buying and identify precisely those liabilities they wish to take over. It is important to identify what exactly is being purchased. Assets transferred as part of an Asset purchase agreement may include: plant and machinery.

Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

An asset purchase agreement (APA) is a definitive agreement that finalizes all terms and conditions related to the purchase and sale of a company's assets. It is different from a stock purchase agreement (SPA) where company shares, including title to the assets and liabilities, are being bought/sold.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.