Lima, Arizona Sale of Business — Promissory Note — Asset Purchase Transaction is a legal transaction that involves the sale of a business in Lima, Arizona, where the buyer agrees to make payments to the seller through a promissory note. This type of transaction is commonly used in business acquisitions when the seller agrees to finance a portion of the purchase price. The sale of business process in Lima, Arizona starts with the buyer and seller negotiating the terms and conditions of the transaction, including the purchase price, payment structure, and terms of the promissory note. Once an agreement is reached, a formal contract known as a Sale of Business — Promissory Not— - Asset Purchase Agreement is drafted. In this transaction, the promissory note acts as a legal document that outlines the buyer's promise to repay the seller over a specified period of time. It includes pertinent details such as the principal amount, interest rate, payment frequency, and any collateral involved. The asset purchase agreement complements the promissory note by specifying the assets being transferred, liabilities being assumed, and any other terms and conditions of the sale. There can be various types of Lima, Arizona Sale of Business — Promissory Note — Asset Purchase Transactions, depending on the specific circumstances and preferences of the parties involved. Some common variations include: 1. Full Purchase Price Promissory Note: In this type of transaction, the buyer agrees to pay the entire purchase price through a promissory note. The seller holds a security interest in the assets until the payment is complete. 2. Partial Purchase Price Promissory Note: In this scenario, the buyer pays a portion of the purchase price upfront in cash or other forms, and the remaining balance is financed through a promissory note. This allows the buyer to secure financing while requiring a smaller upfront payment. 3. Installment Payments Promissory Note: In an installment payments transaction, the buyer agrees to make regular payments over a specified period, typically with interest. This structure allows for flexibility in payment amounts and helps distribute the financial burden over time. 4. Balloon Payment Promissory Note: In a balloon payment transaction, the buyer agrees to make smaller periodic payments for a predetermined period, with a significant final payment known as the balloon payment. This type of arrangement is suitable when the buyer anticipates a large influx of cash in the future. When entering into a Lima, Arizona Sale of Business — Promissory Note — Asset Purchase Transaction, it is crucial for both parties to consult with legal professionals who specialize in business transactions to ensure compliance with local laws and best protect their interests.

Pima Arizona Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Pima Arizona Sale Of Business - Promissory Note - Asset Purchase Transaction?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Pima Sale of Business - Promissory Note - Asset Purchase Transaction suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Pima Sale of Business - Promissory Note - Asset Purchase Transaction, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Pima Sale of Business - Promissory Note - Asset Purchase Transaction:

- Check the content of the page you’re on.

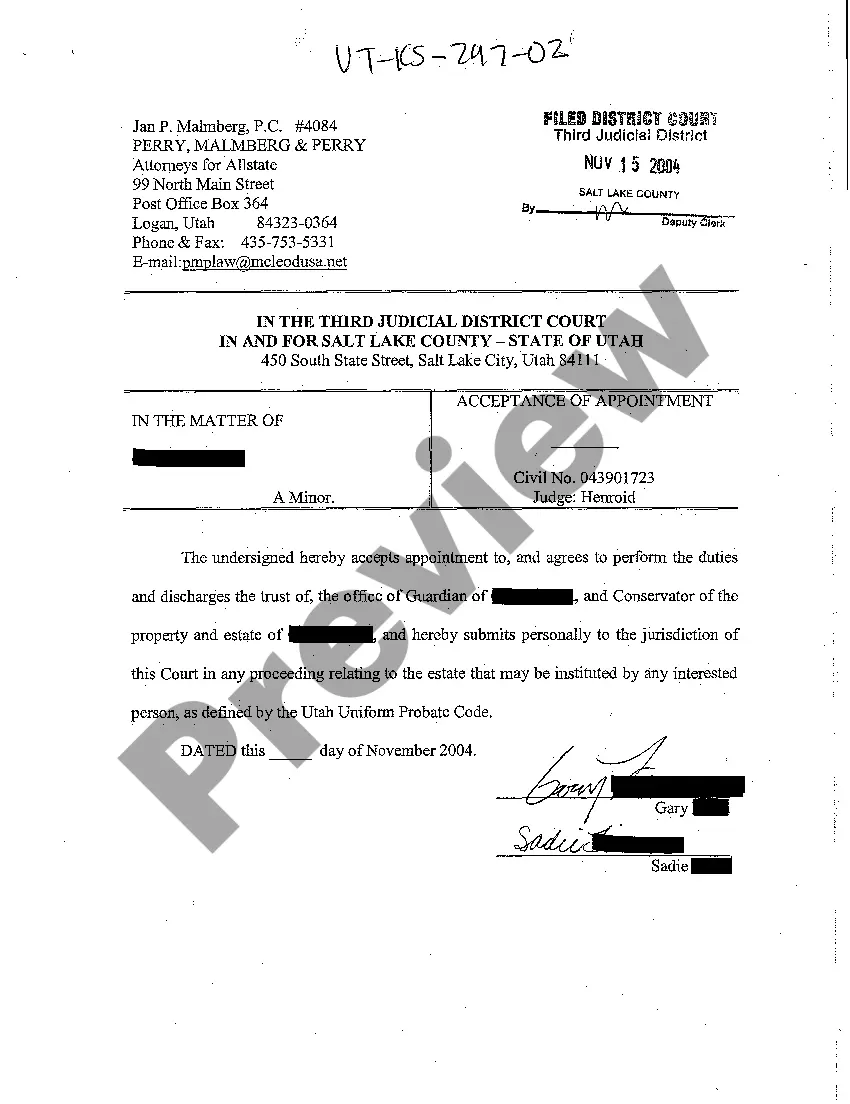

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Pima Sale of Business - Promissory Note - Asset Purchase Transaction.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!