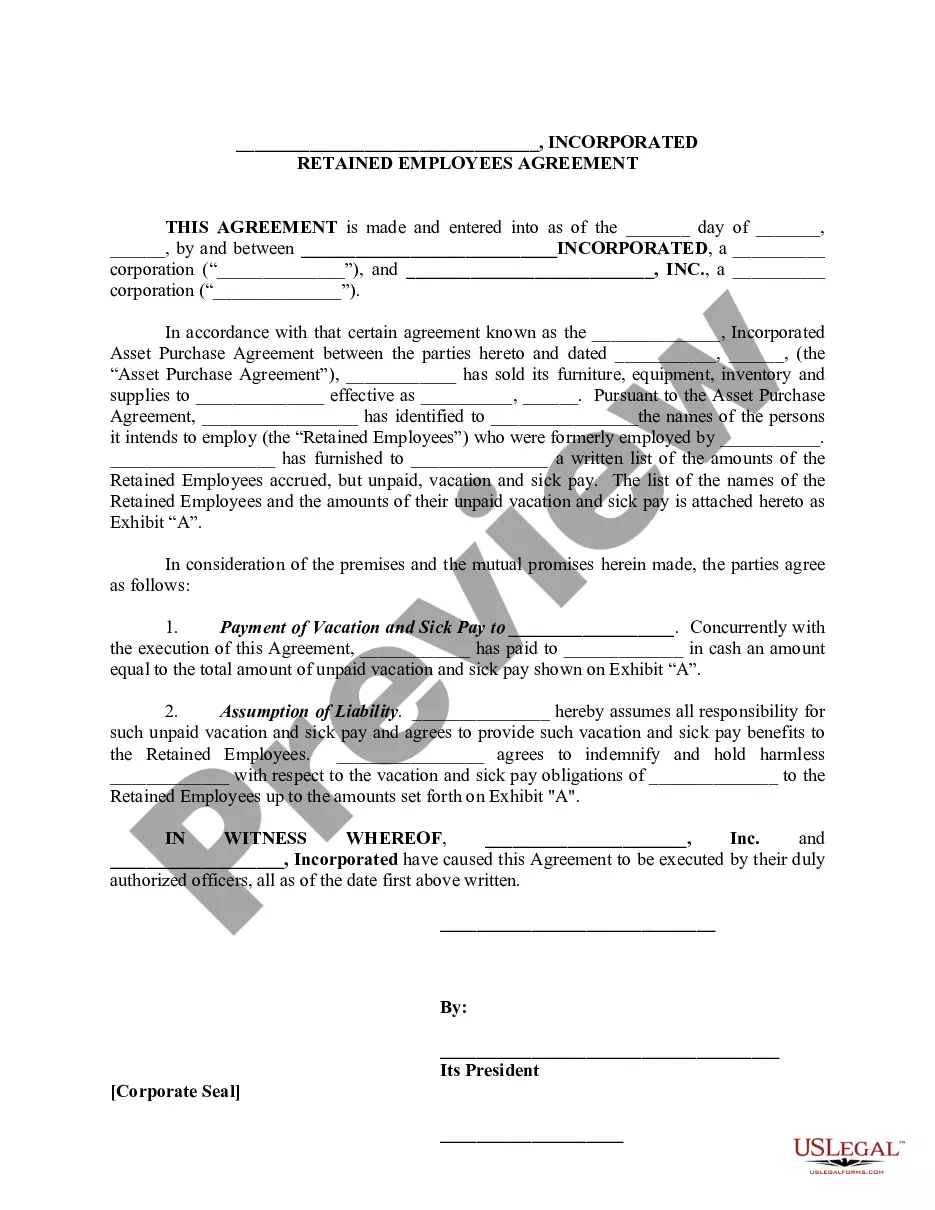

San Diego, California is a vibrant city located on the southern coast of California. Known for its stunning beaches, mild climate, and diverse culture, it has become a popular destination for both tourists and business owners alike. When it comes to the sale of a business in San Diego, there are various types of agreements that can be executed, one of which is the "Retained Employees Agreement" in an asset purchase transaction. In a typical San Diego Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction, a buyer acquires the assets of a business from the seller. This may include tangible assets such as equipment, inventory, and property, as well as intangible assets like customer lists, trademarks, and copyrights. However, rather than taking over the entire workforce of the seller, the buyer retains specific employees as agreed upon in the contract. This type of agreement is particularly common in situations where there are key employees who are crucial to the functioning of the business or possess specialized knowledge that the buyer intends to retain. By specifically identifying and retaining these employees, the buyer can ensure a smooth transition of operations and maintain continuity in business operations. The San Diego Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction offers benefits to both the buyer and the retained employees. For the buyer, it provides a level of comfort knowing that essential employees will remain with the business, reducing the risk of disruption during the transition period. Additionally, retaining knowledgeable employees can help maintain customer relationships and ensure the continuity of existing contracts or business arrangements. For the retained employees, this agreement often offers job security as it guarantees their continued employment under the new ownership. It may also provide additional benefits such as the preservation of accrued employee benefits, bonuses, or other financial incentives. However, it's important to note that the terms of the agreement, such as the duration of employment and any changes in compensation or benefits, can vary depending on the specific asset purchase transaction. Other types of agreements related to the sale of a business in San Diego, California, may include Stock Purchase Agreements, which involve the purchase of company shares instead of assets, and Merger Agreements, which involve the consolidation of two or more businesses into one entity. Each of these agreements has its unique advantages and considerations depending on the circumstances of the transaction. In conclusion, the San Diego Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a specific type of agreement that allows a buyer to acquire certain assets of a business while retaining crucial employees. This agreement aims to ensure a smooth transition of operations, maintain business continuity, and provide job security for retained employees. Other types of agreements related to the sale of a business in San Diego include Stock Purchase Agreements and Merger Agreements, each with its own distinct characteristics.

San Diego California Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out San Diego California Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the San Diego Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Sale of Business - Retained Employees Agreement - Asset Purchase Transaction:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your San Diego Sale of Business - Retained Employees Agreement - Asset Purchase Transaction and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!