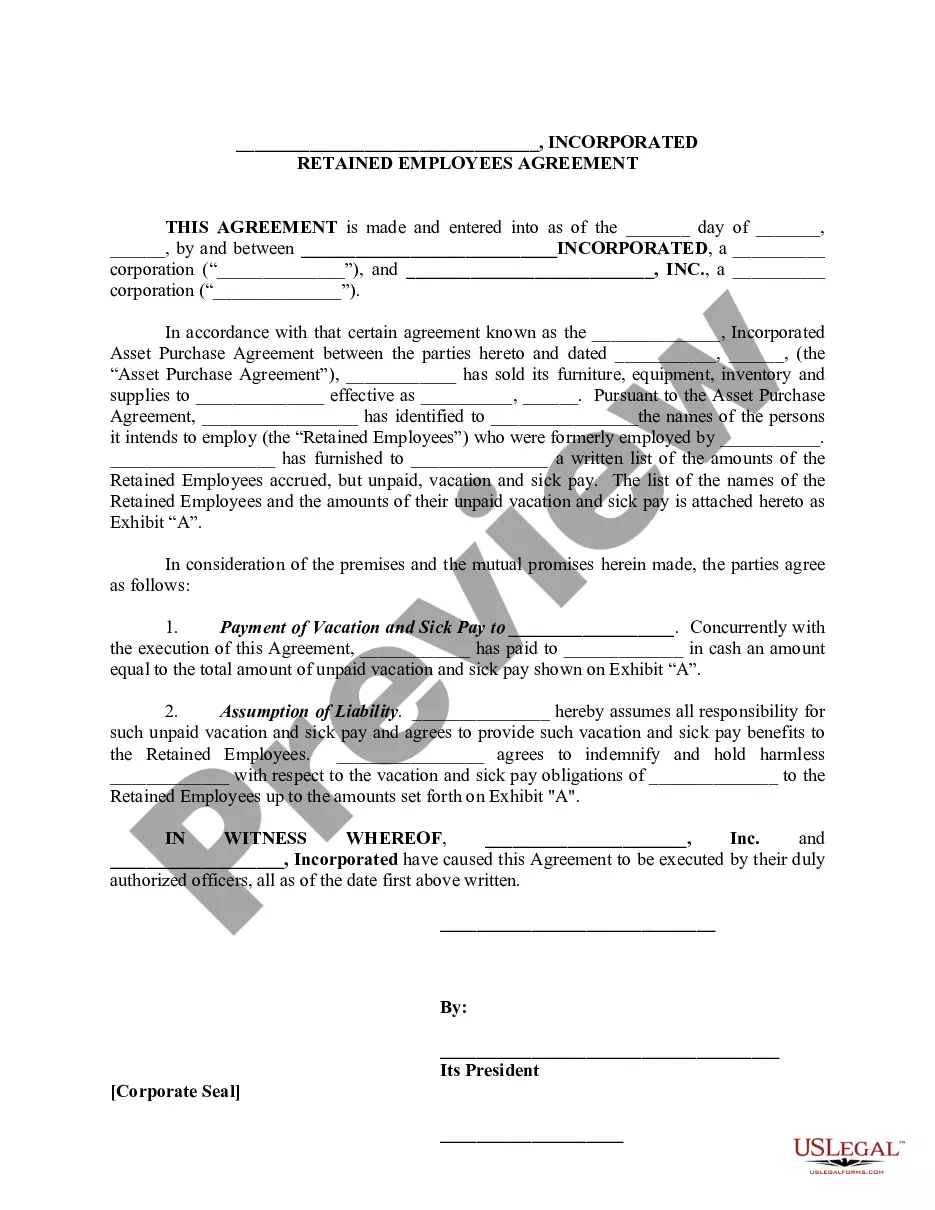

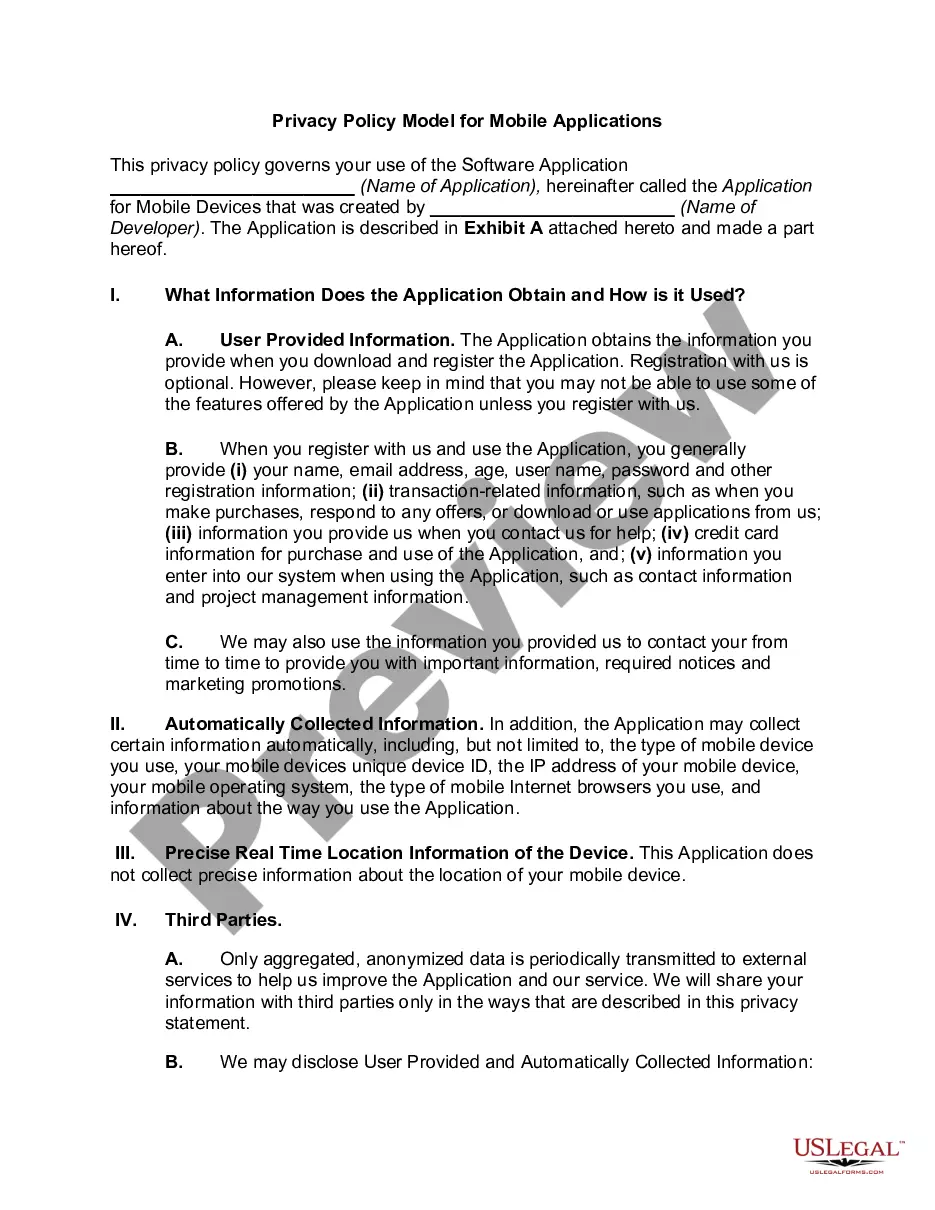

Travis Texas Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legal document that outlines the terms and conditions related to the sale of a business and the retention of employees following the transaction. This agreement is specifically designed for businesses located in Travis, Texas. The purpose of this agreement is to establish the rights and responsibilities of both the buyer and the seller as it pertains to the transfer of assets and employees. The agreement ensures a smooth transition of ownership and provides protection for all parties involved. There are various types of Travis Texas Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions, each catering to different scenarios and requirements. These variations may include: 1. Full asset purchase agreement: This type of agreement involves the complete transfer of all business assets, including tangible and intangible assets such as equipment, inventory, intellectual property, customer lists, and contracts. The agreement specifies the terms of the purchase, the payment structure, and the obligations of both the buyer and the seller. 2. Partial asset purchase agreement: In this case, only specific assets of the business are purchased, rather than the entire business. This agreement allows for the customized acquisition of assets, which may include select equipment, inventory, or intellectual property, to meet the buyer's needs. 3. Stock purchase agreement: Instead of buying the assets of the business, the buyer acquires the seller's existing stock or ownership interest. This type of agreement involves transferring ownership and control of the entire business, along with its assets, liabilities, contracts, and employees. The retained employees' clause in the agreement ensures that certain employees will continue their employment with the new owner following the sale. The agreement outlines the terms and conditions of their employment, including job roles, salaries, benefits, and any additional provisions such as non-compete or non-disclosure agreements. Key elements included in a Travis Texas Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction may comprise: 1. Purchase price and payment terms: Specifies the total purchase price for the business and outlines the payment structure, including any down payments, installments, or contingencies. 2. Asset transfer: Identifies and describes the specific assets being transferred as part of the sale, whether it is the entire business or selected assets only. 3. Employee provisions: Details the employees who will be retained by the buyer and outlines their roles, compensation, benefits, and any applicable terms of employment. 4. Non-compete and non-disclosure agreements: May include clauses that restrict the seller from competing with the buyer's business or disclosing confidential information after the sale. 5. Indemnification and warranties: Specifies the warranties provided by the seller regarding the assets being sold and addresses any indemnification responsibilities. It is crucial to consult with an experienced attorney specializing in business transactions to ensure that the Travis Texas Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is tailored to the specific needs and requirements of both the buyer and the seller.

Travis Texas Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Travis Texas Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

Creating forms, like Travis Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, to manage your legal matters is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for a variety of scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Travis Sale of Business - Retained Employees Agreement - Asset Purchase Transaction template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Travis Sale of Business - Retained Employees Agreement - Asset Purchase Transaction:

- Ensure that your document is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Travis Sale of Business - Retained Employees Agreement - Asset Purchase Transaction isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and download the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Unlike stock purchases, employees generally do not transfer automatically in an asset purchase, meaning the buyer must expressly assume employment agreements and restric- tive covenants with the acquired personnel; any anti-assign- ment or change-in-control clauses in the acquired employees' employment contracts could

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

In an asset purchase, employees who are offered employment will usually sign new employment contracts. A purchaser should be careful if it chooses to hire some employees and not others, to ensure it does not choose not to hire someone for reasons contrary to Ontario human rights legislation.

In the case of an asset purchase, where the assets such as contracts, property, goodwill etc are transferred, the employees of the business may be subject to the Transfer of Undertakings (Protection of Employment) Regulations 2006 (TUPE) which may apply to protect employees in certain situations.

An asset purchase agreement (also known as a 'business purchase agreement' or 'APA') is an agreement setting out the terms and conditions relating to the sale and purchase of assets in a company.

The employees who are employed by the target entity will generally come with the transaction, like a stock purchase. If certain employees at the seller/parent company provide significant services to the target entity, then the transaction will act like an asset purchase with respect to this group of employees.

When selling your business, the purchaser may communicate with you that they will not be retaining your staff. In that case, you will need to pay out your employees' wages/salaries, PAYE, holiday and any other leave entitlements up until settlement.

An asset sale transaction involves the sale of some or all of the assets used in a business from a selling company to a buyer.

Asset acquisitions are accounted for by allocating the cost of the acquisition to the individual assets acquired and liabilities assumed on a relative fair value basis.