A Mecklenburg North Carolina Salesperson Contract, also known as a Percentage Contract or Asset Purchase Transaction, is a legally binding agreement between a salesperson and a company based in Mecklenburg County, located in the state of North Carolina. This type of contract outlines the terms and conditions of the salesperson's employment, compensation structure, and the purchase or transfer of certain assets. The primary purpose of a Mecklenburg North Carolina Salesperson Contract is to establish a fair and mutually beneficial relationship between the salesperson and the company. It outlines the roles, responsibilities, and expectations of both parties involved in the sales process. In a Percentage Contract, the compensation structure is typically based on a percentage of the sales generated by the salesperson. This percentage is often negotiated and may vary depending on the industry, products or services sold, and the experience and performance of the salesperson. This contract type provides an incentive for salespeople to perform well and achieve sales targets. An Asset Purchase Transaction, on the other hand, involves the purchase or transfer of certain assets owned by the salesperson or the company. These assets can include customer lists, intellectual property, existing contracts, or any other tangible or intangible assets that contribute to the salesperson's ability to generate revenue. There are a few different types of Mecklenburg North Carolina Salesperson Contracts, each catering to specific circumstances and needs: 1. Commission based contract: This contract type focuses on compensating the salesperson based on a percentage of the sales volume they generate. The salesperson receives a commission for each sale made, often with a minimum sales target to be met within a designated time period. 2. Exclusive contract: An exclusive contract restricts the salesperson from representing or selling products of competing companies during the contract period. This helps the company maintain a loyal sales force and protects their business interests. 3. Non-compete agreement: A non-compete agreement prevents the salesperson from engaging in a similar business or working for a competitor within a specific geographical area for a certain duration after the contract termination. 4. Profit-sharing contract: In a profit-sharing contract, the salesperson receives a portion of the profits generated by the company as compensation. This contract type aligns the interests of the salesperson with the company's success and encourages them to contribute to the profitability of the business. Before entering into any Mecklenburg North Carolina Salesperson Contract, it is crucial for both the salesperson and the company to carefully review and negotiate the terms and conditions to ensure they are fair, reasonable, and compliant with local laws and regulations. Seeking legal advice or consulting an attorney with experience in employment and contract law is recommended to ensure the contract is legally binding and protects the interests of all parties involved.

Mecklenburg North Carolina Salesperson Contract - Percentage Contract - Asset Purchase Transaction

Description

How to fill out Mecklenburg North Carolina Salesperson Contract - Percentage Contract - Asset Purchase Transaction?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Mecklenburg Salesperson Contract - Percentage Contract - Asset Purchase Transaction, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Mecklenburg Salesperson Contract - Percentage Contract - Asset Purchase Transaction from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Mecklenburg Salesperson Contract - Percentage Contract - Asset Purchase Transaction:

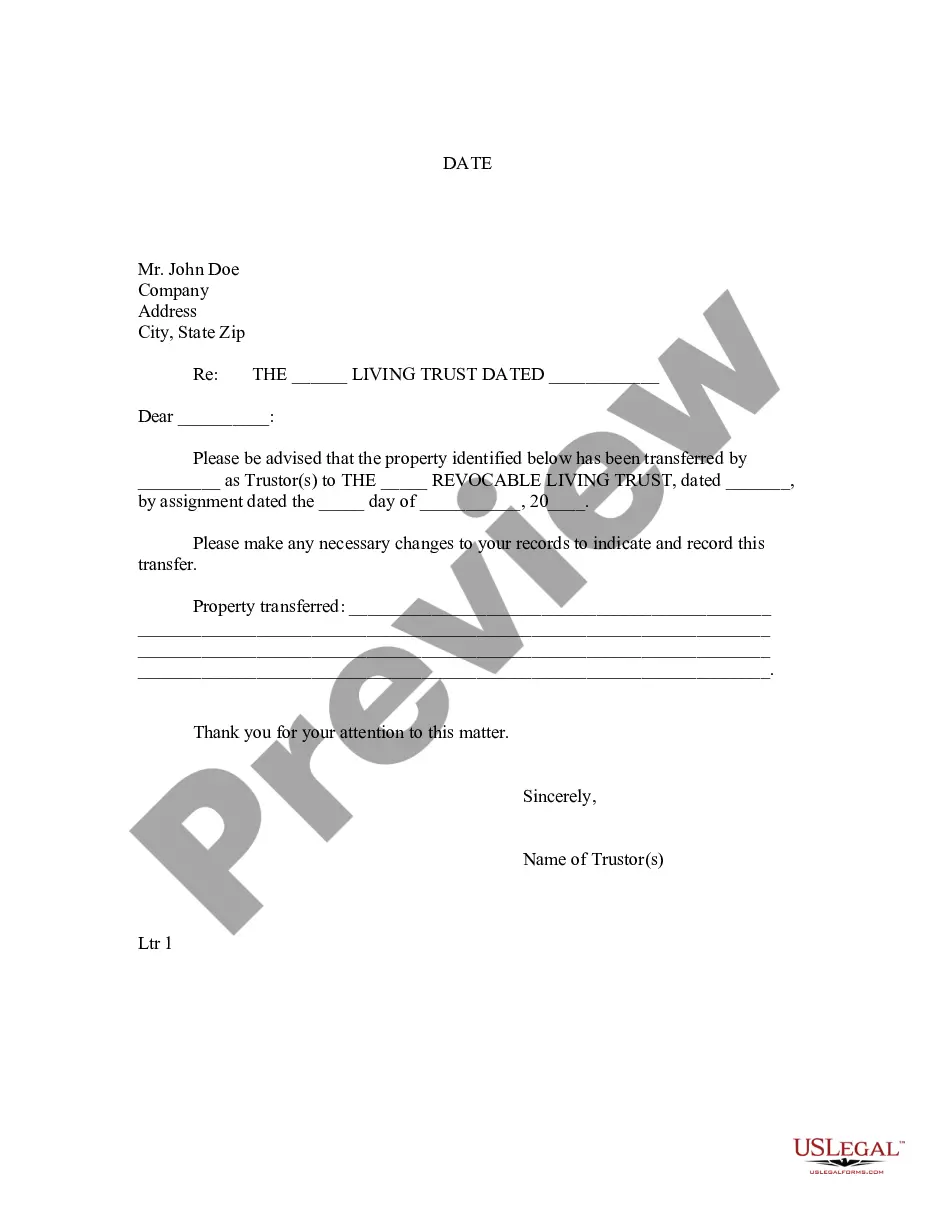

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

A purchase and sale agreement, also known as a purchase and sale contract, P&S agreement, or PSA, is a legally-binding document that establishes the terms and conditions related to a real estate transaction. It defines what requirements the buyer must meet as well as purchase price, limitations, and contingencies.

An asset purchase agreement (also known as a 'business purchase agreement' or 'APA') is an agreement setting out the terms and conditions relating to the sale and purchase of assets in a company.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.)

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Negotiations may go back and forth between the buyer and the seller before both parties are satisfied. Once both parties approve the terms and have signed the purchase agreement, they're considered to be "under contract."

A standard sales agreement is a written contract used to specify, outline, and clarify the terms of a transaction between a buyer and a seller. It helps both parties understand the details of the agreement, which can minimize the chances of a dispute in the future.

Subparagraph E states that the balance of the purchase price (which must be filled in) will be deposited in escrow prior to closing. Subparagraph F shows the total purchase price.