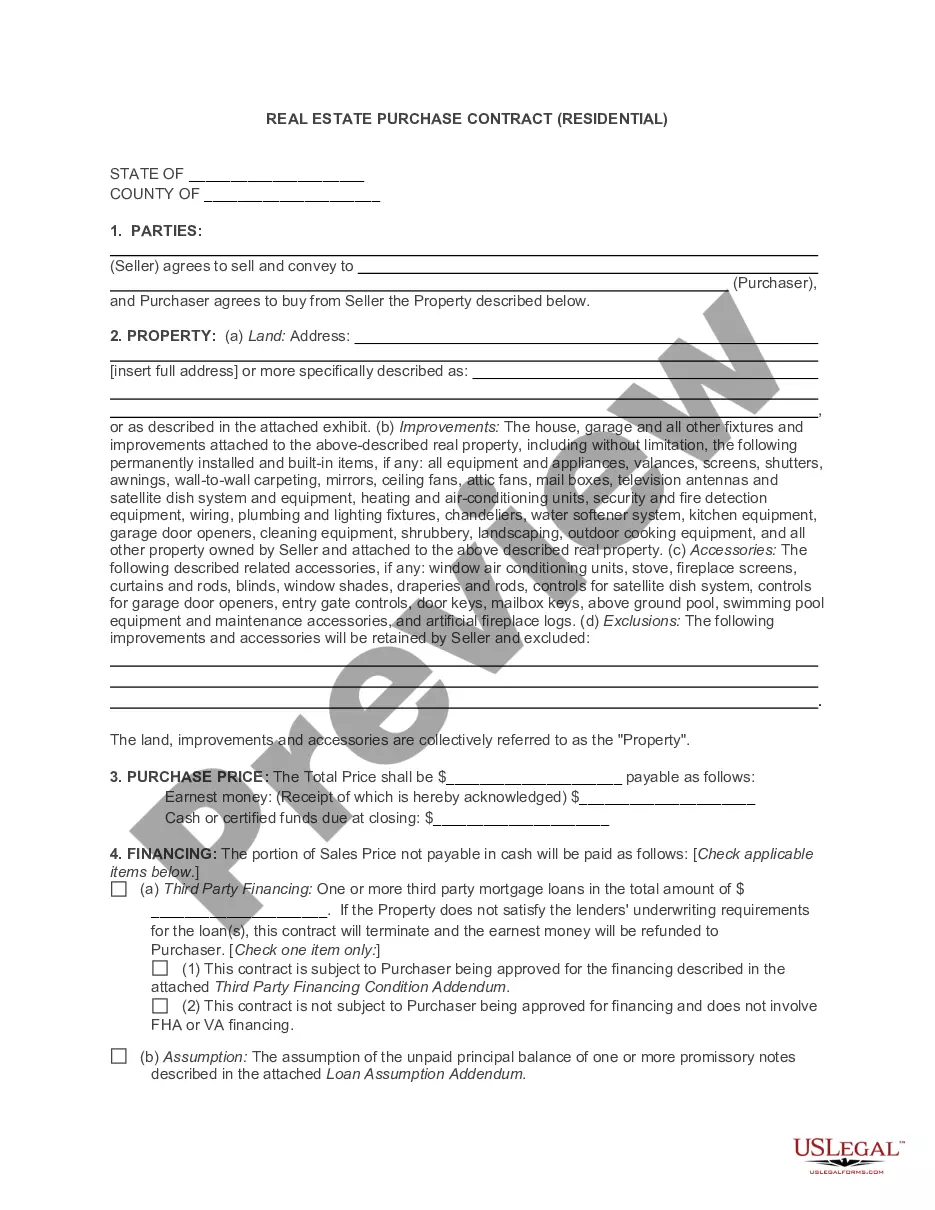

Orange California Shareholders Agreement — Short Form is a legally binding document that outlines the rights, responsibilities, and obligations of shareholders in a California-based company. It serves as a crucial tool to protect shareholders' interests and establish a clear framework for decision-making and governance within the organization. This agreement is specifically designed for small businesses or startups in Orange, California, seeking to define the roles of shareholders in a simplified manner. The Orange California Shareholders Agreement — Short Form covers various essential aspects, including but not limited to: 1. Ownership and Voting Rights: This agreement specifies the percentage of shares held by each shareholder and details the voting rights associated with their ownership. It outlines the procedures for voting on important company matters, such as mergers, acquisitions, or major operational changes. 2. Shareholder Responsibilities and Vesting: The agreement clearly defines the roles and responsibilities of each shareholder, ensuring everyone is aware of their obligations towards the company's growth and success. It also includes provisions for vesting, which determine the ownership of shares over a specified period. 3. Shareholder Meetings: The agreement sets rules for organizing shareholder meetings, including notice requirements, quorum, and procedures for decision-making. It ensures that important matters are discussed and decided upon collectively, fostering transparency and accountability. 4. Transfer of Shares: This section governs the transfer of shares among shareholders. It may include restrictions on the transfer, such as the right of first refusal or preemptive rights, which give existing shareholders the opportunity to buy the shares before they are offered to external parties. 5. Confidentiality and Non-Compete: The agreement encompasses provisions to maintain confidentiality of sensitive company information, trade secrets, and intellectual property. It may also include non-compete clauses to prevent shareholders from engaging in similar business activities that could potentially harm the company's interests. While there might not be different types of Orange California Shareholders Agreement — Short Form, variations can exist based on the specific requirements and preferences of the involved parties. These may include customizations related to the company's industry, size, additional protective clauses, or any specific legal provisions necessary for the shareholders. In conclusion, Orange California Shareholders Agreement — Short Form is a comprehensive legal document that ensures transparency, protection, and efficient decision-making among shareholders in a California-based company. By establishing clear guidelines, it promotes a healthy business environment and enables shareholders to work together harmoniously for the company's growth and success.

Orange California Shareholders Agreement - Short Form

Description

How to fill out Orange California Shareholders Agreement - Short Form?

Are you looking to quickly create a legally-binding Orange Shareholders Agreement - Short Form or probably any other document to manage your own or business matters? You can select one of the two options: hire a professional to draft a legal paper for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant document templates, including Orange Shareholders Agreement - Short Form and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Orange Shareholders Agreement - Short Form is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Orange Shareholders Agreement - Short Form template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the templates we offer are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!