A San Diego California Shareholders Agreement — Short Form is a legally binding document that outlines the terms and conditions between shareholders of a company based in San Diego, California. This agreement specifies the rights, responsibilities, and obligations of each shareholder to ensure a smooth and harmonious operation of the company. It is typically used by small to mid-sized businesses. Here are some relevant keywords and types of San Diego California Shareholders Agreement — Short Form: 1. Shareholders: This term refers to individuals or entities who own shares in a company and have a financial interest in its success. 2. Agreement: This refers to the document that outlines the terms and conditions agreed upon by the shareholders. 3. San Diego: San Diego is a city located in southern California, known for its beautiful beaches, vibrant culture, and thriving business community. 4. California: California is a state in the United States with a strong economy and numerous business opportunities, making it an attractive location for entrepreneurs and investors. 5. Short Form: The Short Form Shareholders Agreement is a condensed version of a more comprehensive document. It focuses on the essential elements necessary to establish the rights and obligations of shareholders. 6. Rights and Responsibilities: The agreement lays out the specific rights and responsibilities of each shareholder, such as voting rights, profit distribution, board member appointments, and decision-making processes. 7. Company Operation: It addresses the day-to-day operation of the company, including how important business decisions will be made, how conflicts will be resolved, and what happens in case of a shareholder dispute or death. 8. Confidentiality: This clause ensures that sensitive company information remains confidential and prohibits shareholders from disclosing trade secrets or proprietary information. 9. Non-Compete Clause: This clause restricts shareholders from engaging in competitive activities that would directly harm the company's business interests. 10. Term and Termination: The agreement may specify the term of the agreement and the conditions under which it can be terminated, such as a shareholder's withdrawal or bankruptcy. 11. Buy-Sell Agreement: A buy-sell agreement can be included in the Short Form Shareholders Agreement to address situations where a shareholder wishes to sell their shares or in case of the death or disability of a shareholder. 12. Additional Types: Depending on the needs of the company, there may be variations or customized versions of the San Diego California Shareholders Agreement — Short Form. These may include specific provisions for technology companies, healthcare businesses, or real estate ventures. In summary, a San Diego California Shareholders Agreement — Short Form is a crucial legal document that provides a framework for shareholders to govern their business relationship. It is essential to consult with legal professionals to draft a comprehensive agreement tailored to the specific needs of the company and its shareholders.

San Diego California Shareholders Agreement - Short Form

Description

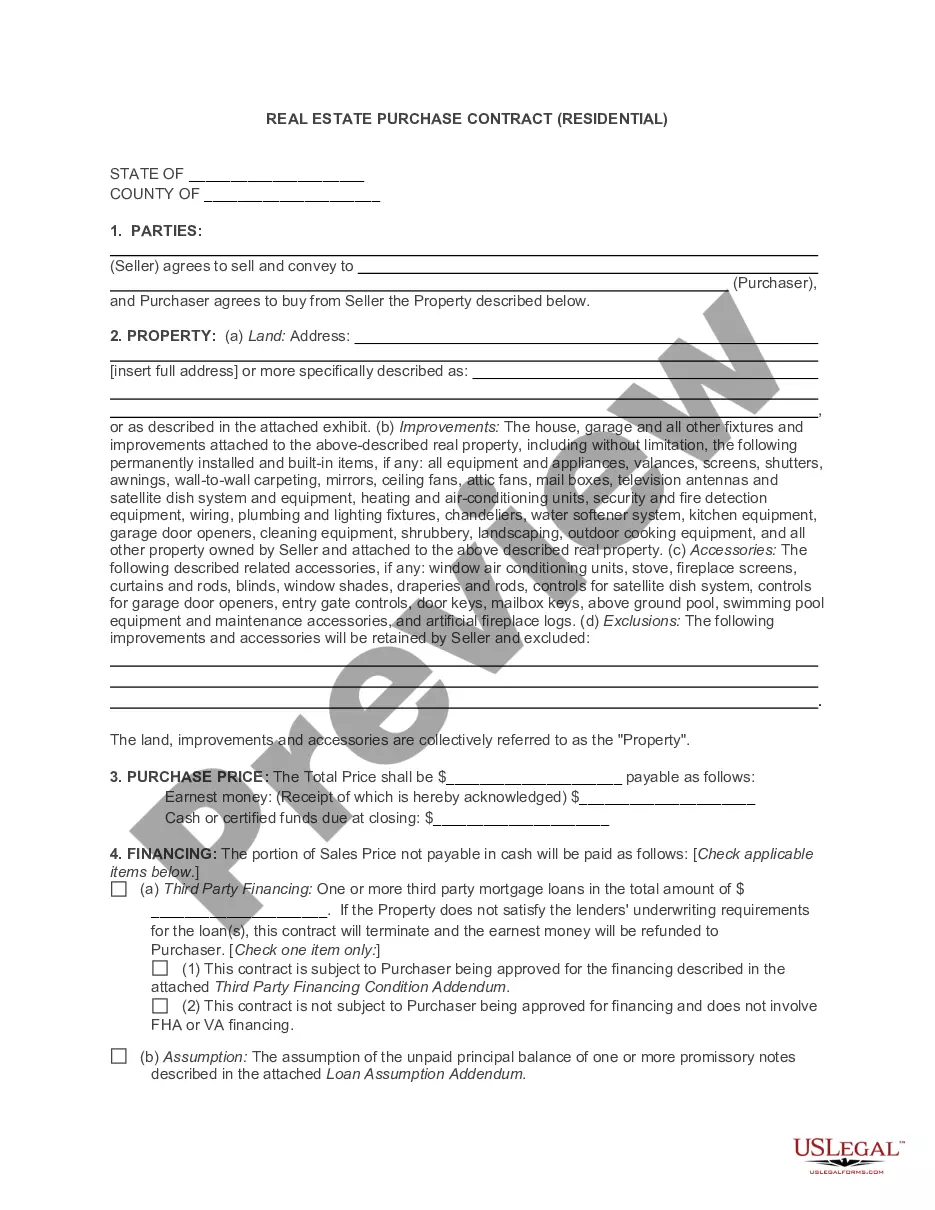

How to fill out San Diego California Shareholders Agreement - Short Form?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like San Diego Shareholders Agreement - Short Form is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the San Diego Shareholders Agreement - Short Form. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Shareholders Agreement - Short Form in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!