Salt Lake Utah Stock Retirement Agreement is a legal contract that outlines the terms and conditions for the retirement of stock holdings within the state of Utah. This agreement is crucial for individuals or businesses who wish to retire their stock and ensure a smooth transition of ownership and control. The Salt Lake Utah Stock Retirement Agreement typically includes several key elements that protect the rights and interests of both parties involved. First, it identifies the individuals or entities involved in the agreement, including the stockholder(s) and the acquiring party. It also specifies the type and amount of stock being retired. Furthermore, the agreement delineates the payment and compensation terms, including the purchase price or valuation of the stock being retired. It may outline a fixed monetary value or specify an agreed-upon formula for valuation, taking into account factors such as market conditions, financial performance, and industry standards. Additionally, the Salt Lake Utah Stock Retirement Agreement incorporates provisions related to the transfer of ownership and title. This may include the transfer of physical stock certificates, electronic stocks, or other relevant documents necessary for the successful retirement of the shares. It also addresses any restrictions or limitations on the transfer of stock, such as rights of first refusal or non-compete clauses. Importantly, the agreement may contain clauses pertaining to the treatment of dividends, stock options, or other related benefits that were accrued by the retiring stockholder. It ensures that these benefits are properly accounted for and transferred to the appropriate party. There may be different types of Stock Retirement Agreements specific to Salt Lake Utah, depending on various factors such as the industry, size of the company, or the intentions of the stockholder. Some common types may include: 1. Individual Stock Retirement Agreement: This is an agreement entered into by an individual stockholder who wishes to retire their stock holdings in Salt Lake Utah. 2. Corporate Stock Retirement Agreement: This agreement is applicable when a corporation located in Salt Lake Utah intends to retire its own stock, possibly as part of a reorganization or restructuring plan. 3. Employee Stock Retirement Agreement: This type of agreement pertains to stock holdings owned by employees of a Utah-based company, who are retiring and wish to transfer or sell their stock as part of their retirement plan. In conclusion, the Salt Lake Utah Stock Retirement Agreement is a vital legal document that facilitates the process of retiring stock holdings in the state. Its purpose is to regulate the transfer of ownership, protect the rights of the involved parties, and ensure a fair and transparent retirement of stocks.

Salt Lake Utah Stock Retirement Agreement

Description

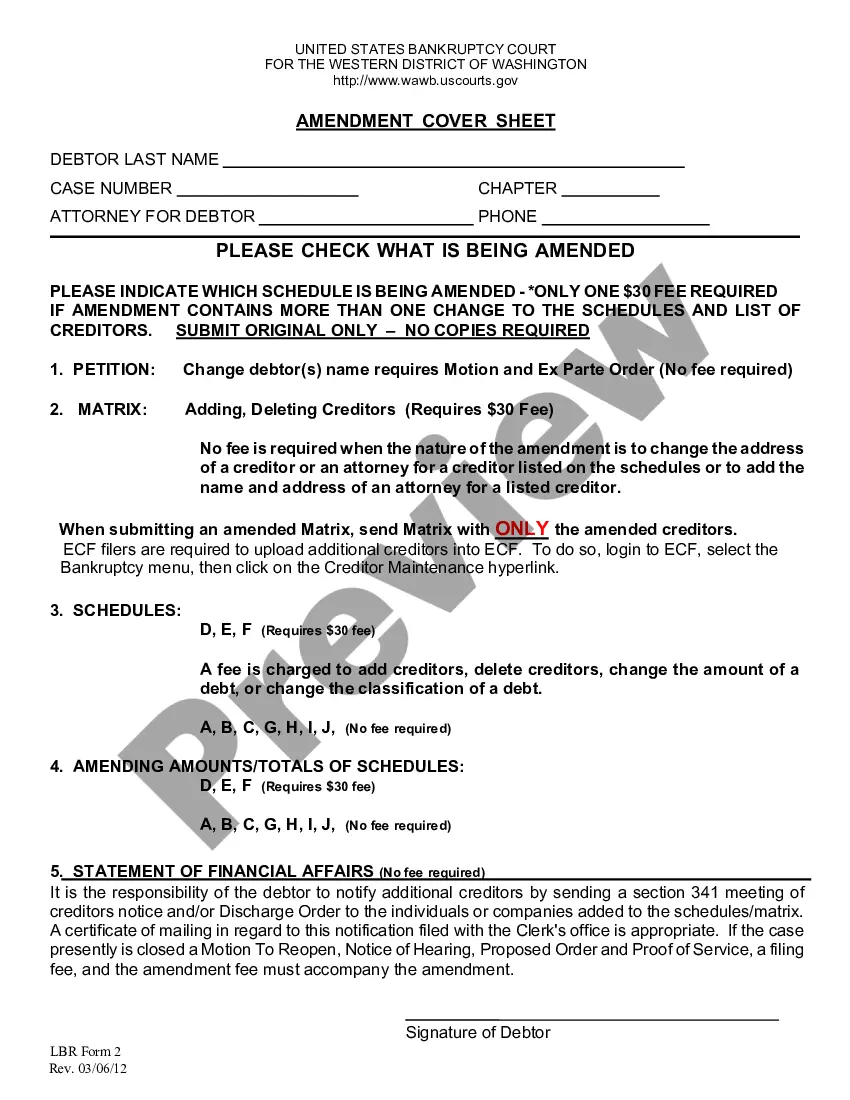

How to fill out Salt Lake Utah Stock Retirement Agreement?

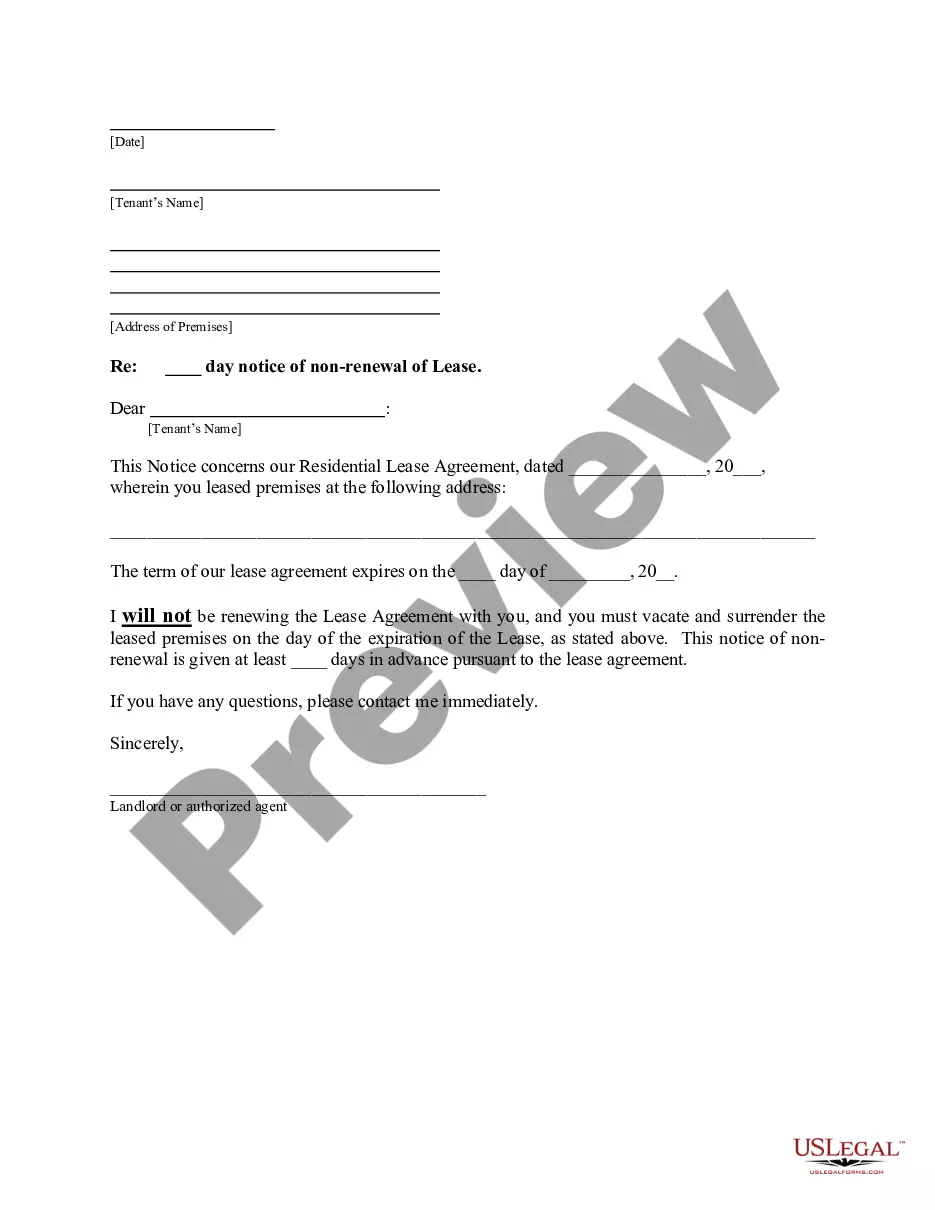

Are you looking to quickly create a legally-binding Salt Lake Stock Retirement Agreement or probably any other document to handle your own or business matters? You can select one of the two options: hire a legal advisor to write a valid document for you or draft it entirely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific document templates, including Salt Lake Stock Retirement Agreement and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Salt Lake Stock Retirement Agreement is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Salt Lake Stock Retirement Agreement template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Costco Wholesale Costco wants its employees to retire comfortably. To help them reach that goal, the company matches employee contributions at 50 cents on the dollar for the first $1,000 each year, for a maximum match of $500 a year ($250 a year for West Coast Union employees).

GS is more "restrictive" on pay setting. NAF likes to mirror GS scale and jobs are normally posted at GS equivalence spread, for example GS12 step 1 $70,000 to GS 10 $89,000 made up these numbers), if posted as GS then GS pay setting rules apply and very limited when doing lateral move (usually pay just stays same).

104-106, 110 Stat. 186, 434-439, provides that certain employees who move from Federal service to NAF instrumentalities are eligible to participate in the TSP by virtue of their election to be covered by the Civil Service Retirement System (CSRS) or the Federal Employees' Retirement System (FERS).

These cards can be given to any family members or any friend of your choice. And if you work for Costco for more than 25 years and retire, you get a lifetime membership card.

Costco Wholesale Costco wants its employees to retire comfortably. To help them reach that goal, the company matches employee contributions at 50 cents on the dollar for the first $1,000 each year, for a maximum match of $500 a year ($250 a year for West Coast Union employees).

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.

You qualify for a monthly retirement benefit if you are: 65 with 4 years of service. 62 with 10 years of service. 60 with 20 years of service. Any age with 35 years of service.

NAF service used towards CSRS or FERS retirement cannot be used in a NAF retirement calculation. Credit for NAF service will not result in higher CSRS or FERS annuity benefits.

How does the plan work? Your cost to participate in the Retirement Plan is 2% of your salary, which is deducted from your pay each pay period. Additionally, your employer contributes 7.6% of your salary to fund your retirement.

Nonappropriated Fund Retirement Plans To help attract and retain qualified and productive employees, each Nonappropriated Fund (NAF) employer provides eligible employees with an opportunity to participate in a retirement program consisting of a defined benefit (pension) plan and a defined contribution (401(K)) plan.