A Tarrant Texas Stock Retirement Agreement is a legally binding document that outlines the terms and conditions for the retirement of stocks or shares in Tarrant, Texas. This agreement is entered into by the company and the stockholder when the stockholder decides to retire from their ownership position in the company. The Tarrant Texas Stock Retirement Agreement typically includes important details such as the effective date of the agreement, the name of the stockholder, and the number of stocks or shares being retired. It also outlines the agreed-upon retirement plan and the compensation or benefits to be received by the stockholder upon retirement. The agreement may specify the method of payment, which could include cash, stock options, or other forms of compensation. Additionally, the agreement may address any restrictions or conditions on the stockholder's rights and obligations post-retirement. There may be different types of Tarrant Texas Stock Retirement Agreements, depending on the specific factors considered in each agreement. Some examples of these agreements may include: 1. Cash Retirement Agreement: In this type of agreement, the stockholder receives a lump sum payment in cash upon retirement, calculated based on their stock ownership and other agreed-upon terms. 2. Stock Option Retirement Agreement: This type of agreement allows the stockholder to exercise their stock options upon retirement, converting them into actual shares or receiving the monetary value of those shares. 3. Deferred Compensation Retirement Agreement: In this agreement, the stockholder receives deferred compensation payments after retirement, spread out over a specified period, instead of receiving a lump sum payment immediately. 4. Buyout Retirement Agreement: This type of agreement involves the company buying back the stockholder's shares at an agreed-upon price, providing them with a cash exit strategy and relieving the stockholder of ownership obligations. It is essential for both parties involved to carefully review and understand the terms and conditions of the Tarrant Texas Stock Retirement Agreement before signing. Seeking legal advice is recommended to ensure that the agreement accurately reflects the intentions of both parties and complies with applicable laws and regulations.

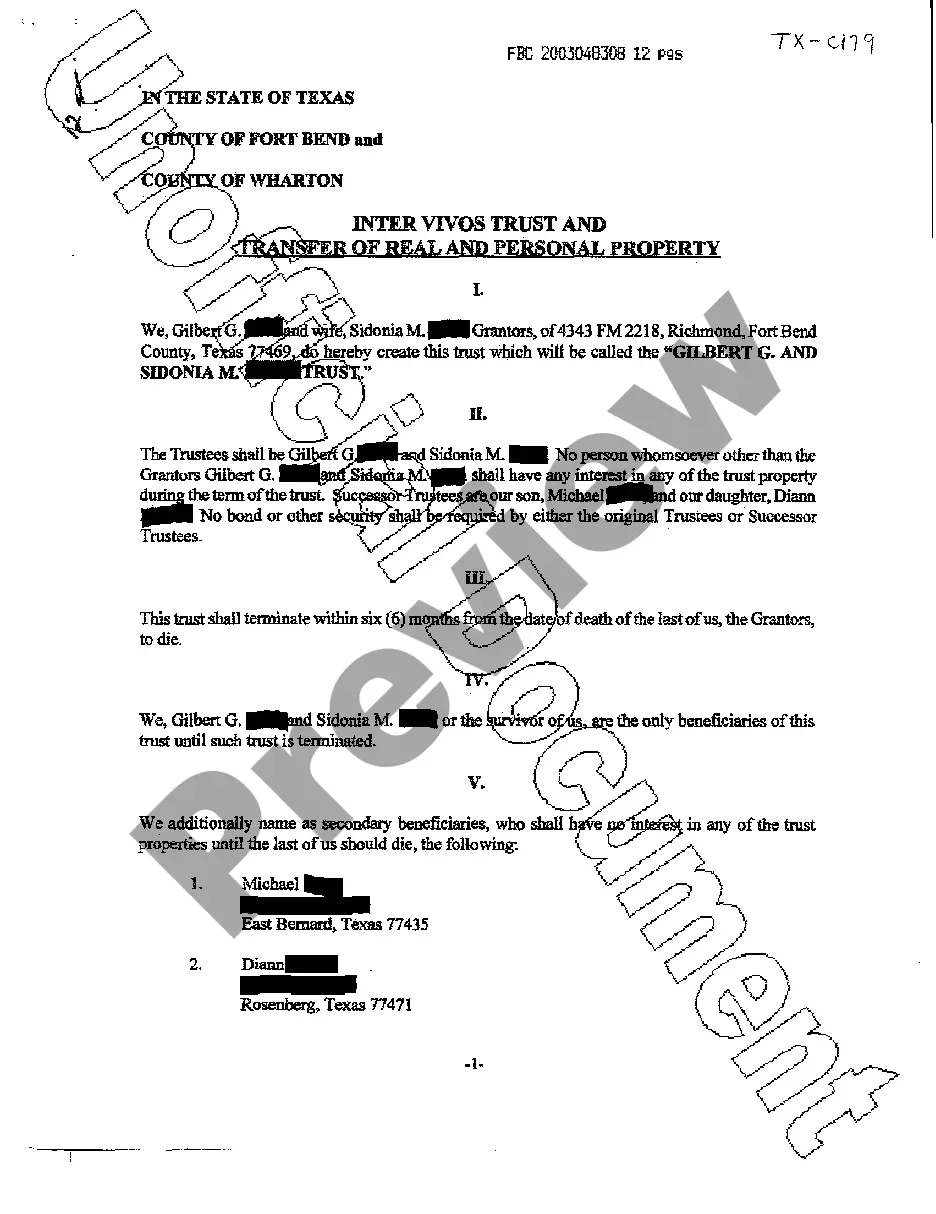

Tarrant Texas Stock Retirement Agreement

Description

How to fill out Tarrant Texas Stock Retirement Agreement?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Tarrant Stock Retirement Agreement is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Tarrant Stock Retirement Agreement. Follow the guide below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Stock Retirement Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

Withdrawals from 457 retirement plans are taxed as ordinary income. However, distributions from a ROTH 457 plan are not subject to tax withholding. Also, 457 plan participants are permitted to roll over their funds into other qualified plans. Rollovers, except into a ROTH IRA, are not taxable events.

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.

If you need more time to put aside money for retirement, a 457 plan is best for you. It has a better catch-up policy and will allow you to stash away more money for retirement. A 403(b) is likely to be your best bet if you want a larger array of investment options.

A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

State and local public employees and sometimes nonprofit organization employees are often offered the 457 retirement plan. Only employers who are exempt from paying federal income taxes and non-church organizations can offer 457 plans, including: State and local governments. Hospitals.

Early Withdrawals from a 457 Plan (Notice I said former). By rolling into the IRA, you lose the ability to cash out early to avoid the penalty in case you need access to your funds. There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age).

You can take penalty-free withdrawals from your 457 account at any age after you leave your job. Most other types of retirement-savings plans assess a 10% penalty if you withdraw money before age 55 or 59½, depending on when you leave your job.

To start the adoption process for your agency or for more information on how to sign up, visit the CalPERS 457 Plan Employer Resource Center. You also can call us toll free at (800) 696-3907 to speak with a representative, or email us.

To start the adoption process for your agency or for more information on how to sign up, visit the CalPERS 457 Plan Employer Resource Center. You also can call us toll free at (800) 696-3907 to speak with a representative, or email us.

To use a 457(b) plan, you must be a state or local government employee. Think firefighter, teacher, police officer, and the like. Even then, not every employer offers these options. Typically, most non-federal government workers will qualify for a 457(b) plan.