The Harris Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding contract between a sole proprietor who wishes to sell their business and a potential buyer. This agreement outlines the terms and conditions of the sale, including the contingency that the final purchase price will be determined based on the results of an audit. Keywords: Harris Texas, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent, Audit. This type of agreement is commonly used in business transactions where the buyer wants to ensure the accuracy of the financial information provided by the seller before finalizing the purchase price. It serves as a safeguard for the buyer, as they can evaluate the true value of the business based on the audit results. The Harris Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit typically includes various clauses and provisions designed to protect the interests of both parties involved. Some of these clauses may include: 1. Purchase Price Contingency: This clause specifies that the final purchase price will be contingent on the results of the audit. It outlines the criteria for determining any adjustments to the price based on the audit findings, such as discrepancies in financial statements or undisclosed liabilities. 2. Scope of the Audit: This section outlines the scope and depth of the audit to be performed. It may include specific financial statements, tax records, contracts, and any other documents relevant to evaluating the business's financial health. The parties may agree to engage a professional auditor or accounting firm to conduct the audit. 3. Confidentiality and Non-Disclosure: This clause ensures that all parties involved will maintain the confidentiality of any sensitive information exchanged during the audit process. It prohibits the buyer from sharing financial data or trade secrets with third parties without the written consent of the seller. 4. Representations and Warranties: This section requires the seller to make certain representations and warranties regarding the accuracy of the financial information provided and the absence of undisclosed liabilities. It also outlines the consequences if any misrepresentations are discovered during the audit. 5. Closing and Transition: This clause specifies the timeline and procedures for closing the sale once the audit is completed. It may include provisions for the transfer of assets, customer contracts, and licenses, as well as any obligations for the seller to assist with the smooth transition of the business to the new owner. Different types or variations of the Harris Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit may exist based on specific industry requirements or the preferences of the parties involved. However, the general purpose remains the same — to ensure a fair and transparent sale of the business while protecting the interests of both the buyer and the seller.

Harris Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Harris Texas Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

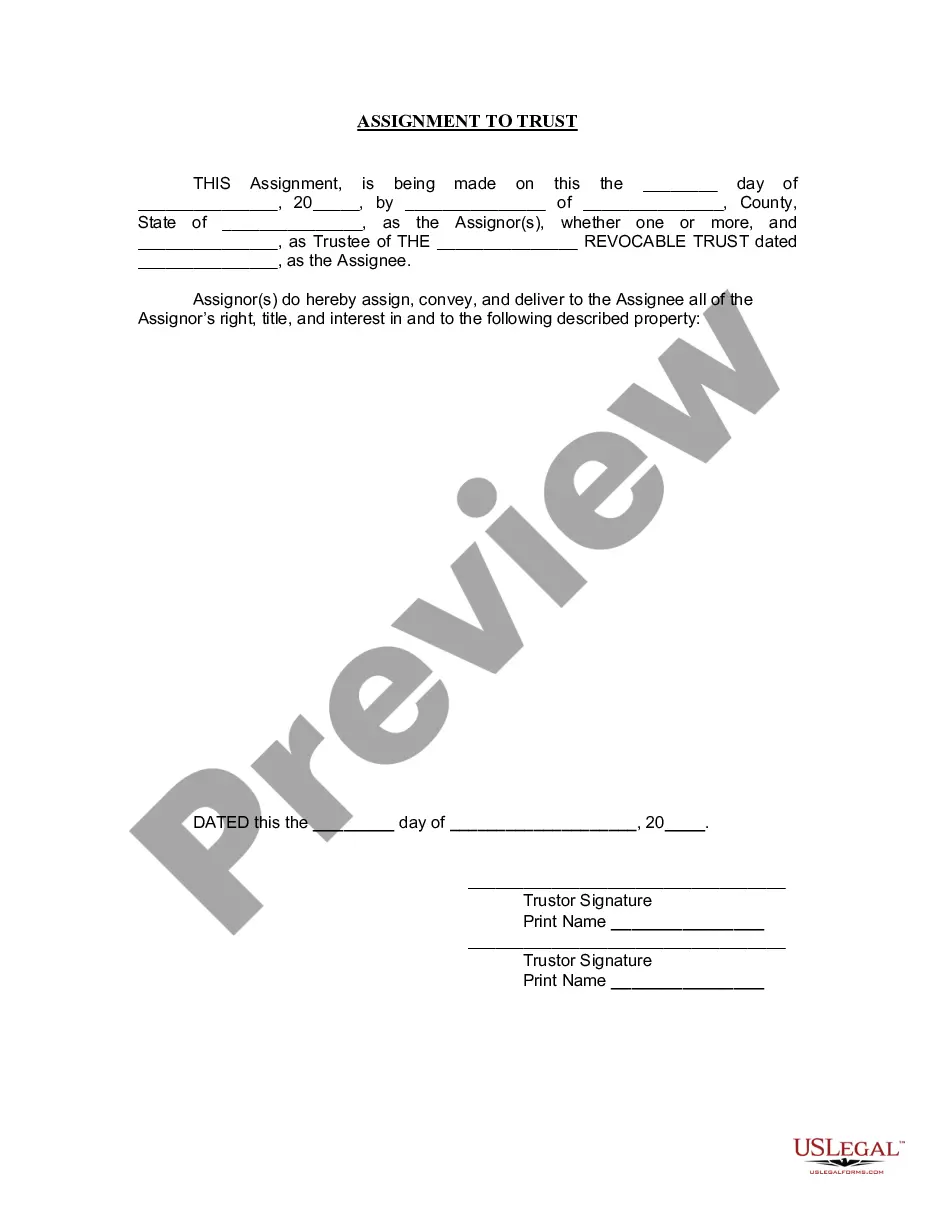

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Harris Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Apart from the Harris Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Harris Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit:

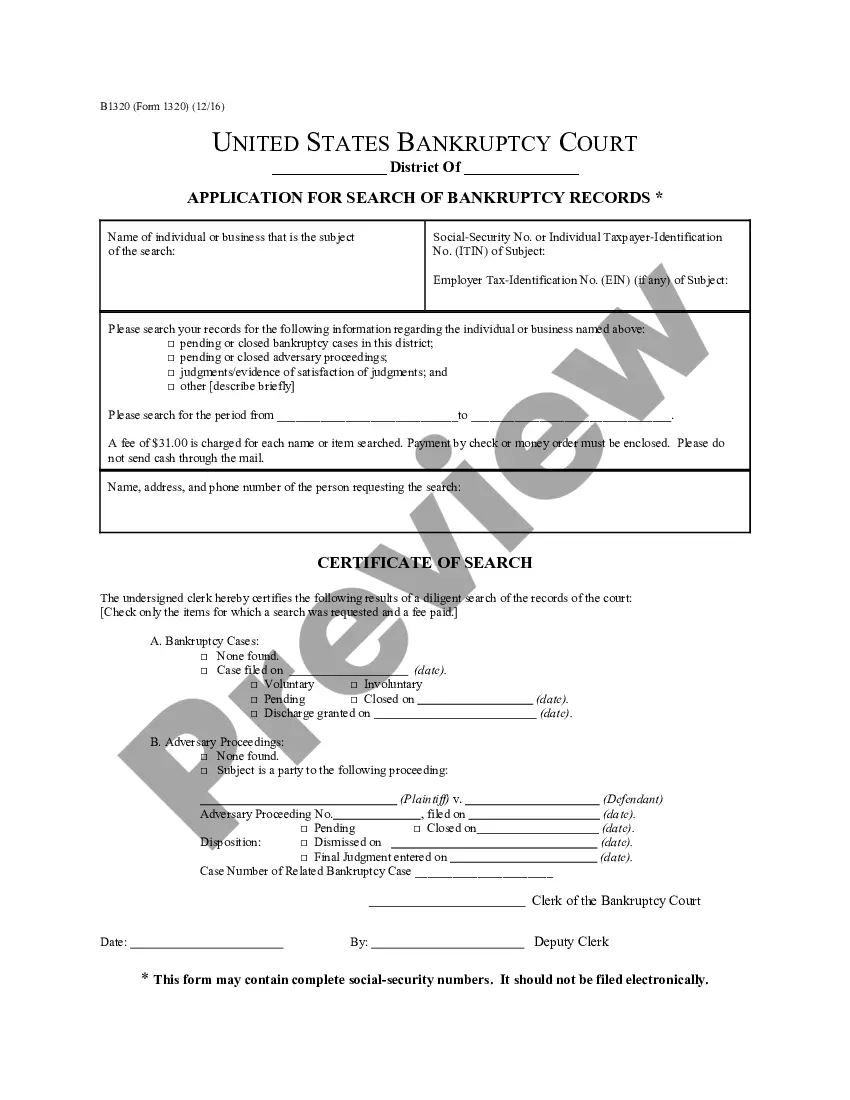

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!