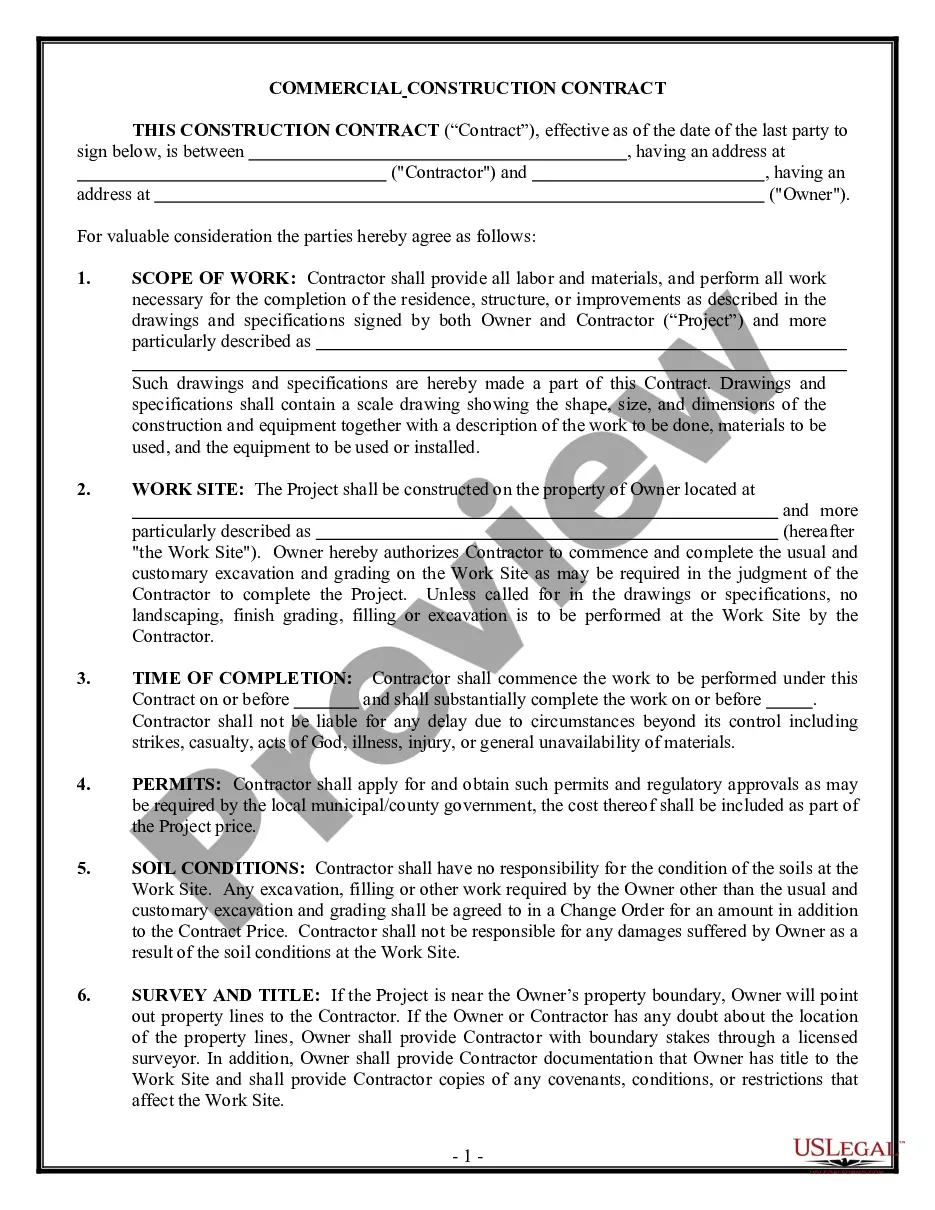

A Miami-Dade Florida Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding contract that outlines the terms and conditions for the sale of a business that is owned and operated by a sole proprietor in Miami-Dade County, Florida. This agreement is particularly unique as it includes a contingency clause where the final purchase price is subject to adjustment based on the results of an audit conducted on the business. In this agreement, the parties involved, typically the seller (sole proprietor) and the buyer, will agree upon various aspects such as the purchase price, payment terms, and the scope of the audit to be conducted. The primary purpose of the audit is to assess the financial health and integrity of the business, ensuring that the buyer is aware of any potential risks or liabilities associated with the transaction. Keywords: Miami-Dade Florida, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent, Audit. Different types of Miami-Dade Florida Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit may include variations based on specific industries or sectors, such as: 1. Miami-Dade Florida Agreement for Sale of Retail Business by Sole Proprietorship with Purchase Price Contingent on Audit 2. Miami-Dade Florida Agreement for Sale of Restaurant by Sole Proprietorship with Purchase Price Contingent on Audit 3. Miami-Dade Florida Agreement for Sale of Service Business by Sole Proprietorship with Purchase Price Contingent on Audit 4. Miami-Dade Florida Agreement for Sale of Professional Practice by Sole Proprietorship with Purchase Price Contingent on Audit Each of these variations would have specific clauses and considerations relevant to the particular industry or sector involved in the sale of the business.

Miami-Dade Florida Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00625BG

Format:

Word;

Rich Text

Instant download

Description

This form is an agreement for a sale of a sole proprietorship with the purchase price to be contingent on a final audit. This agreement also provides a provision for adjusting the purchase price if the audit shows that the net assets do not meet a certain amount.

A Miami-Dade Florida Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding contract that outlines the terms and conditions for the sale of a business that is owned and operated by a sole proprietor in Miami-Dade County, Florida. This agreement is particularly unique as it includes a contingency clause where the final purchase price is subject to adjustment based on the results of an audit conducted on the business. In this agreement, the parties involved, typically the seller (sole proprietor) and the buyer, will agree upon various aspects such as the purchase price, payment terms, and the scope of the audit to be conducted. The primary purpose of the audit is to assess the financial health and integrity of the business, ensuring that the buyer is aware of any potential risks or liabilities associated with the transaction. Keywords: Miami-Dade Florida, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent, Audit. Different types of Miami-Dade Florida Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit may include variations based on specific industries or sectors, such as: 1. Miami-Dade Florida Agreement for Sale of Retail Business by Sole Proprietorship with Purchase Price Contingent on Audit 2. Miami-Dade Florida Agreement for Sale of Restaurant by Sole Proprietorship with Purchase Price Contingent on Audit 3. Miami-Dade Florida Agreement for Sale of Service Business by Sole Proprietorship with Purchase Price Contingent on Audit 4. Miami-Dade Florida Agreement for Sale of Professional Practice by Sole Proprietorship with Purchase Price Contingent on Audit Each of these variations would have specific clauses and considerations relevant to the particular industry or sector involved in the sale of the business.

Free preview