San Diego, California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions of selling a business owned and operated by a sole proprietor in San Diego, California. This agreement is specifically designed to include a clause that adjusts the purchase price based on the results of an audit conducted by an impartial third-party. In San Diego, California, there may be different types of Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, including: 1. Standard Agreement: This is a generic agreement template that establishes the basic terms of the sale, contingency clause, and other relevant details required for the transaction. It offers flexibility for customization based on the specific needs of the business being sold. 2. Asset Purchase Agreement: This type of agreement focuses on the sale of the business's tangible and intangible assets, such as inventory, equipment, intellectual property, customer lists, etc. The purchase price is contingent on the audit results, ensuring a fair valuation of these assets. 3. Stock Purchase Agreement: If the sole proprietorship is organized as a corporation, this agreement is utilized. It details the transfer of ownership in the form of stock shares, along with the contingent purchase price terms. The audit plays a crucial role in determining the value of the stock being sold. 4. Non-Disclosure Agreement: In some cases, a separate non-disclosure agreement (NDA) may accompany the Agreement for Sale of Business by Sole Proprietorship. This NDA ensures that the buyer maintains confidentiality about the business's proprietary information, financials, trade secrets, etc., during and after the sale process. 5. Closing Documents: Once the Agreement for Sale of Business by Sole Proprietorship is signed, several closing documents come into play, including bill of sale, assignment of contracts, escrow instructions, and more. These additional documents ensure a smooth transfer of ownership and address any legal formalities. When utilizing a San Diego, California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, it is advisable to consult with a qualified attorney to ensure compliance with local laws and regulations.

San Diego California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out San Diego California Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

Draftwing forms, like San Diego Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, to manage your legal matters is a difficult and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the San Diego Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting San Diego Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit:

- Ensure that your document is specific to your state/county since the rules for writing legal documents may vary from one state another.

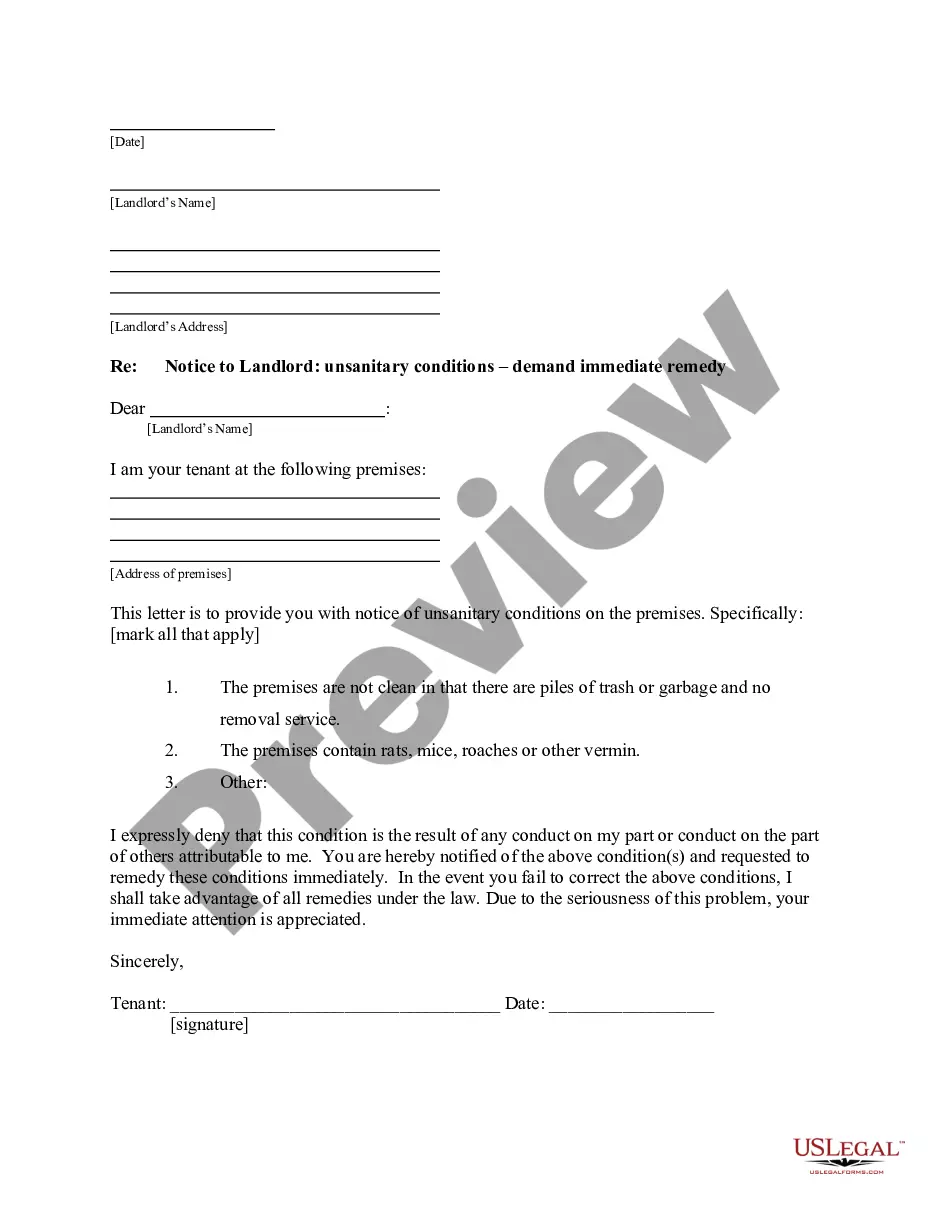

- Discover more information about the form by previewing it or going through a brief intro. If the San Diego Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!