The Oakland Michigan Security Agreement — Short Form is a legal document designed to protect the interests of a lender or creditor in securing a loan or credit transaction with a borrower or debtor. It serves as a written agreement between the two parties, establishing the terms and conditions for the collateral that the borrower or debtor pledges to secure the debt. Key features of the Oakland Michigan Security Agreement — Short Form include the identification of the parties involved, a detailed description of the collateral, and the creation of a security interest. This security interest allows the lender or creditor the right to take possession of, sell, or otherwise dispose of the collateral should the borrower default on the loan or credit agreement. The collateral described in the agreement could vary greatly depending on the specific transaction but often includes items such as real estate, personal property, vehicles, equipment, inventory, or accounts receivable. By outlining the specific collateral and its value, the agreement ensures that the lender has a legal claim to the assets in case of default. Furthermore, the agreement may include provisions for the debtor to maintain insurance coverage on the collateral to protect the lender's interest. Additionally, it may require the debtor to notify the lender of any changes in the collateral's location, any third-party claims against the collateral, or any changes to the debtor's legal name or business structure. It's worth noting that while this description provides a general overview of the Oakland Michigan Security Agreement — Short Form, different variations may exist depending on the specific lender, creditor, or type of transaction. For example, there might be specific forms for real estate transactions, personal loans, commercial lending, or business financing. Each form would address the unique requirements and considerations associated with the particular transaction. In conclusion, the Oakland Michigan Security Agreement — Short Form is a crucial legal document that protects lenders or creditors' interests in loan or credit transactions by establishing a security interest in the collateral. It outlines the terms and conditions of the agreement, identifies the parties involved, describes the collateral, and sets forth procedures in case of default.

Oakland Michigan Security Agreement - Short Form

Description

How to fill out Oakland Michigan Security Agreement - Short Form?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Oakland Security Agreement - Short Form, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the current version of the Oakland Security Agreement - Short Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Oakland Security Agreement - Short Form:

- Look through the page and verify there is a sample for your region.

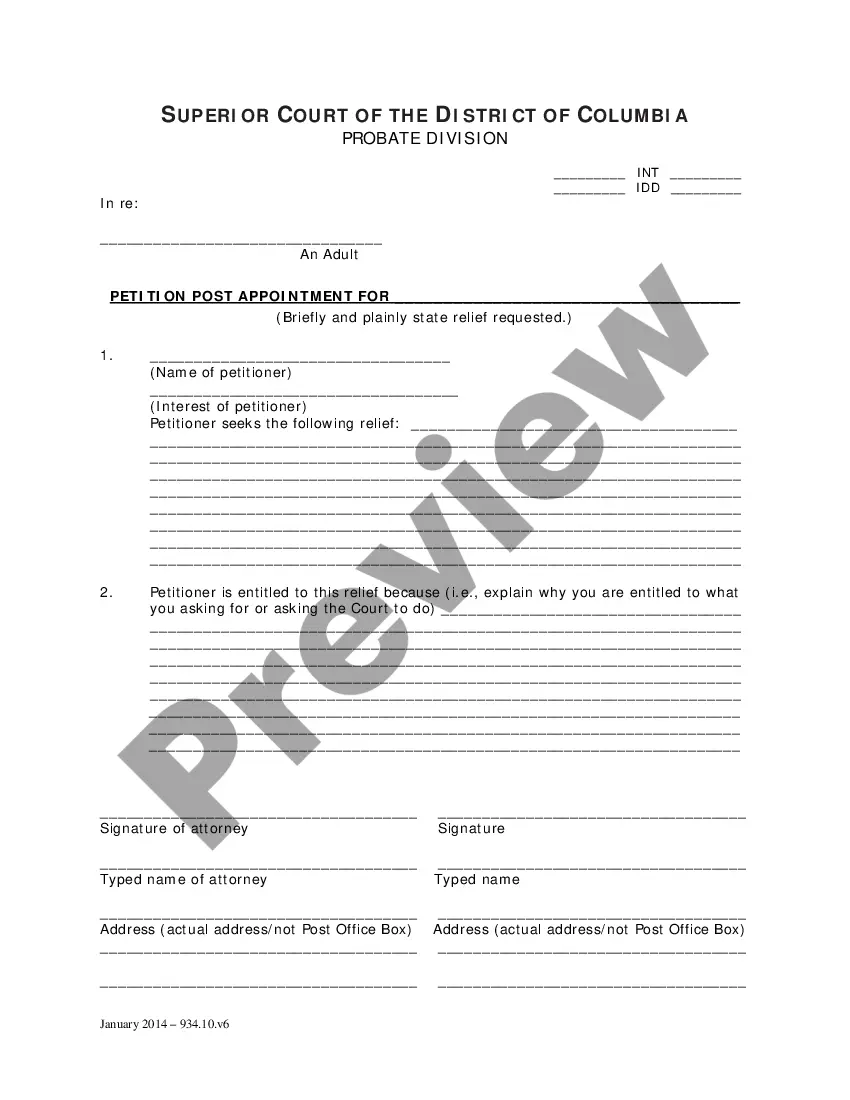

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Oakland Security Agreement - Short Form and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!