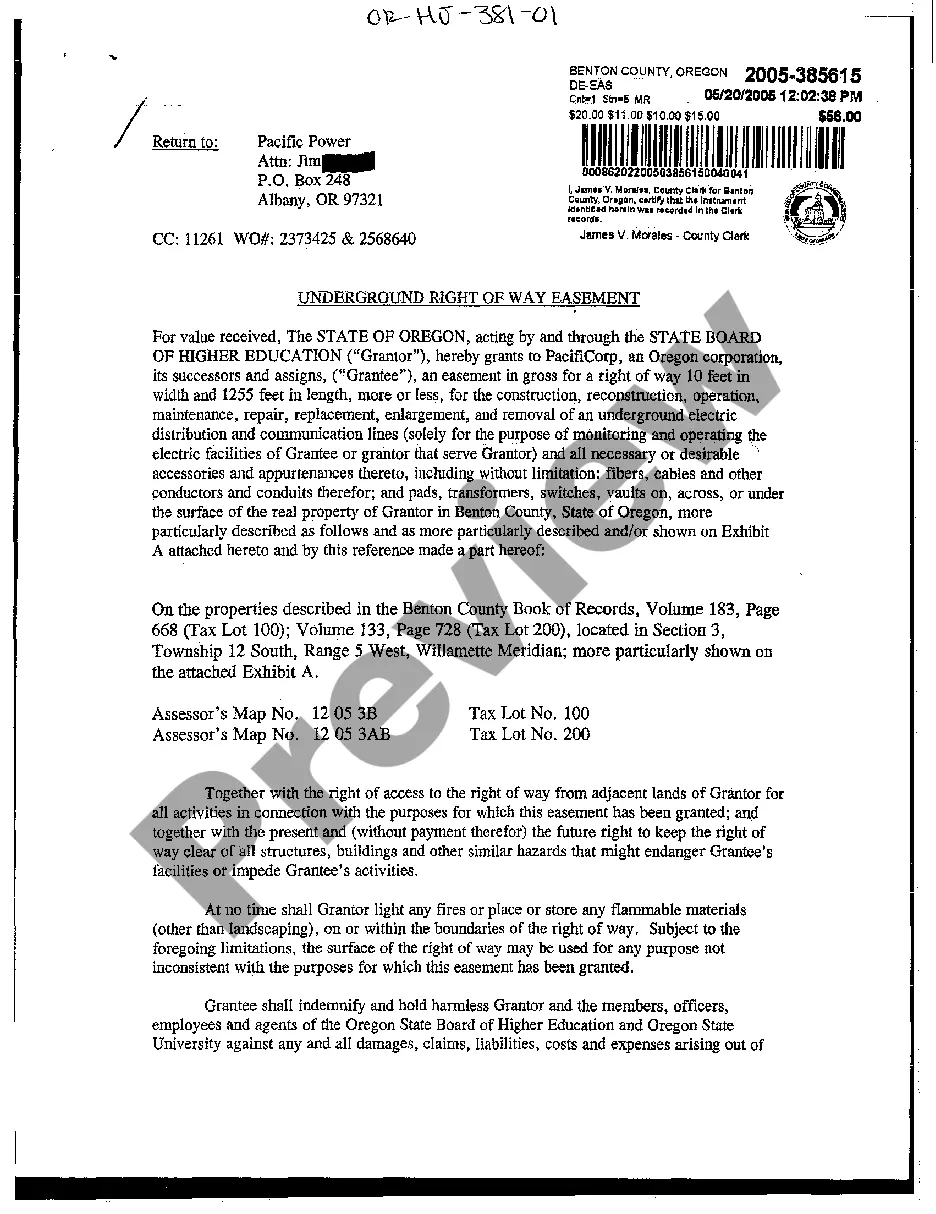

The Harris Texas Security Agreement — Long Form is a legally binding document that outlines the terms and conditions between a debtor and a secured party in the state of Texas. It serves as a means of protecting the rights and interests of the lender by providing security for the repayment of a debt. This agreement is crucial in various financial transactions, such as loans, investments, or credit extensions. The Harris Texas Security Agreement — Long Form contains essential information, including the identification of the debtor and secured party, a detailed description of the collateral used to secure the debt, and the terms and conditions of the agreement. It also outlines the obligations and rights of both parties involved. Keywords: Harris Texas Security Agreement, Long Form, legally binding document, debtor, secured party, repayment of debt, protection of rights, financial transactions, loans, investments, credit extensions, identification of parties, collateral, terms and conditions, obligations, rights. Different types of Harris Texas Security Agreements — Long Form may include: 1. Personal Property Security Agreement: This type of agreement is used when the collateral offered to secure the debt primarily consists of personal property, such as vehicles, equipment, inventory, or accounts receivable. 2. Real Estate Security Agreement: In this case, the collateral used to secure the debt is real estate or immovable property, such as land, buildings, or structures. 3. Intellectual Property Security Agreement: This agreement is employed when the collateral involved comprises intellectual property rights, such as patents, trademarks, copyrights, or trade secrets. 4. General Security Agreement: This type of agreement is more comprehensive and can be used when multiple types of collateral are used to secure the debt, encompassing various assets, including personal property, real estate, and intellectual property. By executing a Harris Texas Security Agreement — Long Form tailored to the specific circumstances of a transaction, both parties can protect their interests and ensure proper repayment or enforcement of the debt in the event of default.

Harris Texas Security Agreement - Long Form

Description

How to fill out Harris Texas Security Agreement - Long Form?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Harris Security Agreement - Long Form without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Harris Security Agreement - Long Form on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Harris Security Agreement - Long Form:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Security agreementAn agreement between debtor and creditor that creates or provides for a security interest in specified personal property.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A security agreement is a legal document that provides a lender a security interest in property or an asset that is promised as collateral. It gives the legal claim to the collateral to the creditor in case of a default by the borrower.

Documentation security is the maintenance of all essential documents stored, filed, backed up, processed, delivered, and eventually discarded when they are no longer needed. Because sensitive documents face major security threats, it is essential to develop a backup and storage plan for documents.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

What are security documents? The term security documents refers to docu- ments that incorporate specific elements intended to make them more difficult to counterfeit, falsify, alter or otherwise tamper with.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

Also known as security documents. The loan documents in a secured loan transaction which secure the borrower's obligations to the lender under the loan agreement.