The Bexar Texas Minimum Checking Account Balance — Corporate Resolutions Form is a document used by corporate entities in Bexar County, Texas to establish and maintain a minimum balance requirement for their checking accounts. This form helps ensure that businesses in Bexar County maintain a sufficient balance in their checking accounts to address any financial obligations or transactions that may arise. By implementing this minimum balance requirement, corporations can effectively manage their financial resources, stay prepared for unexpected expenses, and maintain a healthy cash flow. The minimum checking account balance is typically set by the company's management or board of directors, with consideration given to factors such as the company's size, financial stability, and transaction volume. Different types of Bexar Texas Minimum Checking Account Balance — Corporate Resolutions Forms may include variations based on the specific requirements of the company. For example, a large corporation with significant financial transactions and a high level of business activity may require a higher minimum balance compared to a smaller business with less financial activity. Some key elements that may be included in the Bexar Texas Minimum Checking Account Balance — Corporate Resolutions Form are: 1. Company Information: This section includes details such as the company name, address, legal entity type, and relevant identification numbers. 2. Resolution Details: This part outlines the specific resolution being passed by the company's management or board of directors. It includes the decision to establish a minimum checking account balance, the purpose behind this requirement, and its expected benefits for the company. 3. Minimum Balance Amount: The form will include a field where the desired minimum balance amount is stated. This amount should be determined based on a thorough analysis of the company's financial needs and obligations. 4. Effective Date: The form will specify the effective date when the minimum balance requirement goes into effect. This allows for clear communication and ensures that all relevant parties are aware of when the new policy starts. 5. Signatures: The Bexar Texas Minimum Checking Account Balance — Corporate Resolutions Form will typically require the signatures of key individuals, such as the company's officers, directors, or any other authorized personnel. It's important to note that the specific details and requirements of the Bexar Texas Minimum Checking Account Balance — Corporate Resolutions Form may vary depending on the company and its unique circumstances. Therefore, businesses should consult with legal and financial professionals to ensure compliance with local regulations and to tailor the form to meet their specific needs.

Bexar Texas Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Bexar Texas Minimum Checking Account Balance - Corporate Resolutions Form?

Drafting papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Bexar Minimum Checking Account Balance - Corporate Resolutions Form without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Bexar Minimum Checking Account Balance - Corporate Resolutions Form on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Bexar Minimum Checking Account Balance - Corporate Resolutions Form:

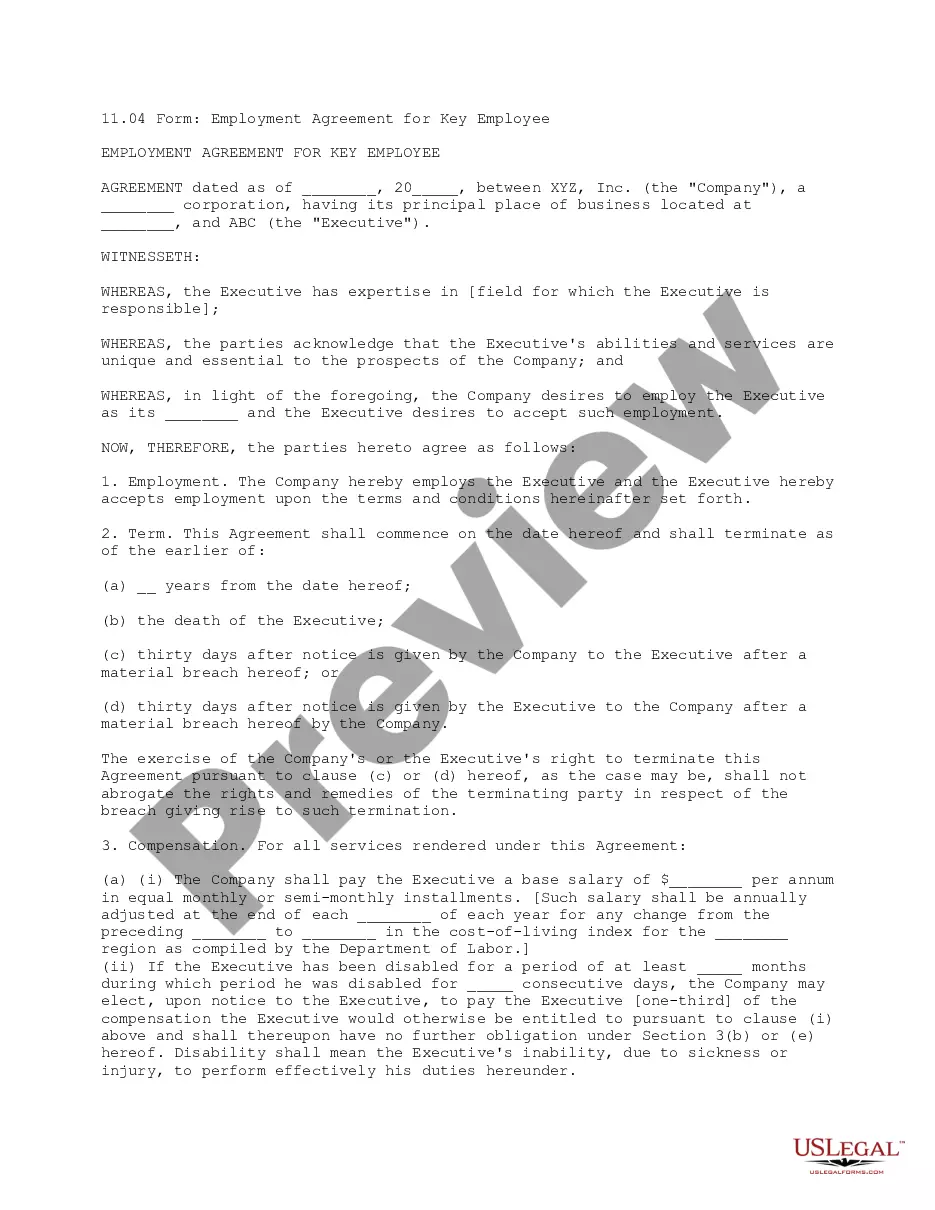

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!