Collin Texas Minimum Checking Account Balance — Corporate Resolutions Form is a document that outlines the minimum balance requirements for a corporate checking account in Collin, Texas. This form is designed to ensure that businesses maintain a certain amount of funds in their checking accounts to meet financial obligations and avoid penalties or account closures. In Collin, Texas, different types of minimum checking account balance requirements may exist based on the specific financial institution or bank. These may include: 1. Collin Texas Minimum Checking Account Balance — Small Businesses: This type of form is specifically designed for small businesses in Collin, Texas. It may have lower minimum balance requirements compared to larger corporations. 2. Collin Texas Minimum Checking Account Balance — Large Corporations: This form is intended for large corporations operating in Collin, Texas. It might have higher minimum balance requirements due to the potentially higher volume of transactions and financial activities. 3. Collin Texas Minimum Checking Account Balance — Nonprofit Organizations: Nonprofit organizations in Collin, Texas might have a separate form with specific minimum balance requirements tailored to their unique financial needs and objectives. The Collin Texas Minimum Checking Account Balance — Corporate Resolutions Form is an essential tool for businesses and organizations to understand and comply with the minimum balance regulations imposed by banks, credit unions, or other financial institutions. It typically includes detailed instructions, definitions of terms, and spaces to record the necessary information such as the company's legal name, account number, and the minimum balance required. Companies using this form will have to agree to maintain the specified minimum balance at all times. Failing to do so might result in fees, reduced account privileges, or even account closure. The form may also include provisions allowing the bank or financial institution to automatically deduct fees or charges against the account if the minimum balance is not maintained. In summary, the Collin Texas Minimum Checking Account Balance — Corporate Resolutions Form is a crucial document for businesses and organizations in Collin, Texas. It ensures compliance with minimum balance requirements set by financial institutions and helps avoid penalties and account disruptions. Different variations of this form may exist, targeting specific types of businesses or organizations with varying minimum balance thresholds.

Collin Texas Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Collin Texas Minimum Checking Account Balance - Corporate Resolutions Form?

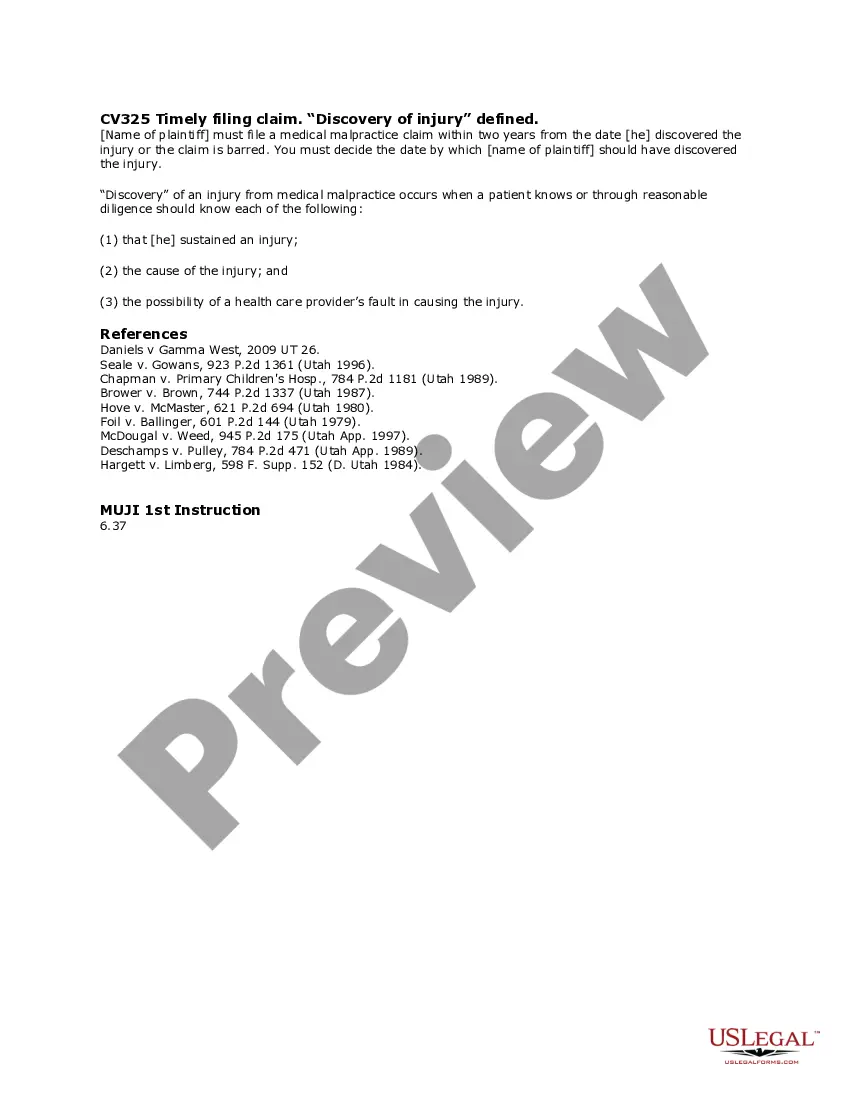

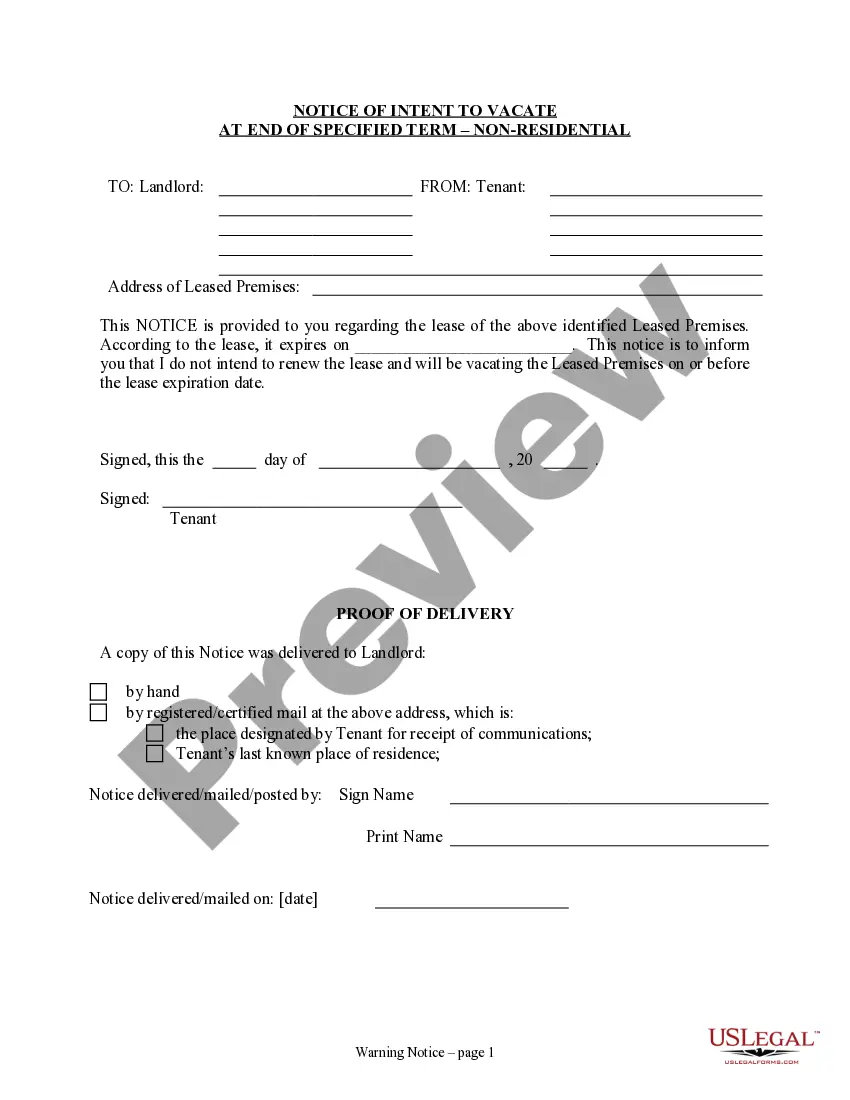

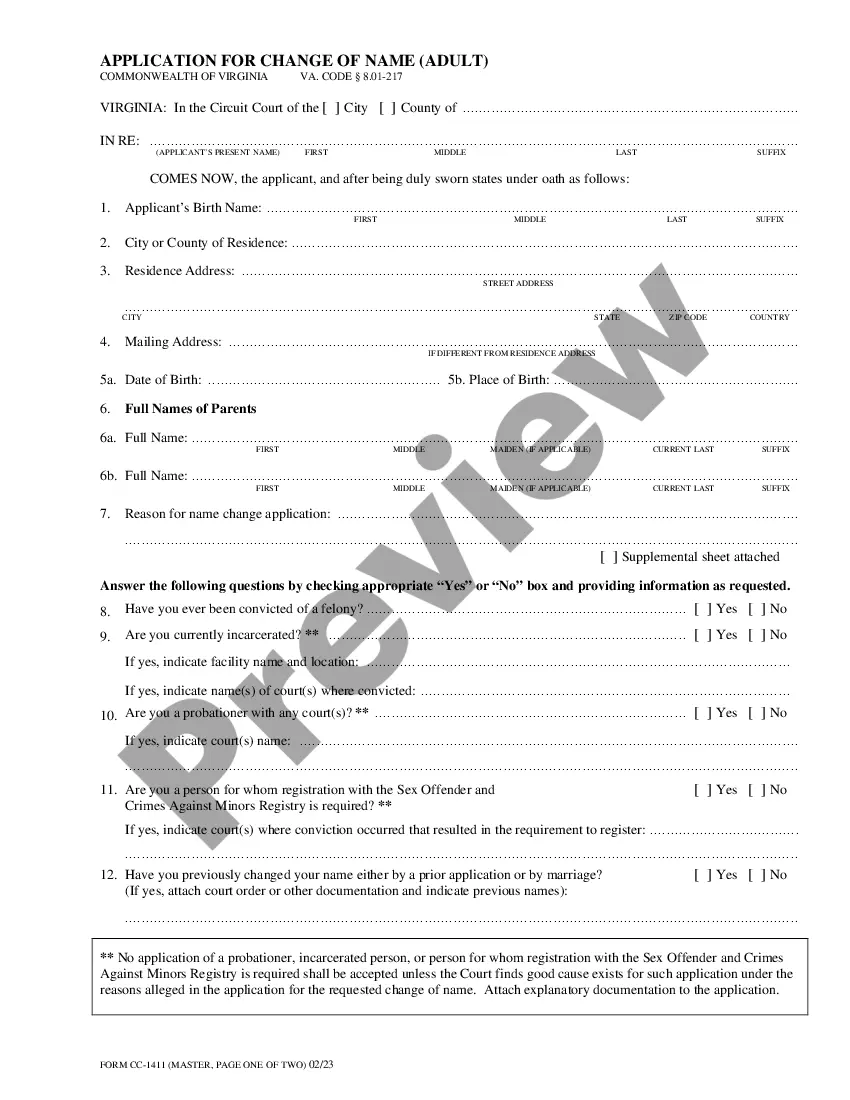

Creating forms, like Collin Minimum Checking Account Balance - Corporate Resolutions Form, to manage your legal matters is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for a variety of cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Collin Minimum Checking Account Balance - Corporate Resolutions Form template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Collin Minimum Checking Account Balance - Corporate Resolutions Form:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Collin Minimum Checking Account Balance - Corporate Resolutions Form isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Disbursement. Disbursement means the Financial Aid Office has applied funds from your financial aid award (such as grants and student loans) to any tuition, fees, or book charges owed on your student customer account.

If you were eligible for a 1098-T and did not receive one, call 866-428-1098 to request your form.

Students with an EFC of $16,000 or below were given $1,200 if enrolled full time, $600 if enrolled in 6-11 hours and $300 if enrolled in less than 6 hours. For the fall and spring, awards are automatically made to all students who complete a FAFSA for the 2021-2022 aid year.

For those who have decided to permanently leave school, it's important to note that all student loan debt must be repaid. Typically, federal student loan borrowers leaving school have a six-month grace period following withdrawal. Toward the end of that time, the student loan bills will begin to arrive.

In most situations, the refund check corresponds to a particular credit on your student account, such as an excess student loan, an overpayment, or a credit from your department.

A refund check is money that is directly given to you from your school, but it's not a gift. It is the excess money left over from your financial aid package after your tuition and fees have been paid.

To resolve the hold, official proof of exemption must be provided by a high school or college transcript, an official test score report, or by taking the TSI Assessment in one of our campus Testing Centers.

TSI HOLDS WILL NOT BE REMOVED UNTIL A STUDENT HAS EARNED A PASSING SCORE ON THE TSI ASSESSMENT OR EARNED A GRADE OF DC IN AN EXIT-LEVEL TSI COURSE AS STIPULATED BY THE STUDENT'S TSI ADVISOR.

To check your holds, log in to CougarWeb, click the Student Tab, find the Mandatory Trainings and Hold section. Once there, click View My Holds link.

More info

The next round of stable coin launches. The most promising stable coin launches. The more likely a stable coin will be to make money, relative to other cryptocurrencies. For that, you'd like stability in your coin. The ability to be traded on exchanges. Stability of your cryptocurrency. In order to create stable coins, you need to have a base (mined) and a reward (mined) coin. The more coins you mine, the more coins you mine for the reward, and therefore the more stable the coin is. “The better you are for a good long while,” Buttering argues, “the better stable [coins] you will make. And the stronger your base will be.” Why do we consider the number of coins you're mining to be a factor in your stability? If a person with 100 in their bank account earns 0.1 ether, the person now in possession of 100 of ether will be more stable because the initial 100 coin will still be worth 100 a day in ether.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.