Montgomery Maryland Minimum Checking Account Balance — Corporate Resolutions Form is a legal document that outlines the minimum amount of funds required to be maintained in a checking account for corporations in Montgomery, Maryland. This form is essential for corporate entities operating in the area to ensure compliance with financial regulations and maintain a healthy financial standing. The Montgomery Maryland Minimum Checking Account Balance — Corporate Resolutions Form helps businesses establish and adhere to a minimum balance requirement as mandated by local laws and regulations. It details the specific dollar amount that must be maintained in the corporate checking account at all times, ensuring companies are in good standing with their financial institution. There might be various types of Montgomery Maryland Minimum Checking Account Balance — Corporate Resolutions Forms, including: 1. Basic Minimum Checking Account Balance — Corporate Resolutions Form: This type of form sets a standard minimum balance requirement for corporate checking accounts. It is typically applicable to a wide range of businesses across various industries. 2. Industry-specific Minimum Checking Account Balance — Corporate Resolutions Form: In some cases, certain industries may have unique regulations governing minimum balance requirements. Industry-specific forms may be tailored to address these specific requirements. For example, financial institutions, healthcare organizations, or government contractors might have distinct minimum balance rules. 3. Varying Minimum Checking Account Balance — Corporate Resolutions Form: Some corporations may have different minimum balance requirements based on factors such as company size, financial stability, or transaction volume. This type of form allows flexibility in setting the minimum account balance according to individual circumstance. 4. Annual Review of Minimum Checking Account Balance — Corporate Resolutions Form: A yearly review of the minimum balance requirement may be necessary for corporations to adjust their financial strategies accordingly. This form enables companies to assess their financial needs and update the minimum balance requirement as needed. Businesses in Montgomery, Maryland, must use the appropriate Montgomery Maryland Minimum Checking Account Balance — Corporate Resolutions Form to ensure compliance with local financial regulations. Failure to maintain the designated minimum balance may result in penalties, loss of privileges, or other legal consequences. In conclusion, the Montgomery Maryland Minimum Checking Account Balance — Corporate Resolutions Form is a vital document that helps corporations in Montgomery, Maryland, establish and maintain the minimum balance required in their checking accounts. It ensures financial compliance and stability for businesses operating in the area.

Montgomery Maryland Minimum Checking Account Balance - Corporate Resolutions Form

Description

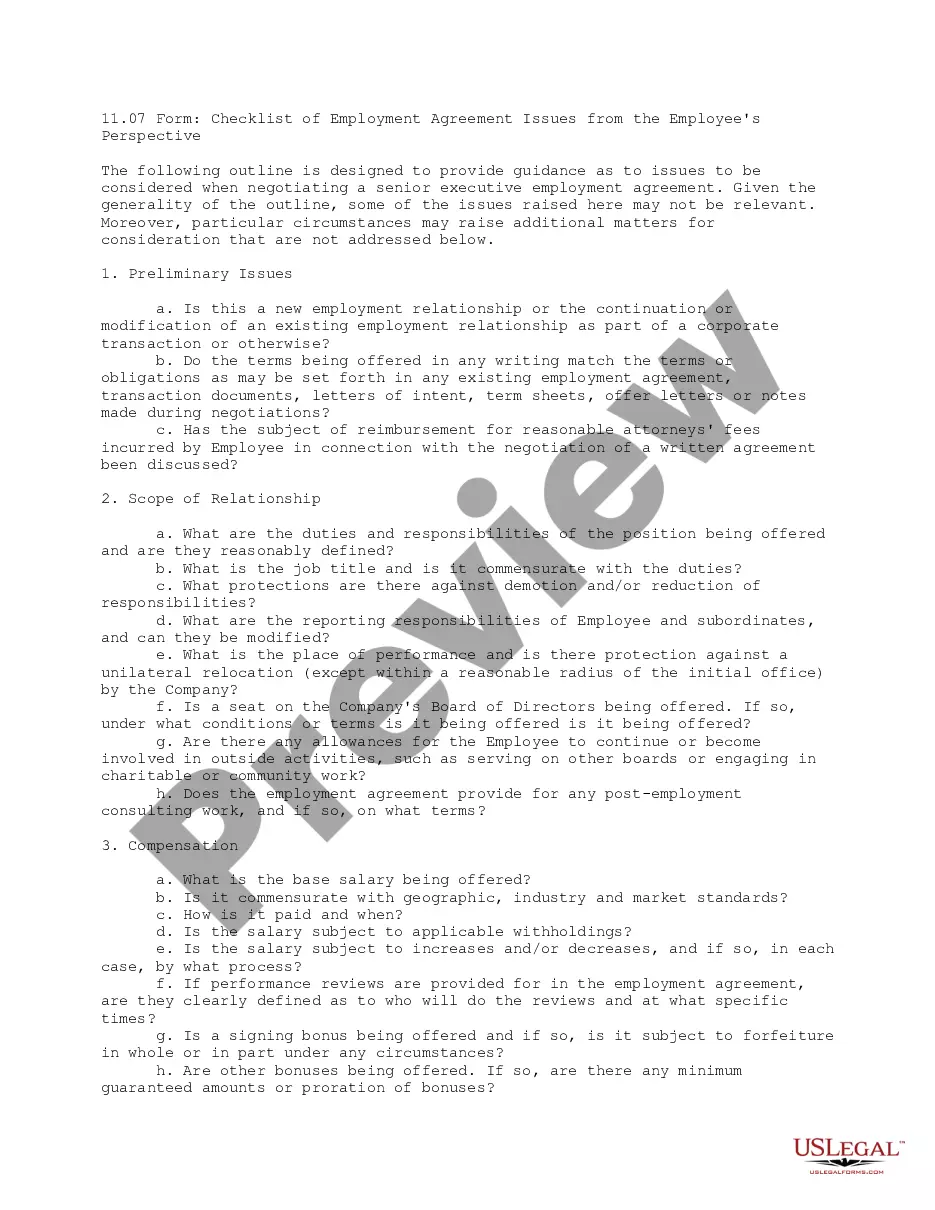

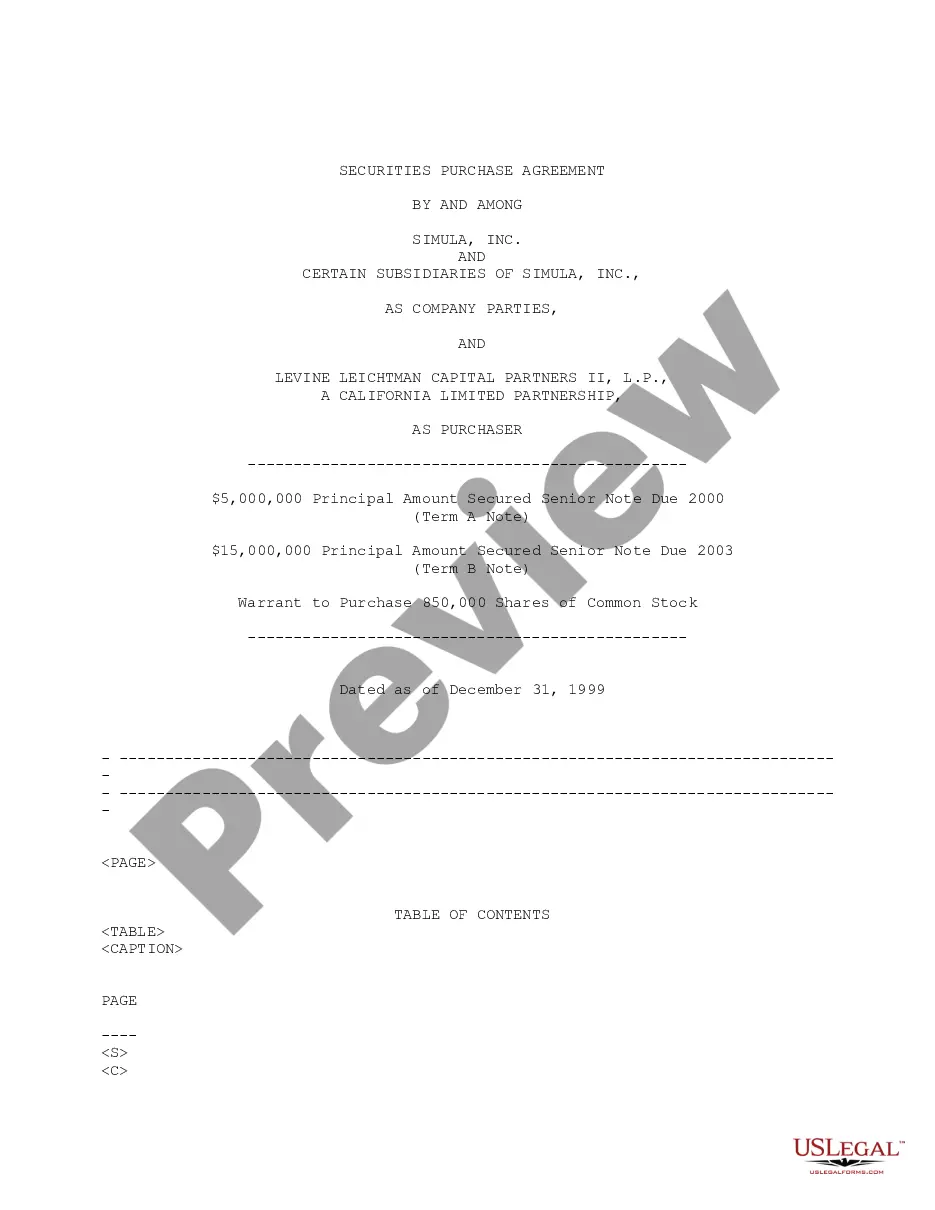

How to fill out Montgomery Maryland Minimum Checking Account Balance - Corporate Resolutions Form?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a Montgomery Minimum Checking Account Balance - Corporate Resolutions Form meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Montgomery Minimum Checking Account Balance - Corporate Resolutions Form, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Montgomery Minimum Checking Account Balance - Corporate Resolutions Form:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Montgomery Minimum Checking Account Balance - Corporate Resolutions Form.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!