The Cuyahoga County in Ohio is known for its diverse insurance landscape, with numerous contracts established between General Agents of Insurance Companies and Independent Agents. These contracts serve as the foundation for a professional relationship in which the General Agent ("GA") and Independent Agent ("IA") work together to sell insurance products and provide services to clients. Such agreements outline the roles, responsibilities, and compensation arrangements between the parties involved. One type of common Cuyahoga Ohio Contract between a General Agent of an Insurance Company and an Independent Agent is the Exclusive Agency Contract. Under this contract, the General Agent grants the Independent Agent the exclusive right to sell and service insurance policies within a specific geographical region or market segment. In return, the Independent Agent is expected to meet certain production quotas and uphold the highest ethical and professional standards. Another type of Cuyahoga Ohio Contract is the Non-Exclusive Agency Contract. In this arrangement, the General Agent allows the Independent Agent to sell and service insurance policies while also allowing them to work with other insurance companies. This contract offers flexibility and allows the Independent Agent to offer a wider range of insurance products to their clients. The Contract between the General Agent and Independent Agent typically includes various key provisions and clauses. These may include: 1. Commission Structure: The contract details the commission structure and the percentage of commission that the Independent Agent will receive for each insurance policy sold. 2. Production Quotas: The contract may stipulate the minimum production requirements that the Independent Agent must meet to continue the relationship. 3. Termination and Renewal: The contract outlines the conditions and procedures for termination and renewal, including the notice period and any associated fees or penalties. 4. Incentives and Bonuses: The contract may include provisions for additional incentives or bonuses based on the Independent Agent's performance, such as achieving specific sales targets. 5. Intellectual Property: The contract may address ownership and usage rights of intellectual property, such as trademarks, logos, and marketing materials provided by the General Agent. 6. Training and Support: The contract may outline the General Agent's commitment to providing necessary training, support, and resources to the Independent Agent to ensure their success. 7. Compliance and Ethical Standards: The contract may include provisions requiring the Independent Agent to comply with all applicable laws, regulations, and industry ethical standards. 8. Confidentiality: The contract may require the Independent Agent to maintain the confidentiality of customer information and other proprietary company information. Overall, the Cuyahoga Ohio Contract between a General Agent of an Insurance Company and an Independent Agent is a crucial agreement that establishes the terms and conditions of their professional relationship. It sets clear expectations and guidelines to ensure a successful partnership in serving the insurance needs of clients within the county.

Cuyahoga Ohio Contract between General Agent of Insurance Company and Independent Agent

Description

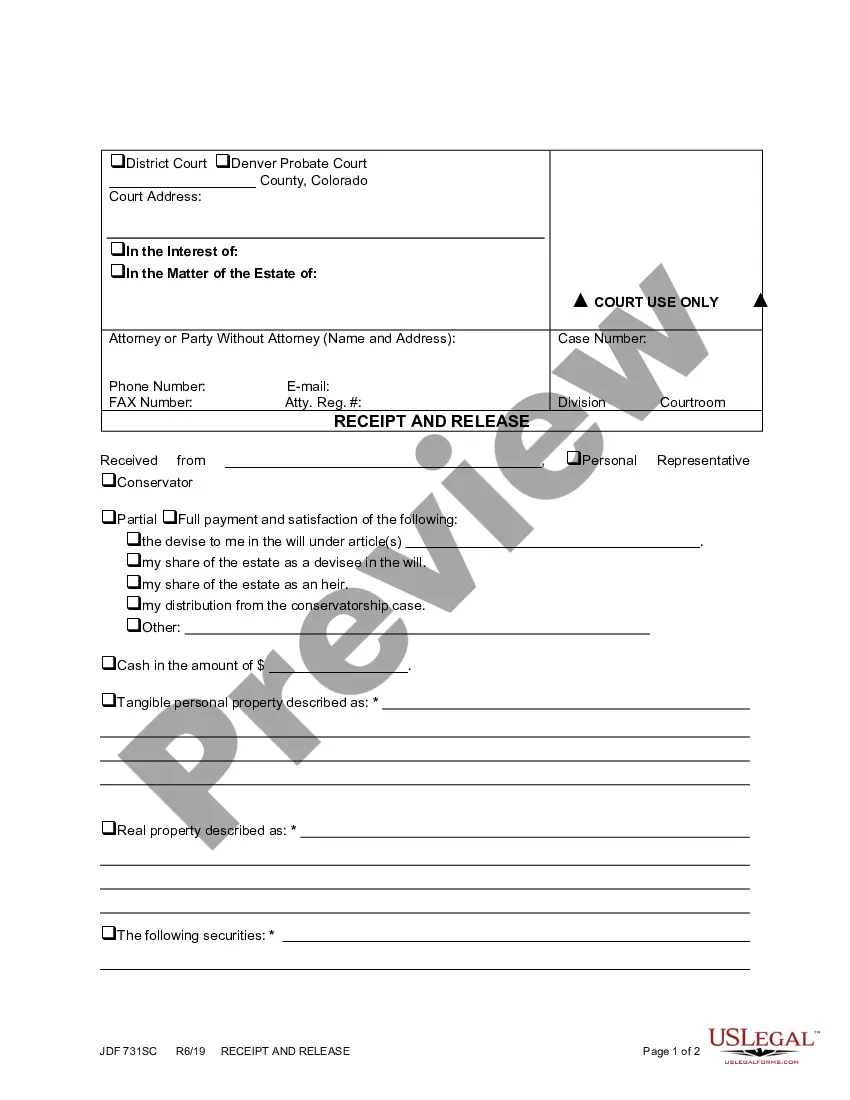

How to fill out Cuyahoga Ohio Contract Between General Agent Of Insurance Company And Independent Agent?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Cuyahoga Contract between General Agent of Insurance Company and Independent Agent suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Cuyahoga Contract between General Agent of Insurance Company and Independent Agent, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Cuyahoga Contract between General Agent of Insurance Company and Independent Agent:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Contract between General Agent of Insurance Company and Independent Agent.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!