A Hennepin Minnesota Contract between a General Agent and an Independent Agent in the insurance industry is a legal agreement that defines the relationship, obligations, and compensation structure between a general agent (GA) and an independent agent (IA) operating within Hennepin County, Minnesota. This contract serves as a foundation for the working partnership between these parties, ensuring clarity, fair practices, and compliance with regulatory requirements. The terms and conditions of a Hennepin Minnesota Contract between a General Agent and an Independent Agent may vary based on various factors, such as the type of insurance being sold, the size and scope of operations, and the specific objectives of the parties involved. Here are some common types of contracts that may exist: 1. Producer Agreement: This contract establishes the basic terms and conditions under which the IA will act as an authorized representative of the GA. It outlines the responsibilities of both parties, including marketing, selling insurance policies, and providing customer service. 2. Compensation Agreement: This type of contract determines how the IA will be compensated for their services. It typically includes details about commission rates, bonuses, and any additional incentives based on performance metrics such as sales volume or policy retention. 3. Termination Agreement: In cases where the relationship between the GA and IA needs to be terminated, a separate contract may be established to outline the terms and conditions for ending the partnership. This could include a notice period, provisions for the disposal of client records, and any outstanding compensation owed to the IA. 4. Non-Compete Agreement: To protect the GA's interests, an additional contract might be implemented to prevent the IA from competing directly with the GA or soliciting its clients for a certain period after the termination of the agreement. Some essential elements that are commonly addressed in a Hennepin Minnesota Contract between a General Agent and an Independent Agent include: — Scope of authority granted to the IA by the GA — Detailed description of the insurance products to be marketed and sold — Procedures for handling policy applications, underwriting, and claims processes — Compliance with applicable laws, regulations, and industry standards — Confidentiality and privacy protection of client information — Dispute resolution mechanisms, including arbitration or mediation procedures — Duration of the contract, renewal options, and conditions for termination — Indemnification and liability provisions to protect both parties from legal claims — Non-disclosure of trade secrets or proprietary information — Appointment and termination procedures for the IA's sub-agents, if applicable It is important for both the GA and IA to carefully review and negotiate the terms of the contract, seeking legal advice if necessary, to ensure that the agreement meets their specific requirements and aligns with Minnesota state laws and regulations.

Hennepin Minnesota Contract between General Agent of Insurance Company and Independent Agent

Description

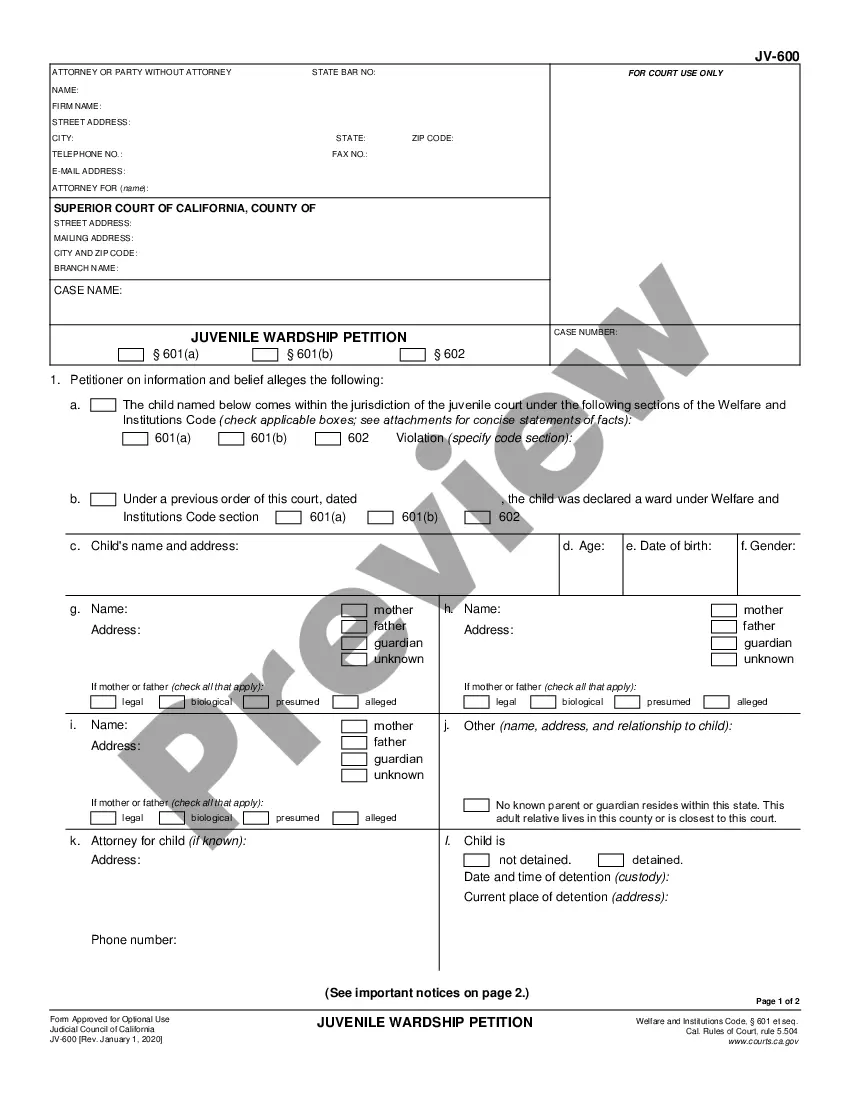

How to fill out Hennepin Minnesota Contract Between General Agent Of Insurance Company And Independent Agent?

Drafting papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Hennepin Contract between General Agent of Insurance Company and Independent Agent without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Hennepin Contract between General Agent of Insurance Company and Independent Agent on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Hennepin Contract between General Agent of Insurance Company and Independent Agent:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!