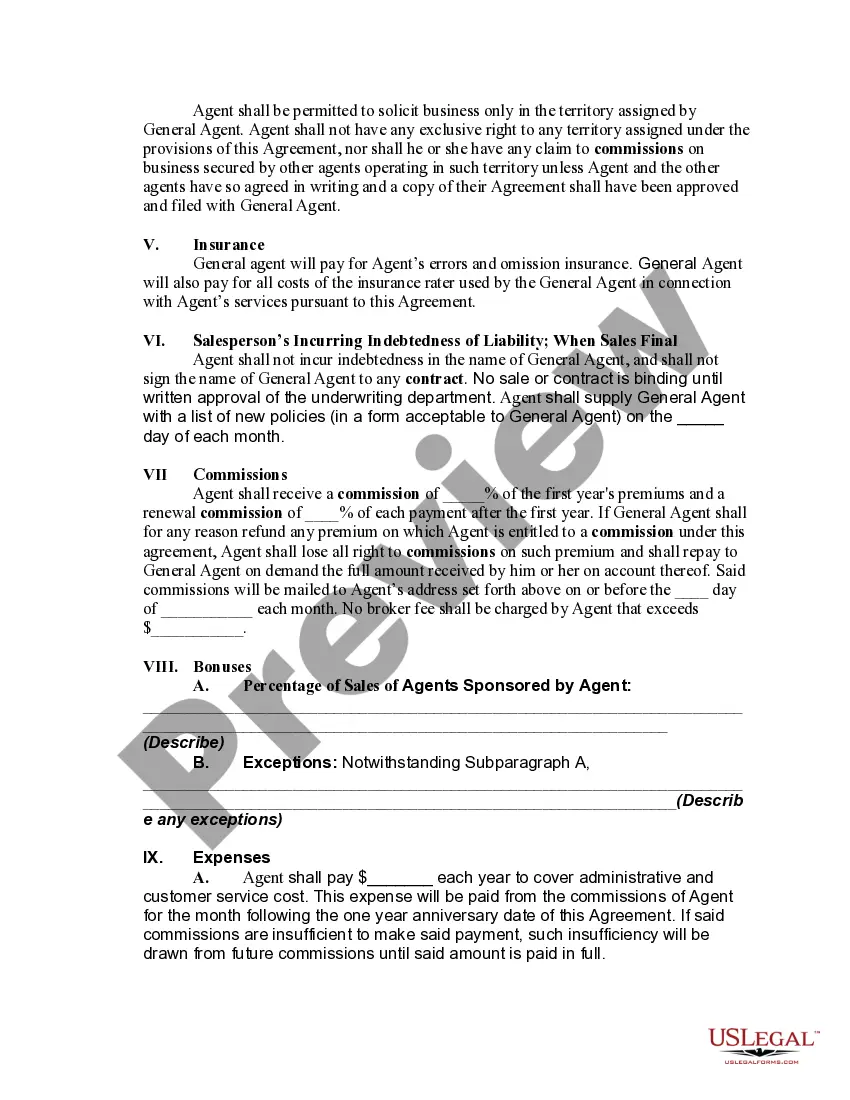

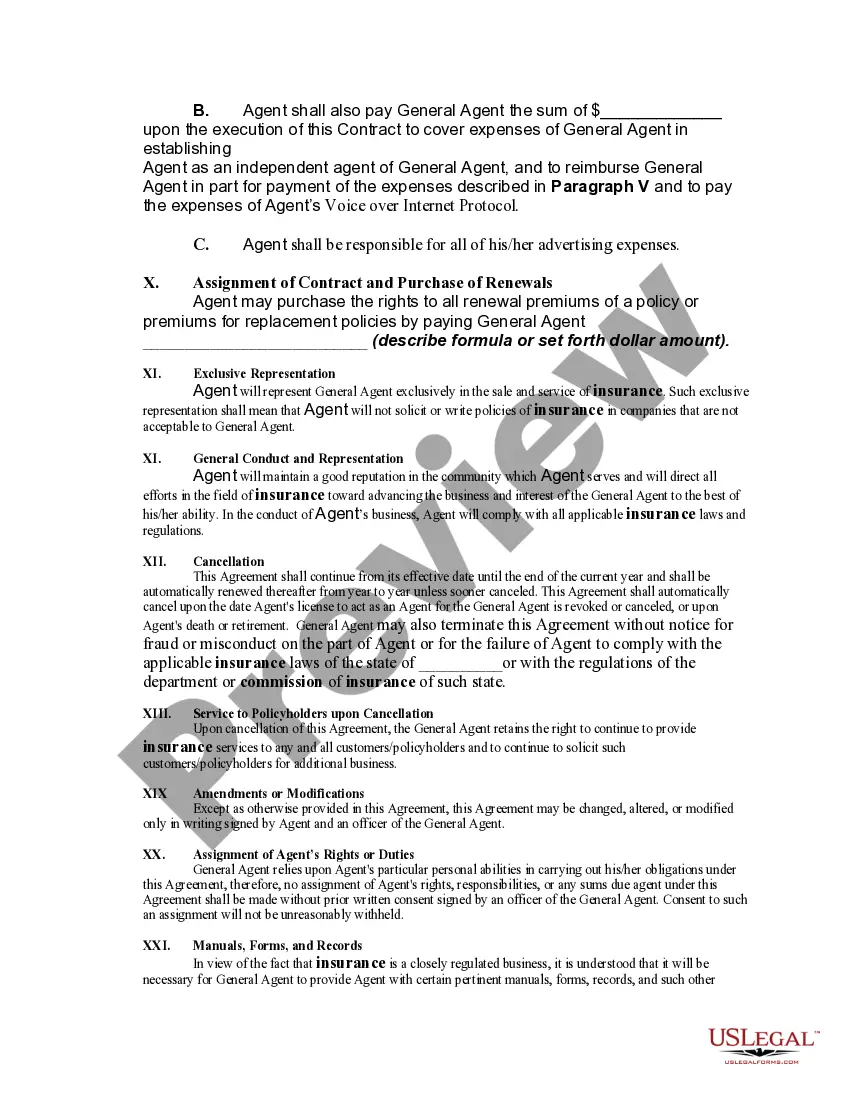

Title: Understanding Salt Lake Utah Contracts between General Agents of Insurance Companies and Independent Agents Introduction: Salt Lake City, Utah, plays host to a myriad of contractual arrangements between General Agents (GA's) of insurance companies and Independent Agents (IAS). These agreements aim to define the specific roles, responsibilities, and obligations of both parties involved in the distribution and sale of insurance products. This article intends to delve into the details of Salt Lake Utah Contracts between General Agents of Insurance Companies and Independent Agents, with a spotlight on the different types of agreements prevalent in this locale. 1. General Agent (GA): The General Agent serves as a representative of an insurance company and typically engages with Independent Agents to distribute products within a specific region. They act as an intermediary between the insurance company and the Independent Agent, facilitating smooth operations based on predetermined contractual terms. 2. Independent Agent (IA): An Independent Agent is an entity or individual who operates autonomously, representing multiple insurance companies simultaneously. They sell insurance products directly to clients and rely on the General Agent for support, training, and the necessary expertise related to the products they offer. Types of Salt Lake Utah Contracts between General Agents and Independent Agents: 1. Exclusive General Agent Agreement: This agreement establishes an exclusive relationship between the General Agent and the Independent Agent, wherein the Independent Agent agrees to work solely with the respective insurance company. This type of contract offers benefits such as increased commission rates, preferential treatment, and access to specialized training and marketing resources. 2. General Agent Subcontracting Agreement: Under this contract, the General Agent enters into an agreement with the Independent Agent, allowing them to subcontract specific duties or functions related to the insurance sales process. This arrangement enables the Independent Agent to leverage the expertise and resources of the General Agent while fulfilling certain obligations. 3. General Agency Intermediary Agreement: In this contractual arrangement, the General Agent serves as an intermediary between the Independent Agent and the insurance company. The General Agent facilitates communication, manages paperwork, and provides administrative support to ensure smooth operations. This agreement helps shield the Independent Agent from certain administrative tasks, allowing them to focus on sales and client relationships. 4. General Agency Assignment Agreement: When a General Agent intends to transfer certain rights and responsibilities associated with selling insurance products to an Independent Agent, a General Agency Assignment Agreement is utilized. This agreement outlines the expectations, obligations, and compensation arrangements during the transition of duties. Conclusion: Salt Lake City, Utah, offers a diverse array of Salt Lake Utah Contracts between General Agents of Insurance Companies and Independent Agents. Understanding the different types of agreements, including Exclusive General Agent Agreements, General Agent Subcontracting Agreements, General Agency Intermediary Agreements, and General Agency Assignment Agreements, enables insurance professionals to establish mutually beneficial partnerships and promote seamless insurance product distribution in the region.

Salt Lake Utah Contract between General Agent of Insurance Company and Independent Agent

Description

How to fill out Salt Lake Utah Contract Between General Agent Of Insurance Company And Independent Agent?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Salt Lake Contract between General Agent of Insurance Company and Independent Agent is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Salt Lake Contract between General Agent of Insurance Company and Independent Agent. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Contract between General Agent of Insurance Company and Independent Agent in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!