A San Diego California contract between a General Agent of an Insurance Company and an Independent Agent is an agreement that outlines the working relationship between both parties in the insurance industry. This contractual agreement serves to establish the terms and conditions under which the General Agent and the Independent Agent will collaborate to promote and sell insurance policies in the San Diego area. The San Diego California contract between a General Agent of an Insurance Company and an Independent Agent typically covers a range of key aspects such as: 1. Roles and Responsibilities: This section defines the respective responsibilities of the General Agent and the Independent Agent. The General Agent acts as the intermediary between the Insurance Company and the Independent Agent. The Independent Agent undertakes tasks such as prospecting for potential customers, providing insurance quotes, and submitting policy applications. 2. Licensing and Compliance: The contract specifies that the Independent Agent must possess all the required licenses and certifications, as mandated by the California Department of Insurance and other relevant regulatory bodies. It emphasizes the need for the Independent Agent to adhere to all legal and ethical guidelines in the insurance industry. 3. Exclusive or Non-Exclusive Agreement: Depending on the nature of the partnership, the contract may specify whether the Independent Agent holds an exclusive or non-exclusive agreement with the General Agent. An exclusive agreement means that the Independent Agent solely represents the General Agent, whereas a non-exclusive agreement allows the Independent Agent to collaborate with other insurance entities. 4. Commission Structure: The contract includes details about the commission structure for the Independent Agent. It outlines the compensation terms, including the commission rates, bonuses, and any additional incentives offered by the General Agent. The commission structure may vary depending on the type of insurance policies sold, such as life insurance, auto insurance, health insurance, or property insurance. 5. Termination Clause: This section outlines the conditions under which either party can terminate the contractual agreement. It may include provisions for giving advance notice, reasons for termination, and any potential compensation owed to the Independent Agent upon termination. Types of San Diego California contracts between General Agents of Insurance Companies and Independent Agents can include: 1. Exclusive General Agency Agreement: This type of agreement grants exclusive representation rights to the Independent Agent in a specific territory or market segment. The Independent Agent becomes the sole representative of the General Agent in that area, while the General Agent offers support, training, and resources to aid the Independent Agent's sales efforts. 2. Non-Exclusive General Agency Agreement: In this type of agreement, the Independent Agent has the flexibility to represent multiple General Agents simultaneously. The Independent Agent is not bound to represent only one insurance company and can collaborate with various General Agents to offer a wider range of insurance policies to customers. These contracts facilitate a mutually beneficial partnership between the General Agent of an Insurance Company and the Independent Agent, ensuring efficient functioning, compliance with industry regulations, and effective sales and distribution of insurance policies in San Diego, California.

San Diego California Contract between General Agent of Insurance Company and Independent Agent

Description

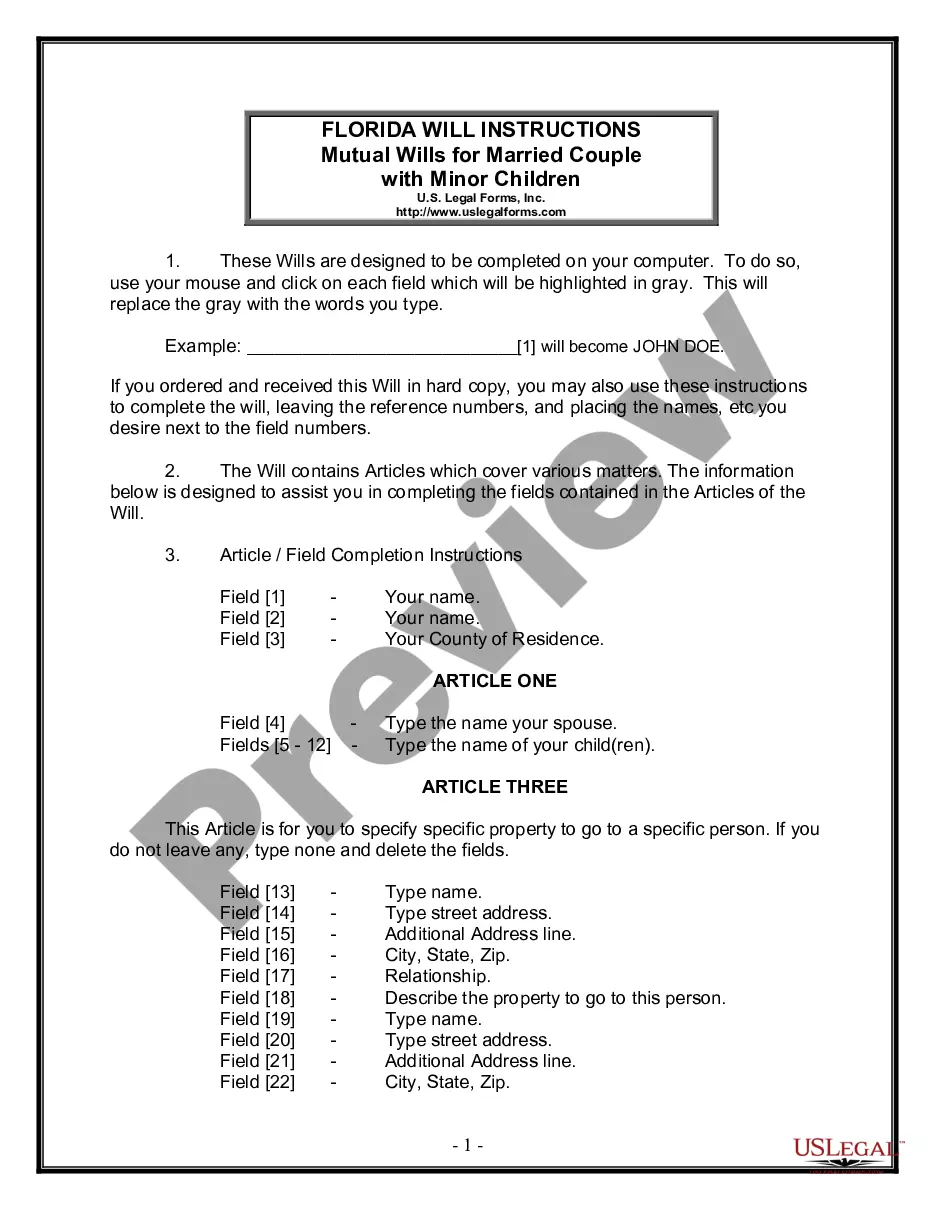

How to fill out San Diego California Contract Between General Agent Of Insurance Company And Independent Agent?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create San Diego Contract between General Agent of Insurance Company and Independent Agent without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid San Diego Contract between General Agent of Insurance Company and Independent Agent on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the San Diego Contract between General Agent of Insurance Company and Independent Agent:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!