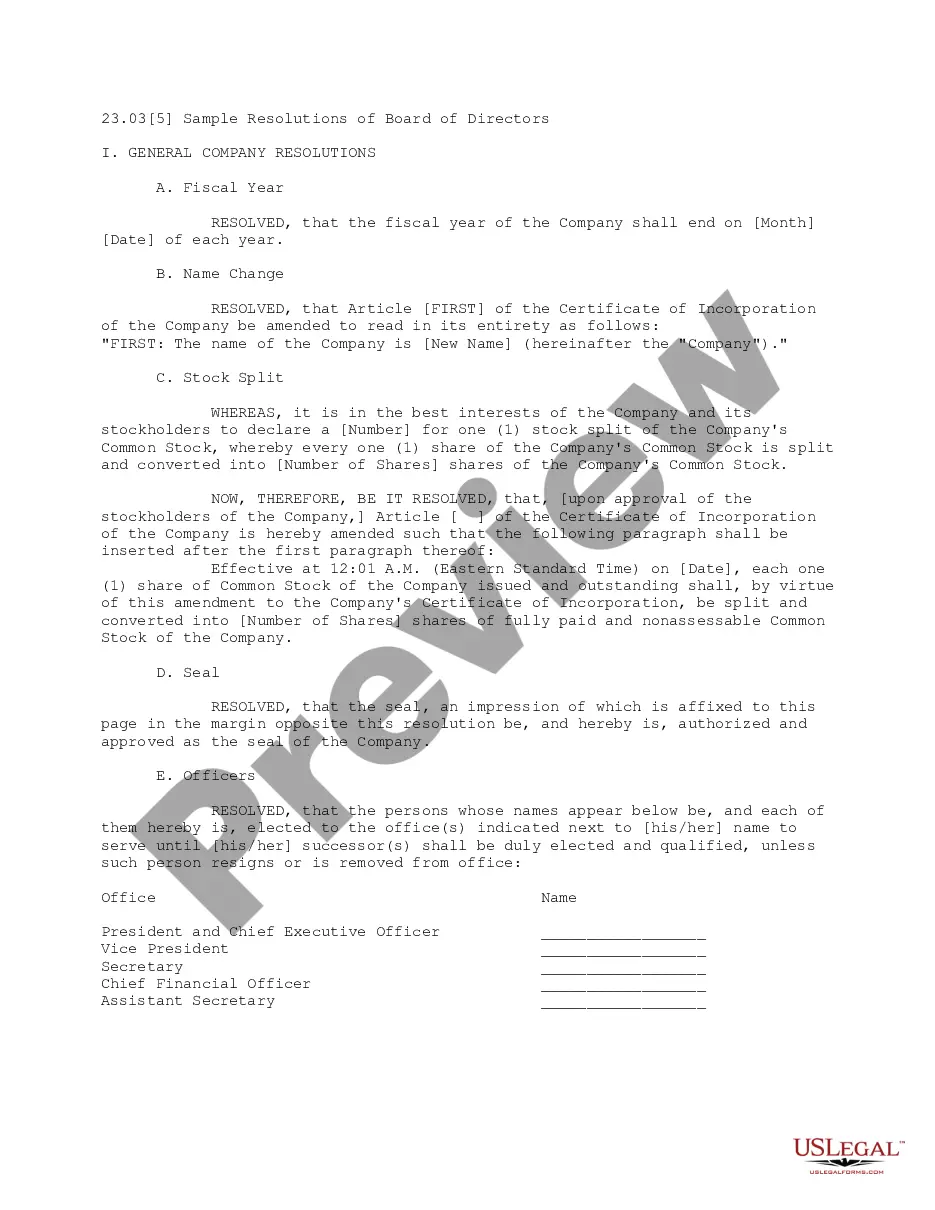

The Allegheny Pennsylvania Commercial Partnership Agreement in the form of a Bill of Sale is a legally binding document that outlines the terms and conditions of a partnership agreement between two or more entities engaged in commercial activities in Allegheny County, Pennsylvania. This agreement serves as a vital tool for businesses looking to establish a partnership in the county and ensures a clear understanding of each partner's rights, responsibilities, and obligations. Keywords: Allegheny Pennsylvania, commercial partnership agreement, Bill of Sale, partnership, entities, terms and conditions, County, businesses, rights, responsibilities, obligations. Different types of Allegheny Pennsylvania Commercial Partnership Agreements in the form of a Bill of Sale may include: 1. General Partnership Agreement: This type of agreement establishes a partnership where all partners share equal rights and liabilities in the business. It outlines the profit-sharing, decision-making, and management responsibilities of each partner. 2. Limited Partnership Agreement: In a limited partnership, there are general partners who have unlimited liability, and limited partners who have limited liability. This agreement specifies the roles and responsibilities of both types of partners and ensures compliance with relevant laws and regulations. 3. Limited Liability Partnership (LLP) Agreement: Laps provide partners with limited liability protection, shielding their personal assets from business debts and liabilities. This agreement details the structure, management, and responsibilities of the partners within the LLP. 4. Joint Venture Agreement: A joint venture is a temporary partnership formed for a specific project or venture. This agreement defines the scope, objectives, profit-sharing, and termination conditions for the joint venture. 5. Master Limited Partnership (MLP) Agreement: Maps are a specific form of partnership commonly used in the energy and natural resources sectors. This agreement specifies the distribution of cash flows, tax considerations, limited partner governance, and other key aspects unique to Maps. Regardless of the type, Allegheny Pennsylvania Commercial Partnership Agreements in the form of a Bill of Sale provide a legally binding framework, ensuring that business partners operate in accordance with agreed-upon terms while protecting their rights and interests. It is advisable to seek legal assistance to draft and customize the agreement to address specific partnership needs and comply with relevant laws.

Allegheny Pennsylvania Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Allegheny Pennsylvania Commercial Partnership Agreement In The Form Of A Bill Of Sale?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Allegheny Commercial Partnership Agreement in the Form of a Bill of Sale, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork completion simple.

Here's how to find and download Allegheny Commercial Partnership Agreement in the Form of a Bill of Sale.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Allegheny Commercial Partnership Agreement in the Form of a Bill of Sale.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Allegheny Commercial Partnership Agreement in the Form of a Bill of Sale, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to deal with an extremely challenging case, we advise using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!