Allegheny Pennsylvania is a county in the state of Pennsylvania, United States. It is home to various cities and townships, including Pittsburgh, the county seat. Opening a bank account in Allegheny Pennsylvania is a straightforward process that requires certain legal formalities, including the completion of Corporate Resolutions Forms. Corporate Resolutions Forms are legal documents used by corporations to make important decisions and authorize actions related to corporate bank accounts. These forms serve as written evidence of the approval and consent of the company's board of directors or shareholders. There are several types of Corporate Resolutions Forms that may be used when opening a bank account in Allegheny Pennsylvania, including: 1. Opening a Corporate Checking Account Resolution Form: This form authorizes the establishment of a corporate checking account, outlining the necessary information, such as the account holder's name, business address, and Tax ID number. 2. Corporate Signer Resolution Form: This form designates authorized signers who have the authority to transact on behalf of the corporation. It includes details about the individuals authorized to sign checks, make deposits, withdraw funds, and perform other banking activities. 3. Corporate Resolution for Account Signatories Form: This document outlines the individuals who have the power to sign legal documents, binding the corporation to contracts or agreements related to the account. 4. Corporate Resolution for Account Closure Form: In the event a corporation decides to close its bank account, this form is used to authorize the closure and outline the necessary steps to be taken. 5. Corporate Resolution for Account Changes Form: If any changes need to be made to an existing bank account, such as adding or removing authorized signatories, updating contact information, or modifying account restrictions, this form is utilized. When opening a bank account in Allegheny Pennsylvania, it is crucial to consult with the bank's requirements and speak with a bank representative to ensure the proper completion and submission of the relevant Corporate Resolutions Forms. This process ensures compliance with the appropriate legal procedures and enables the corporation to establish a secure and efficient banking relationship for its financial operations.

Allegheny Pennsylvania Open a Bank Account - Corporate Resolutions Forms

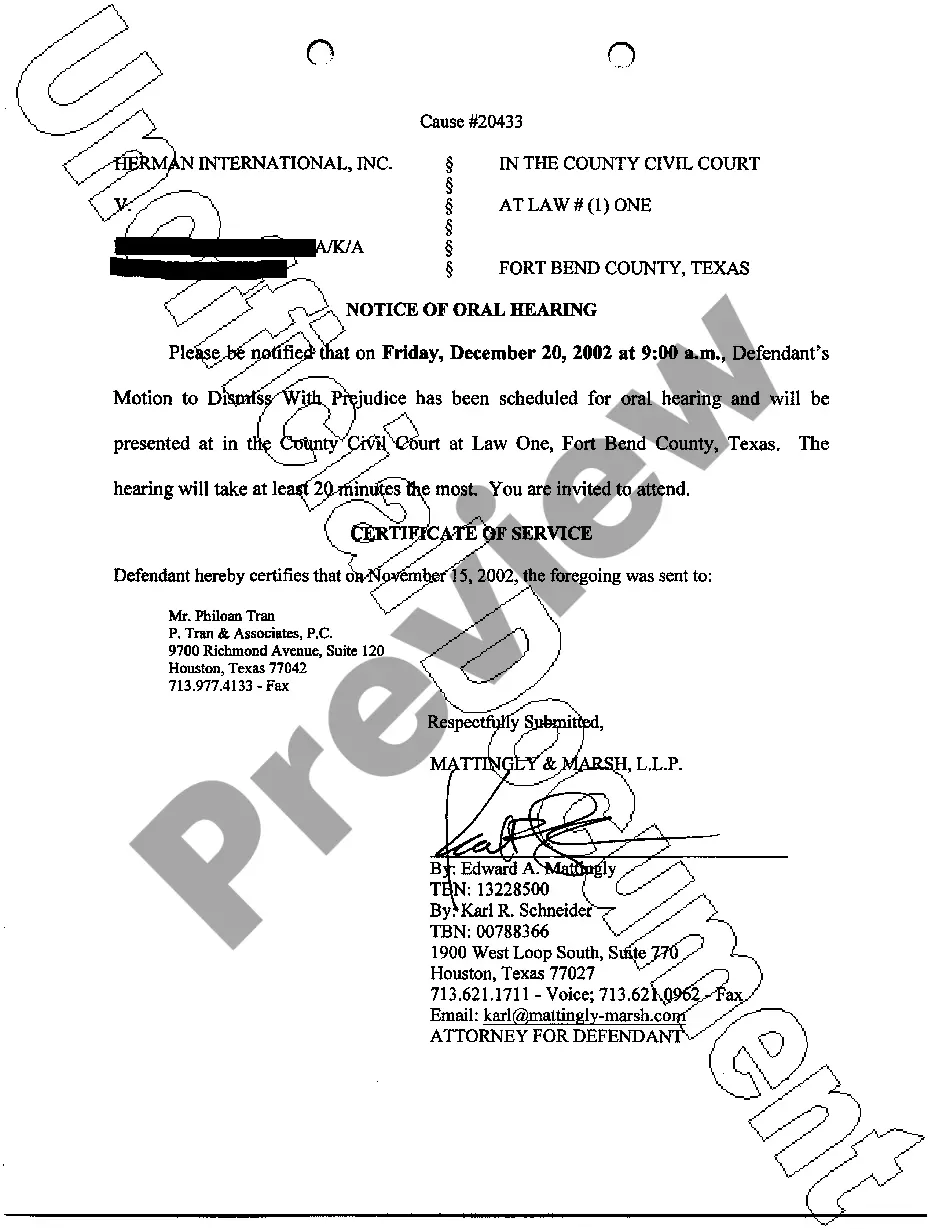

Description

How to fill out Allegheny Pennsylvania Open A Bank Account - Corporate Resolutions Forms?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Allegheny Open a Bank Account - Corporate Resolutions Forms suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Allegheny Open a Bank Account - Corporate Resolutions Forms, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Allegheny Open a Bank Account - Corporate Resolutions Forms:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Allegheny Open a Bank Account - Corporate Resolutions Forms.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!