If you're looking to open a bank account in Oakland, Michigan, it's important to be familiar with the necessary documentation and forms involved, specifically the Corporate Resolutions Forms. These forms are typically required when a corporation, rather than an individual, wants to open a bank account. They serve as official records demonstrating corporate authorization for banking activities and setting out the rules and decision-making processes within the corporation. The Corporate Resolutions Forms may vary slightly depending on the bank and the specific requirements of the corporation. However, they generally include the following key components: 1. General Corporate Information: This section requires basic information about the corporation, such as the legal name, registered address, employer identification number (EIN), and the names of key corporate officers or authorized signatories. 2. Account Signatories: Here, detailed information about individuals authorized to manage the account and conduct banking transactions on behalf of the corporation is provided. This typically includes names, titles, addresses, contact details, and sometimes even Social Security Numbers. 3. Account Specifications: This part outlines the type of account being opened, whether it's a checking account, savings account, money market account, or any other specific account offered by the bank. It may also require information regarding desired features, such as online banking, debit cards, or additional services the corporation may require. 4. Authority and Signatory Powers: This section specifies the scope of authority granted to the authorized individuals and outlines the decision-making process within the corporation regarding banking matters. It may include details about required signatures for different transaction types, spending limits, and any special restrictions or instructions that must be followed. 5. Fiduciary Responsibility Statement: Some banks may require a fiduciary statement, in which the corporation affirms that the authorized individuals will act in the best interests of the corporation and adhere to applicable laws and regulations. Different types of Corporate Resolutions Forms may exist, depending on the bank and its specific requirements. For instance, banks may have tailored Corporate Resolutions Forms for different types of corporations, such as C corporations, S corporations, limited liability companies (LCS), or non-profit organizations. Additionally, variations can occur based on the particular banking policies and regulations in Oakland, Michigan. When opening a bank account, it's crucial to contact the chosen financial institution in advance to obtain the bank's specific Corporate Resolutions Forms and requirements. This ensures that the corporation has the appropriate documentation prepared and avoids any unnecessary delays or complications during the account opening process.

Oakland Michigan Open a Bank Account - Corporate Resolutions Forms

Description

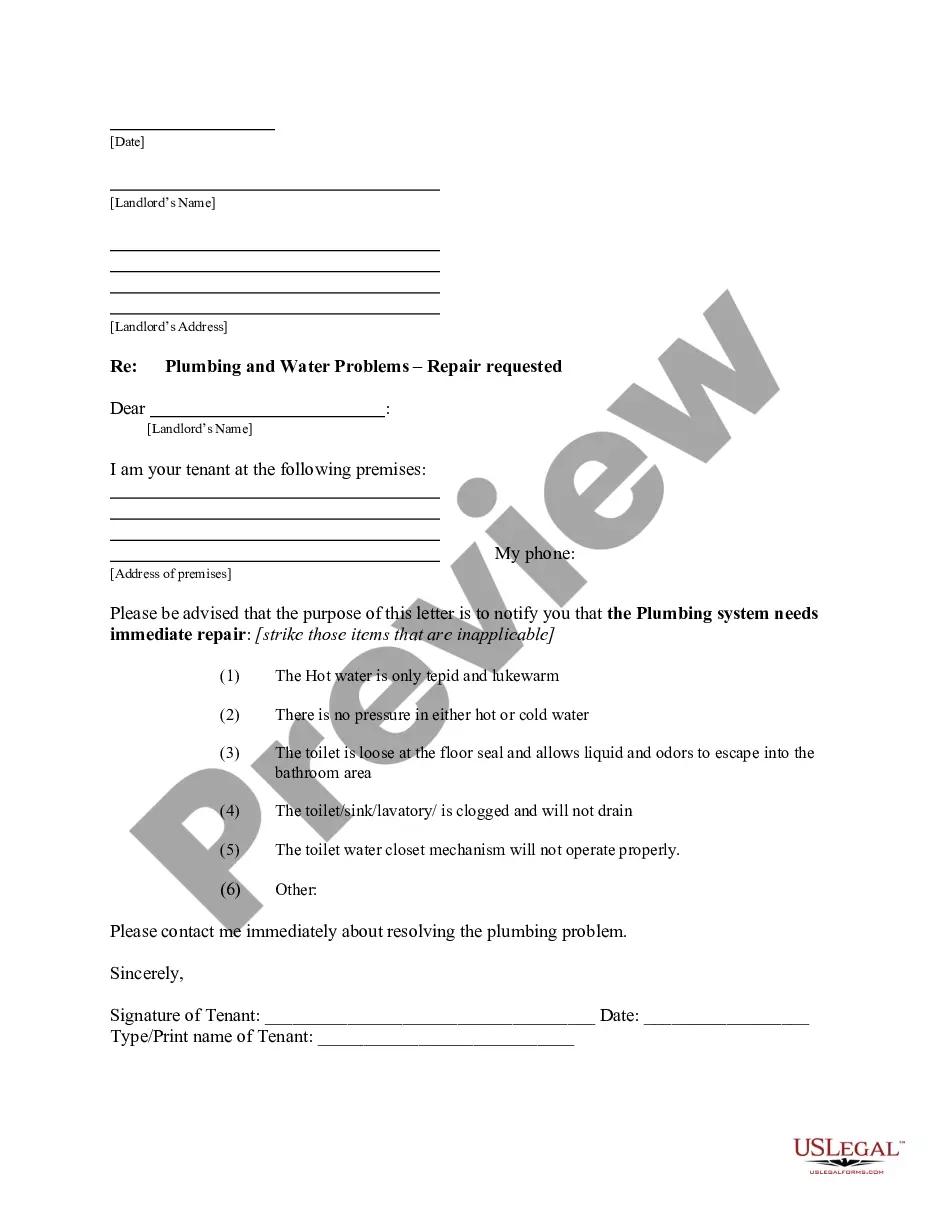

How to fill out Oakland Michigan Open A Bank Account - Corporate Resolutions Forms?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Oakland Open a Bank Account - Corporate Resolutions Forms, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Oakland Open a Bank Account - Corporate Resolutions Forms from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Oakland Open a Bank Account - Corporate Resolutions Forms:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

What is a resolution to open a bank account? A banking resolution allows a business to document the authorization by its members/board of directors to open a bank account. This document is required by the bank as proof that the person who will apply for a bank account on behalf of the business is authorized to do so.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

There will be several resolutions during the first meeting, but the banking resolution is often the most necessary resolution from the general minutes of the meeting. Banks will require this document to open up a bank account.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

How to write Corporate/board Resolution to Open Bank Account?corporate name and address.the title i.e CORPORATE/BOARD RESOLUTION TO OPEN BANK ACCOUNT.the date which the resolution passed.the purpose of opening a bank account.the Bank name and address where the account will be opened,More items...