San Diego, California, is a vibrant city located on the Pacific coast of the United States. Known for its stunning beaches, perfect weather, and rich cultural heritage, San Diego offers a plethora of opportunities for residents and visitors alike. For individuals or businesses looking to open a bank account in San Diego, there are a few key steps to consider. To begin, it is essential to understand the different types of bank accounts available to cater to various needs. 1. Personal Bank Account: This type of account is designed for individual use, allowing depositors to manage their personal finances, save money, and conduct day-to-day transactions conveniently. It typically provides services such as check writing, debit card access, and online banking. 2. Business Bank Account: Aimed at supporting businesses, this type of account helps manage financial transactions, facilitates payroll processing, and simplifies tax reporting. It offers features like merchant services, remote deposit capture, and business-specific banking tools. 3. Corporate Bank Account: Tailored for larger enterprises and corporations, corporate bank accounts provide advanced cash management solutions, access to specialized treasury management services, and enhanced security options for managing business finances. To open a bank account in San Diego, individuals or businesses will need to complete certain documentation, such as the corporate resolutions forms. These forms play a crucial role in authorizing and documenting decisions made by the company's board of directors or shareholders. Corporate resolutions forms are essential for various purposes, including: 1. Appointing authorized signatories: These forms specify individuals authorized to sign on behalf of the corporation, ensuring proper accountability and control over financial matters. 2. Approving banking resolutions: Corporate resolutions forms enable corporations to establish banking relationships, grant specific powers to officers or employees, and outline limits or conditions for banking-related activities. 3. Authorizing account openings and closures: These forms record the approval of opening or closing bank accounts and provide relevant information, such as account numbers, signatories, and account types. 4. Granting borrowing authority: Corporate resolutions forms can be used to authorize borrowing activities, outlining the purposes, amounts, and terms of loans that the corporation may enter into. San Diego, with its thriving business community, offers multiple options for individuals or businesses seeking to open a bank account. Whether one's needs are personal, small business-oriented, or require more comprehensive corporate banking services, San Diego's financial institutions and banking professionals are well-equipped to cater to diverse requirements. In conclusion, opening a bank account in San Diego, California, involves careful consideration of the available account types tailored to personal or business needs. Additionally, completion of important documents like corporate resolutions forms is necessary to establish banking relationships, authorize signatories, and make well-documented financial decisions.

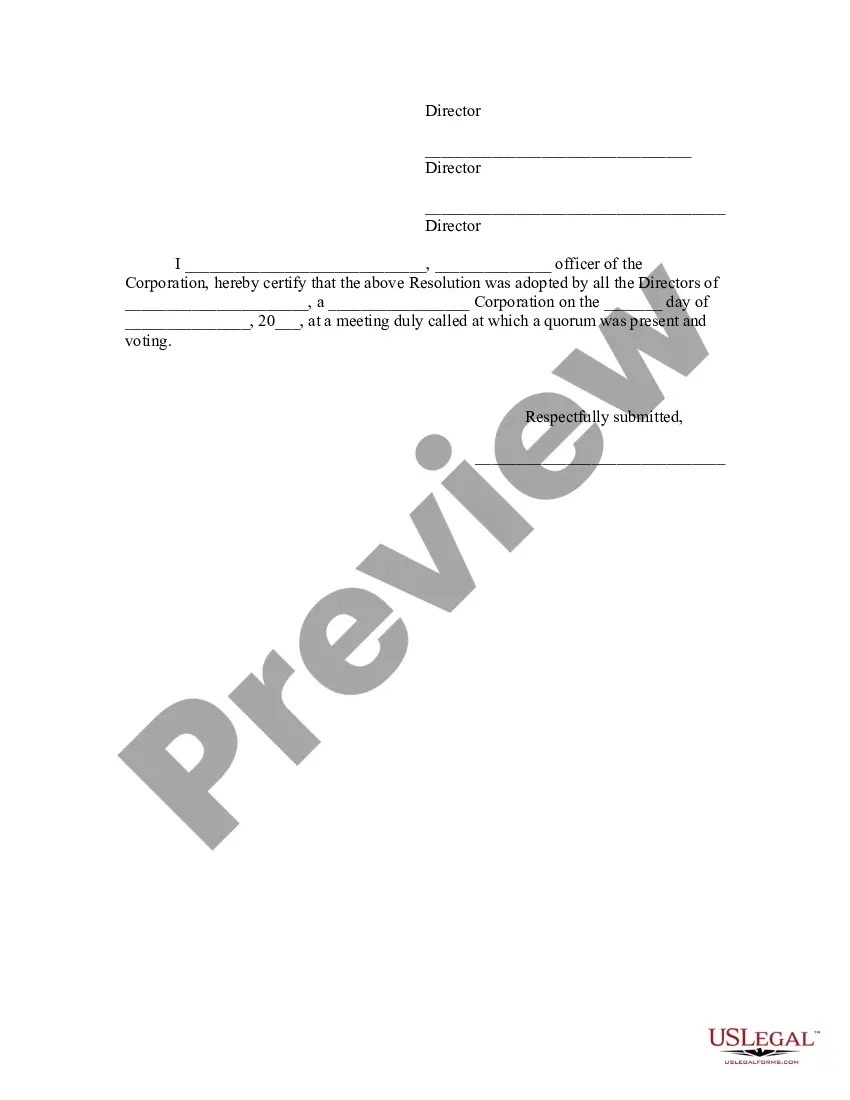

San Diego California Open a Bank Account - Corporate Resolutions Forms

Description

How to fill out San Diego California Open A Bank Account - Corporate Resolutions Forms?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like San Diego Open a Bank Account - Corporate Resolutions Forms is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the San Diego Open a Bank Account - Corporate Resolutions Forms. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Open a Bank Account - Corporate Resolutions Forms in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!