A Collin Texas Subordination Agreement — Lien is a legal document that establishes the priority of liens on a property in Collin County, Texas. It is an important tool used in real estate transactions, particularly when multiple parties have claims or interests in the property. In simpler terms, a subordination agreement determines the order in which liens are paid off if the property is sold or if there is a foreclosure. It allows one lien holder to move their claim to a lower priority position, allowing another lien holder to take precedence in case of default or liquidation. There are different types of Collin Texas Subordination Agreement — Lien that can be used, depending on the specific circumstances and needs of the parties involved: 1. First Lien Subordination Agreement: This type of subordination agreement allows a second or subordinate lien holder to move their claim behind or below the first lien holder. It is commonly used when a property owner wants to refinance their mortgage while keeping the first mortgage intact. 2. Second Lien Subordination Agreement: In this case, a third lien holder or creditor is seeking to establish their claim as the second lien, after the first lien holder. This arrangement is typical when an additional loan or line of credit is obtained, and the new lender requires second priority in case of default. 3. Intercreditor Agreement: This is a more complex subordination agreement that involves multiple lien holders or creditors. It establishes the priority of each creditor's claim in a specific order, outlining their respective rights and responsibilities. An intercreditor agreement is commonly used in commercial real estate transactions or when several loans are involved. It is important to note that the terms and conditions of a Collin Texas Subordination Agreement — Lien may vary depending on the specific requirements of the parties involved. It is advisable to consult with a qualified attorney or a real estate professional who is familiar with Texas property laws and regulations to ensure that the agreement is comprehensive, legally binding, and addresses all relevant details. Keywords: Collin Texas, Subordination Agreement, Lien, property, real estate, priority, liens, claim, foreclosure, refinance, first lien, second lien, intercreditor agreement, mortgage, creditor, default, refinancing, commercial real estate, attorney, regulations.

Collin Texas Subordination Agreement - Lien

Description

How to fill out Collin Texas Subordination Agreement - Lien?

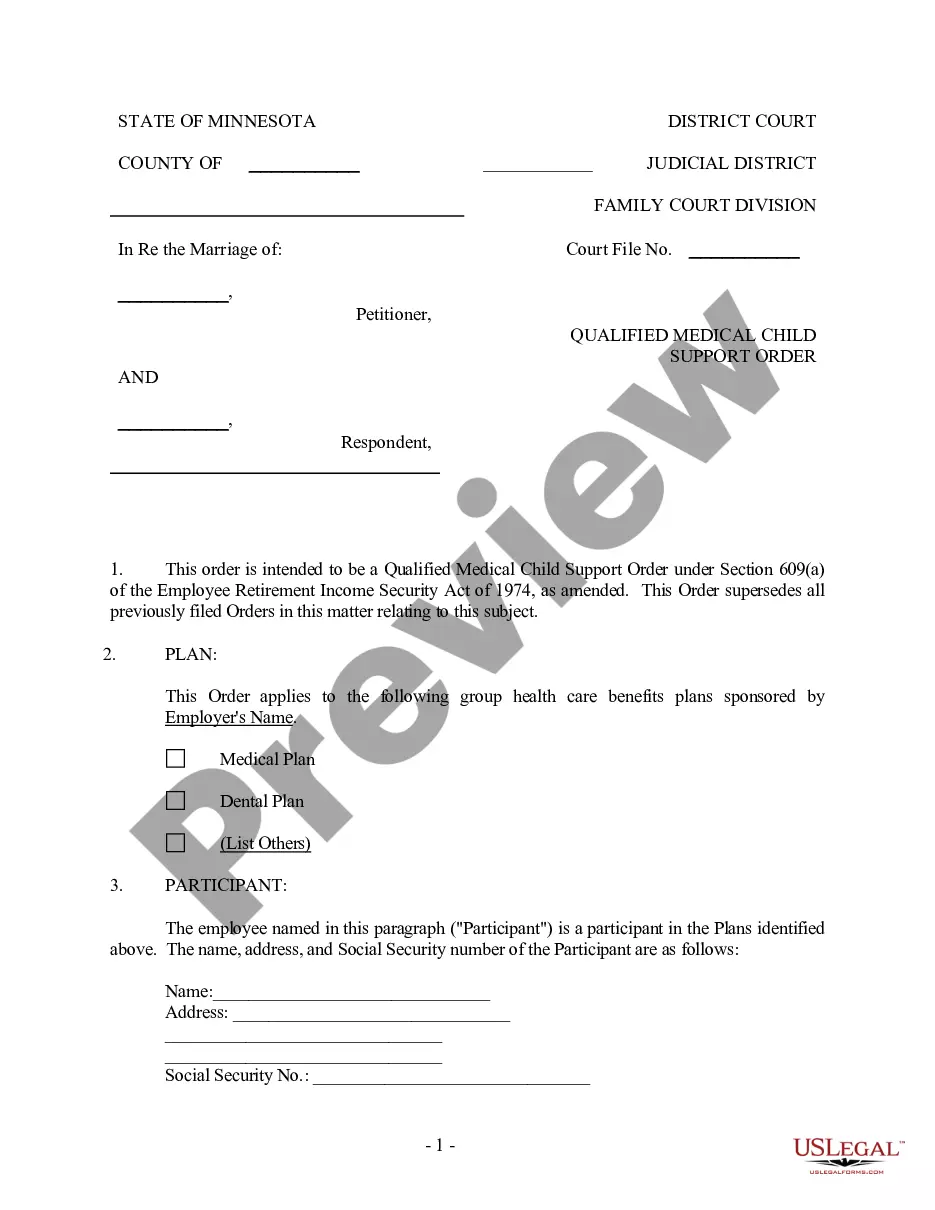

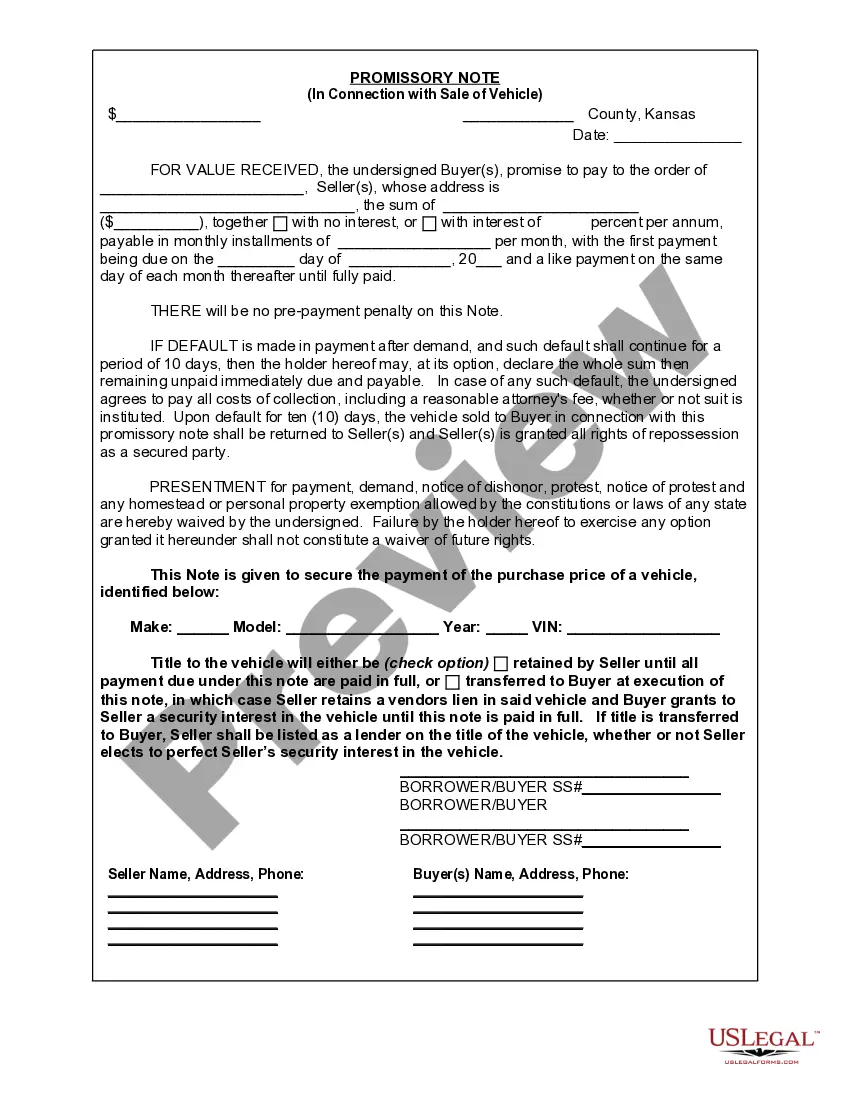

Do you need to quickly create a legally-binding Collin Subordination Agreement - Lien or maybe any other document to take control of your personal or business affairs? You can go with two options: hire a professional to draft a legal document for you or draft it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Collin Subordination Agreement - Lien and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Collin Subordination Agreement - Lien is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Collin Subordination Agreement - Lien template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

So, the purpose of a subordination agreement is to adjust the new loan's priority so that in the event of a foreclosure, that lien gets paid off first. In a subordination agreement, a prior lienholder agrees that its lien will be subordinate (junior) to a subsequently recorded lien.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

What Is a Subordination Agreement? A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

An intercreditor agreement is a bit different than a subordination agreement. They both serve to do the same thing, allow two different lenders to split up the collateral of a business so both can be secured in the first lien on their respective collateral.

A subordination agreement refers to a legal agreement that prioritizes one debt over another for securing repayments from a borrower. The subordinated debts sometimes get little or no repayments when the borrowers do not hold sufficient funds to repay the debts.

A Subordination of Mortgage is a document signed when there are two mortgages on a property and one (the first one) is subordinated to the other (the second one).

Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

More info

A subordinated and subordinate agreement is similar to a regular mortgage agreement and may require a higher amount of money, interest, and payments to obtain security. A subordinated and subordinate agreement is similar to a regular mortgage agreement and may require a higher amount of money, interest, and payments to obtain security. Loan originators who prefer not to form a new secured mortgage with the borrower can still use a subordinated Lien Agreement or subordinate Lease agreement. Loan originators who prefer not to form a new secured mortgage with the borrower can still use a subordinated Lien Agreement or subordinate Lease agreement. A subordinate Lien Agreement or joint mortgage includes a mortgage, mortgage, and lien on more than one property for the same property. A subordinate Lien Agreement or joint mortgage includes a mortgage, mortgage, and lien on more than one property for the same property.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.