A San Antonio Texas Subordination Agreement — Lien is a legally binding document that outlines the prioritization of liens on a property and establishes the order in which they will be enforced in the event of foreclosure or debt repayment. This agreement is commonly used in real estate transactions to clarify the rights and responsibilities of parties involved, such as lenders, borrowers, and subordinate lien holders. In San Antonio, Texas, there are different types of Subordination Agreements — Lien, each serving a specific purpose: 1. First Mortgage Subordination Agreement: This type of agreement typically involves a property owner who wishes to obtain a second mortgage or refinance an existing mortgage while keeping the first mortgage in place. The agreement ensures that the new mortgage is subordinate to the first mortgage, meaning that in the case of foreclosure, the first mortgage lender will have priority over the second lender. 2. Second Mortgage Subordination Agreement: Opposite to the first mortgage subordination, this type of agreement involves a borrower seeking a second mortgage while still having a prior mortgage in place. It establishes the precedence of the second mortgage lender, ensuring their rights are subordinate to the first mortgage lender. 3. Subordinate Lien Subordination Agreement: This form of agreement is used when there are multiple liens on the same property, such as a primary mortgage, a home equity line of credit (HELOT), and other liens. The agreement sets forth the priority of each lien, determining which liens will be paid first in case of foreclosure or repayment. A San Antonio Texas Subordination Agreement — Lien is a crucial document that protects the interests of all parties involved. It ensures transparency and clarity in the order of lien priorities, enabling lenders to make informed decisions regarding loan extensions, refinancing, or foreclosure. Furthermore, this agreement provides a legal framework for resolving any disputes that may arise between different lien holders, thereby promoting a more efficient and fair real estate market in San Antonio, Texas.

San Antonio Texas Subordination Agreement - Lien

Description

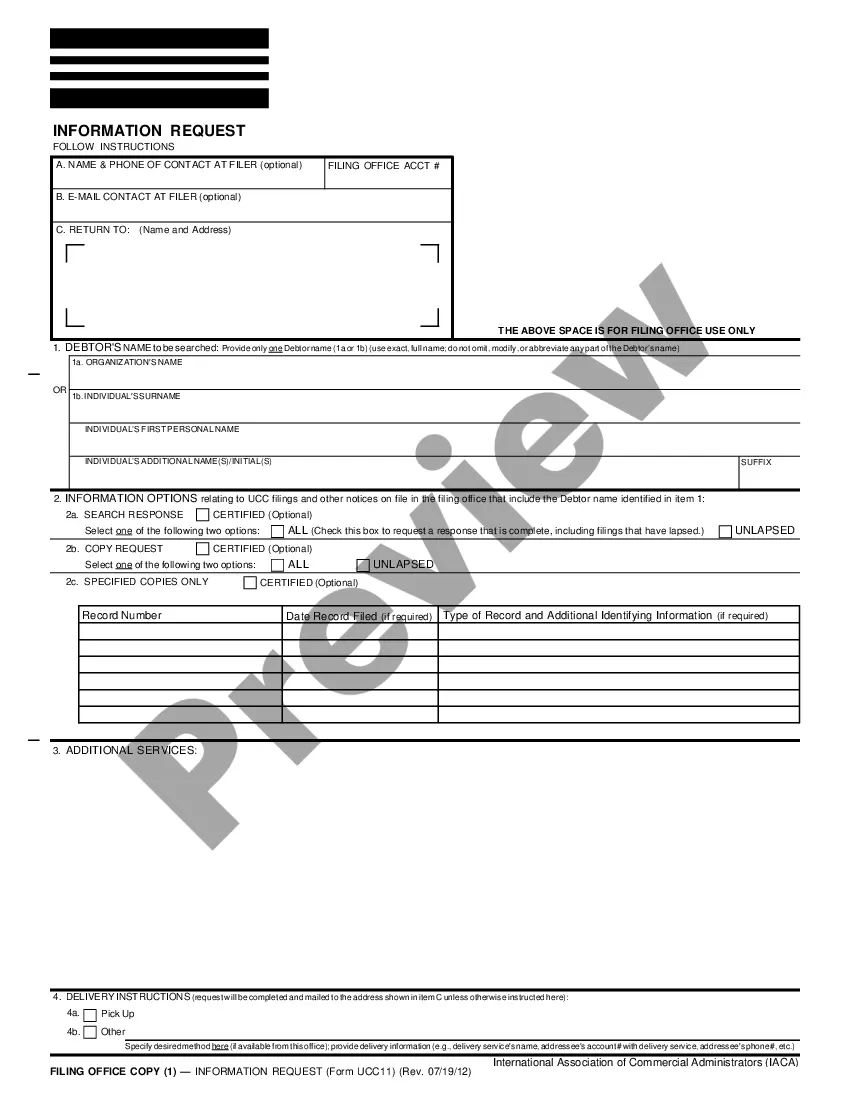

How to fill out San Antonio Texas Subordination Agreement - Lien?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio Subordination Agreement - Lien, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the recent version of the San Antonio Subordination Agreement - Lien, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Subordination Agreement - Lien:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Antonio Subordination Agreement - Lien and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

A subordination agreement refers to a legal agreement that prioritizes one debt over another for securing repayments from a borrower. The agreement changes the lien position. A lien is a right allowing one party to possess a property of another party who owns a debt until the debt is dissolved.

NFC grants lenders permission to fill in their name, the new loan amount, the new mortgage county recording information, and the date of the new mortgage. Fee for Subordination: $100 for one mortgage and $150 for two mortgages. This fee may not be able to be charged to the borrower.

Often, all the information needed will be available from your mortgage lender and the title company. The process usually takes approximately 25 business days.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, then the second mortgage can take its place as the primary loan. As a second mortgage, the lender will be taking on more risk.

More info

A mortgage is superior to a lease for purposes of determining whether the mortgage itself is a lien, even if a lease is a valid lien. The following cases show that a mortgage is a superior lien when it is superior in terms of the right to payment and of the ability to secure payment. In Bancroft, the trustee executed a mortgage against the residence of the owner. I'd. At 452. The owner brought suit against the trustee claiming superior lien status, alleging that the mortgage was the sole lien upon the property and that there was no other leasehold interest or leasehold rights on the home. I'd. At 453. The trustee contended that it held a subordinate lien on the property and that the owner's right to payments was a lien upon the mortgage. I'd. The trial court granted summary judgment on the liability issues, concluding that the superior mortgage was superior to the lease. I'd. At 450.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.