Los Angeles, California Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price: A Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legal document that outlines the terms and conditions of the sale of a business by a sole proprietor to a buyer, where the seller agrees to finance a portion of the purchase price. This agreement is specifically tailored for businesses located in Los Angeles, California. It ensures that the sale process adheres to the state's laws and regulations. This agreement is commonly used in various industries across Los Angeles, such as retail, hospitality, manufacturing, and services. The agreement contains several key components to protect the interests of both the seller and the buyer. These components include: 1. Identification of Parties: Names, contact details, and legal entities of both the seller (sole proprietor) and the buyer. 2. Business Description: A detailed description of the business being sold, including its name, address, industry, and any assets or inventory included in the sale. 3. Price and Payment Terms: The total purchase price of the business and the portion that the buyer will finance directly from the seller. It also outlines the payment schedule, interest rate (if applicable), and any other terms related to the payment. 4. Representations and Warranties: Representations and warranties made by both parties regarding the accuracy of the information provided, ownership of assets, absence of undisclosed liabilities, etc. This section ensures transparency and minimizes future disputes. 5. Closing and Transfer of Assets: Specifies the closing date, the process of transferring ownership, and responsibilities of both parties during the transition period. It also addresses any potential liabilities or encumbrances on the assets being transferred. 6. Seller Financing: Outlines the terms and conditions of the financing agreement, including the interest rate, duration of the loan, payment schedule, and any collateral or security arrangements. 7. Non-Compete and Confidentiality Clauses: Restrictions placed on the seller to prevent competition within a specified geographical area and to maintain the confidentiality of certain business information. 8. Dispute Resolution and Governing Law: Specifies the jurisdiction and procedures to resolve any disputes that may arise during the implementation of the agreement. Types of Los Angeles California Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price: 1. Standard Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price: This is the most common type used for general business sales where the seller agrees to finance part of the purchase price. 2. Industry-Specific Agreement: Several industries in Los Angeles may require specialized clauses or terms unique to their respective sectors. Examples include agreements for restaurants, retail stores, medical practices, or technology companies. 3. Negotiated Agreement: In certain cases, the buyer and seller may negotiate customized terms based on specific needs or circumstances related to the sale of the business. It is crucial to consult with a qualified attorney or legal professional when drafting or entering into a Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price to ensure compliance with California laws and protect both parties' interests.

Los Angeles California Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Los Angeles California Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the current version of the Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price:

- Look through the page and verify there is a sample for your area.

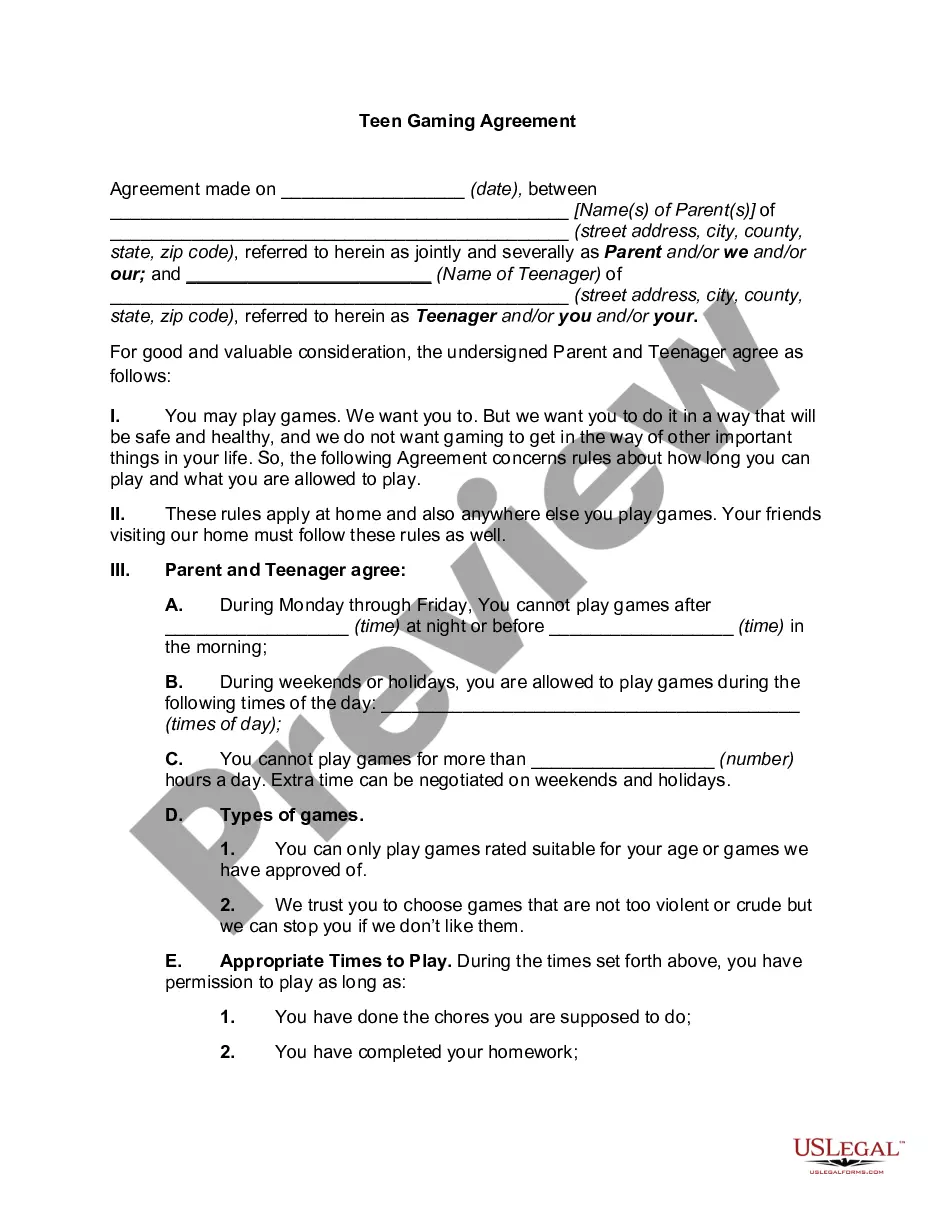

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Los Angeles Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!