Chicago is a bustling city in Illinois that offers numerous opportunities for real estate investors. One important aspect to consider when engaging in real estate transactions in Chicago is the Tax Free Exchange Agreement, also known as Section 1031 of the Internal Revenue Code. The Chicago Illinois Tax Free Exchange Agreement Section 1031 allows investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property, also known as a "like-kind" exchange. This provision enables investors to preserve their cash flow and build wealth by deferring taxes that would otherwise be due upon the sale. There are several types of Section 1031 exchanges available in Chicago, which include: 1. Simultaneous Exchange: This type of exchange involves the direct swap of properties between the investor and another party. Both properties are transferred simultaneously, minimizing the risk of potential financing troubles or market fluctuations. 2. Delayed Exchange: Under this scenario, investors sell their property and subsequently identify a replacement property within 45 days. After identification, the investor must close on the replacement property within 180 days. This type of exchange offers more flexibility in finding suitable replacement properties. 3. Reverse Exchange: In a reverse exchange, investors identify and acquire the replacement property before selling their existing property. This method allows investors to secure a desirable property without the risk of losing it before the sale of their current property concludes. 4. Improvement Exchange: This type of exchange allows investors to utilize the exchange proceeds to improve the replacement property. The investor may fund renovations or upgrades to enhance the property's value, further maximizing their investment potential. The Chicago Illinois Tax Free Exchange Agreement Section 1031 presents significant advantages for real estate investors. By deferring capital gains taxes, investors can reinvest their profits and potentially acquire higher-value properties, diversify their portfolio, or consolidate their holdings. It is crucial to consult with a qualified tax advisor or intermediary to navigate the intricacies of Section 1031 exchanges and ensure compliance with IRS regulations. In conclusion, Chicago Illinois Tax Free Exchange Agreement Section 1031 offers real estate investors an opportunity to defer capital gains taxes and maximize their investment potential. Various types of exchanges, including simultaneous, delayed, reverse, and improvement exchanges, allow investors to tailor their strategies to their specific goals and circumstances. Engaging in Section 1031 exchanges in Chicago can provide investors with financial flexibility, increased cash flow, and the potential for long-term wealth accumulation.

1031 Exchange Illinois

Description 1031 illinois

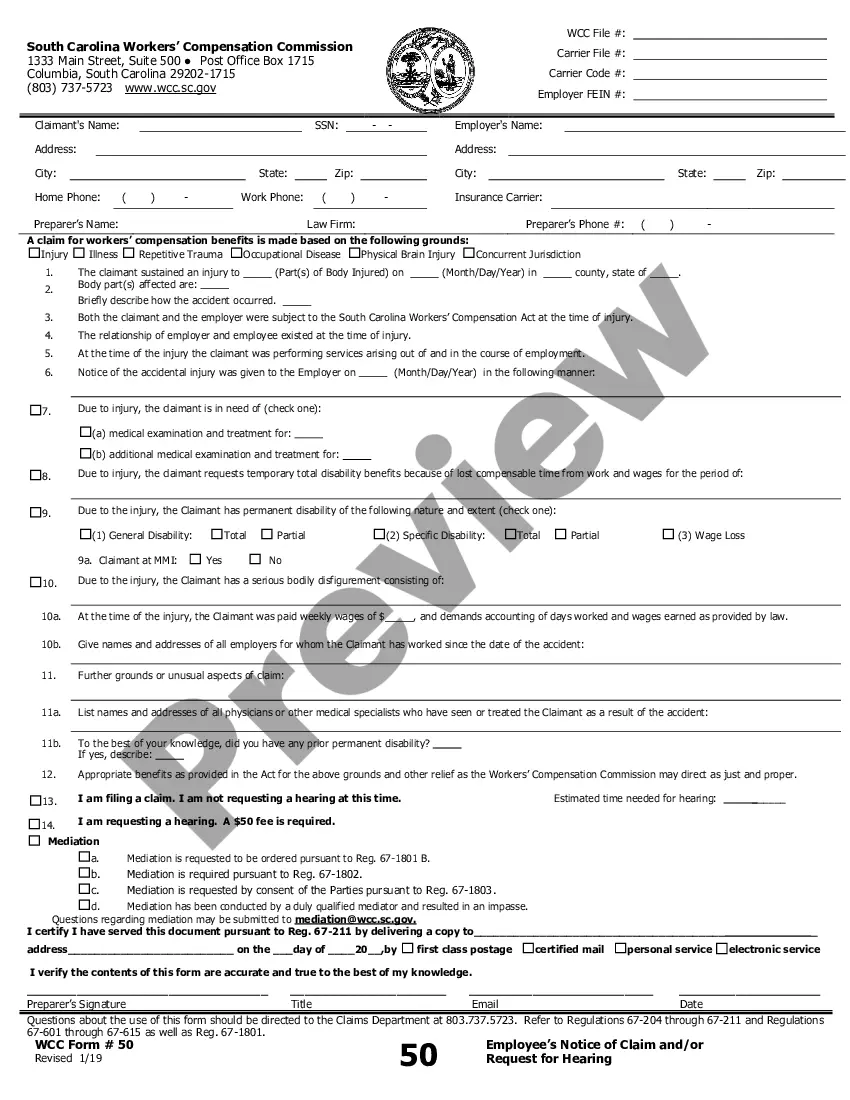

How to fill out Chicago Illinois Tax Free Exchange Agreement Section 1031?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Chicago Tax Free Exchange Agreement Section 1031, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Chicago Tax Free Exchange Agreement Section 1031 from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Chicago Tax Free Exchange Agreement Section 1031:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!