Contra Costa County, located in California, has a Tax Free Exchange Agreement Section 1031 in place, which allows property owners to defer capital gains taxes when exchanging certain types of property for another. Section 1031 of the Internal Revenue Code outlines the rules and regulations for tax-free exchanges, also known as like-kind exchanges or 1031 exchanges. These exchanges can be highly beneficial for individuals and businesses looking to reinvest their profits into new properties without incurring immediate tax liabilities. The basic principle behind a Contra Costa California Tax Free Exchange Agreement Section 1031 is that if a property owner sells their investment property and uses the proceeds to acquire another qualifying property within a specific timeframe, they can defer paying capital gains taxes. This allows them to preserve and potentially grow their investment capital, leveraging it for further real estate acquisitions. The Contra Costa Tax Free Exchange Agreement Section 1031 encompasses various types of exchanges. Let's explore some key types below: 1. Simultaneous Exchange: In this type of exchange, the sale and purchase of the properties occur simultaneously. The relinquished property (the property being sold) and the replacement property (the property being acquired) are transferred directly between the parties involved. 2. Delayed Exchange: This type of exchange is more common, as it allows for a time gap between the sale of the relinquished property and the acquisition of the replacement property. Within 45 days of selling the relinquished property, the property owner must identify potential replacement properties to be acquired. They will then have 180 days to close on the purchase of one or more of the identified replacement properties. 3. Reverse Exchange: In a reverse exchange, the property owner acquires the replacement property before selling the relinquished property. This type of exchange requires the use of a qualified intermediary to hold either the relinquished or replacement property temporarily until the exchange is completed. 4. Construction or Improvement Exchange: This type of exchange allows the property owner to use exchange funds to improve or construct a replacement property rather than purchasing an existing property. The improvements must be completed within 180 days of acquiring the property. It's important to note that while Section 1031 provides tax deferral benefits, it does not eliminate taxes entirely. Ultimately, when the replacement property is eventually sold without being exchanged, the deferred capital gains tax will become due. The Contra Costa California Tax Free Exchange Agreement Section 1031 offers property owners in the county a valuable opportunity to strategically manage their real estate investments and potentially grow their portfolios while deferring tax obligations.

Contra Costa County 1031 Exchange Properties For Sale

Description

How to fill out Contra Costa California Tax Free Exchange Agreement Section 1031?

Whether you intend to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Contra Costa Tax Free Exchange Agreement Section 1031 is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Contra Costa Tax Free Exchange Agreement Section 1031. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

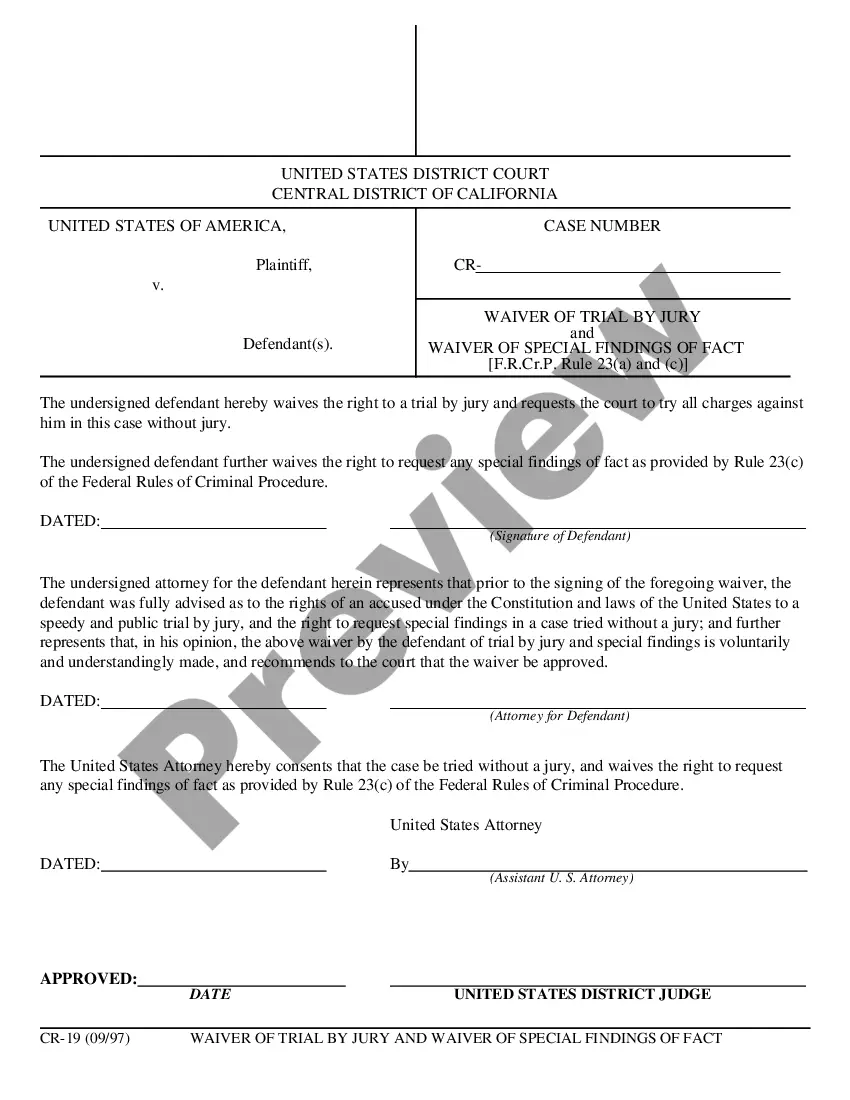

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Tax Free Exchange Agreement Section 1031 in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!