Los Angeles, California Tax Free Exchange Agreement Section 1031 is an important provision that falls under the Internal Revenue Code (IRC) and provides tax benefits to individuals or businesses involved in property exchanges. This agreement allows for the deferral of capital gains tax on the sale of real estate when the proceeds are reinvested into a similar property. Section 1031 exchanges have become a popular strategy for real estate investors looking to maximize profits and defer taxes. Key keywords: Los Angeles, California, Tax Free Exchange Agreement, Section 1031, Internal Revenue Code, capital gains tax, deferral, real estate, property exchange, tax benefits, reinvestment, property investors. When it comes to the types of Section 1031 exchanges available in Los Angeles, California, there are a few options to consider: 1. Simultaneous Exchange: This is the most basic type of exchange where the sale of the relinquished property and the purchase of the replacement property occur at the same time. Both transactions are interconnected, allowing the taxpayer to defer capital gains tax. 2. Delayed Exchange: This is the most common type of Section 1031 exchange and provides individuals with the flexibility to sell their relinquished property before acquiring a replacement property. There is a strict timeframe involved, as the replacement property must be identified within 45 days of the sale, and the transaction must be completed within 180 days. 3. Reverse Exchange: In a reverse exchange, the taxpayer acquires the replacement property before selling the relinquished property. This type of exchange requires the assistance of an exchange facilitator, as the taxpayer cannot hold both properties simultaneously. Reverse exchanges are beneficial when there is an urgent need to secure the replacement property. 4. Build-to-Suit Exchange: This type of exchange allows individuals or businesses to use the proceeds from the sale of the relinquished property to construct or improve a replacement property. The build-to-suit exchange provides the flexibility to tailor the replacement property to specific needs, ensuring a better long-term investment. 5. Improvement Exchange: Also known as a construction or improvement exchange, this type enables taxpayers to use the exchange funds to make significant improvements to the replacement property. These improvements should result in an increase in the property's value, enhancing the overall investment. 6. Personal Property Exchange: Section 1031 exchanges are not limited to real estate properties. Individuals or businesses can also exchange personal properties such as paintings, collectibles, or business equipment, as long as they meet the necessary requirements. This helps in deferring capital gains on the appreciated value of personal assets. Understanding the various types of Los Angeles, California Tax Free Exchange Agreement Section 1031 allows taxpayers to make informed decisions based on their investment goals and requirements. However, it is essential to consult with a qualified tax professional or exchange facilitator to ensure compliance with IRS regulations and maximize the benefits of such exchanges.

Los Angeles California Tax Free Exchange Agreement Section 1031

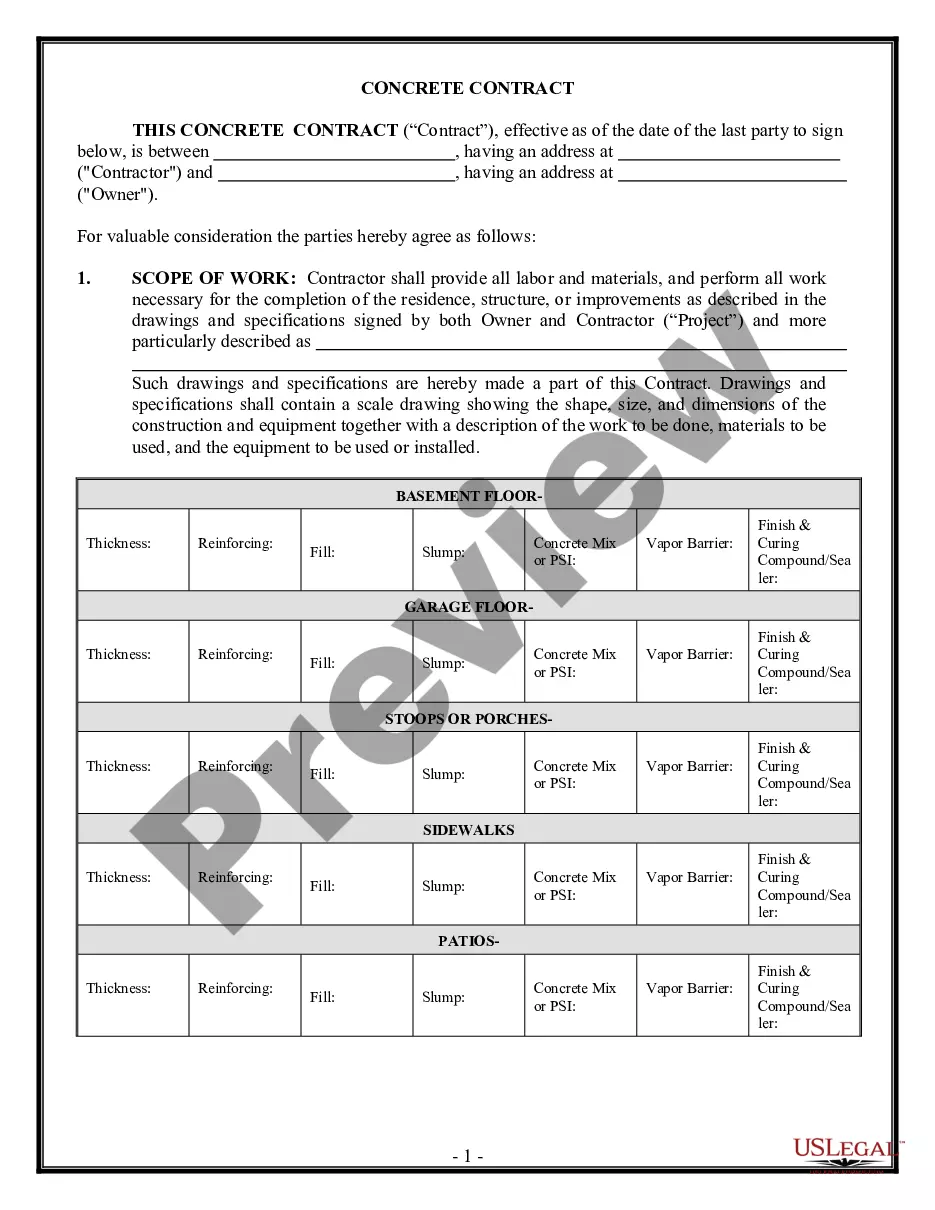

Description

How to fill out Los Angeles California Tax Free Exchange Agreement Section 1031?

Draftwing paperwork, like Los Angeles Tax Free Exchange Agreement Section 1031, to take care of your legal affairs is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for different cases and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Los Angeles Tax Free Exchange Agreement Section 1031 form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Los Angeles Tax Free Exchange Agreement Section 1031:

- Make sure that your document is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Los Angeles Tax Free Exchange Agreement Section 1031 isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our website and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!