Miami-Dade Florida Trust Agreement — Family Special Needs is a legally binding arrangement aimed at protecting the financial interests and well-being of individuals with special needs in the Miami-Dade County, Florida area. This specialized trust agreement ensures that individuals with disabilities continue to receive essential care, support, and resources even when their family members or guardians are no longer able to provide such assistance. The Family Special Needs Trust Agreement is one type of trust agreement available in Miami-Dade County, Florida. Its primary purpose is to hold and manage assets for the benefit of an individual with special needs while preserving their eligibility for government benefits and assistance programs. The trust is created by a family member or guardian with the intention of providing supplemental support to the beneficiary beyond what government programs can offer. This type of trust allows the beneficiary to maintain their eligibility for crucial benefits like Medicaid, Supplemental Security Income (SSI), and other vital resources. Within the realm of Miami-Dade Florida Trust Agreement — Family Special Needs, there may be various subtypes or specific variations to cater to different circumstances. These may include: 1. Third-Party Family Special Needs Trust: This type of trust is established by family members or loved ones of an individual with special needs. It allows them to fund the trust with assets or investments for the benefit of the beneficiary while also protecting those assets from being counted as resources for government benefits eligibility purposes. 2. First-Party or Self-Settled Special Needs Trust: This specific trust is created using the assets owned by the individual with special needs themselves. It is commonly employed when the beneficiary receives a sudden influx of funds such as an inheritance, personal injury settlement, or other financial windfalls. By placing the funds into the trust, the individual can still maintain their eligibility for government assistance while utilizing the resources in a controlled manner. 3. Pooled Special Needs Trust: This type of trust is administered and managed by a nonprofit organization. It allows individuals with special needs to pool their resources together for investment purposes while still maintaining their eligibility for government benefits. The pooled trust provides professional management and accountability to ensure the funds are used to benefit the individual with disabilities. In Miami-Dade County, Florida, special attention is given to addressing the unique needs and legal requirements of individuals with disabilities through the Miami-Dade Florida Trust Agreement — Family Special Needs. By establishing a well-crafted trust agreement, families can secure the future of their loved ones with special needs, enhance their quality of life, and provide long-term financial stability while maintaining eligibility for critical government assistance programs.

Miami-Dade Florida Trust Agreement - Family Special Needs

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00646

Format:

Word;

Rich Text

Instant download

Description

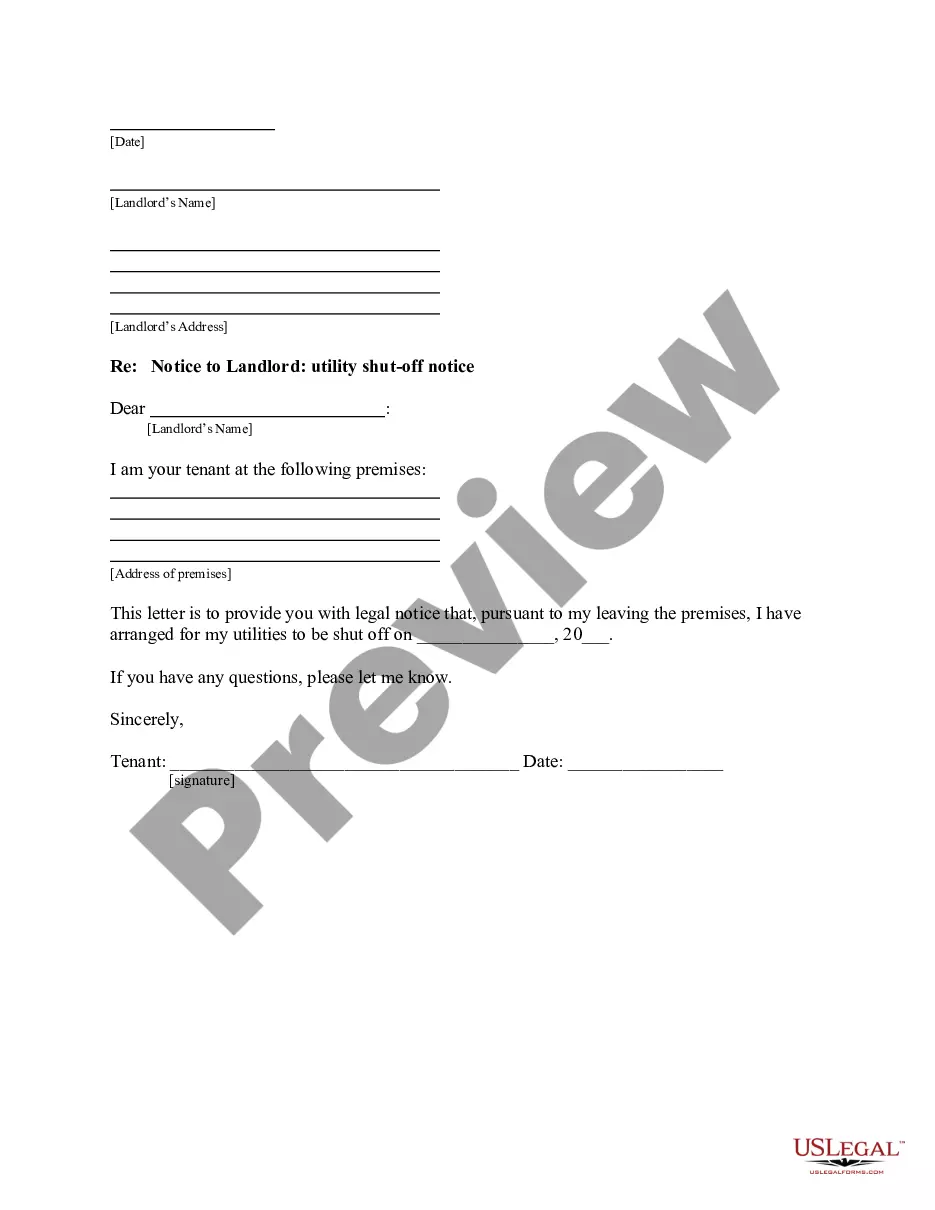

The grantor establishes an irrevocable trust and assigns, conveys, transfers and delivers to the trustee certain property and the trustee accepts such property as the initial trust estate. It is the grantor's primary concern that the trust continue in existence as a supplemental and emergency fund to public assistance for the sake of the beneficiary throughout his/her life. Other provisions of the trust agreement include: the management and disposition of the trust estate, trustee powers, and additional optional clauses.

Miami-Dade Florida Trust Agreement — Family Special Needs is a legally binding arrangement aimed at protecting the financial interests and well-being of individuals with special needs in the Miami-Dade County, Florida area. This specialized trust agreement ensures that individuals with disabilities continue to receive essential care, support, and resources even when their family members or guardians are no longer able to provide such assistance. The Family Special Needs Trust Agreement is one type of trust agreement available in Miami-Dade County, Florida. Its primary purpose is to hold and manage assets for the benefit of an individual with special needs while preserving their eligibility for government benefits and assistance programs. The trust is created by a family member or guardian with the intention of providing supplemental support to the beneficiary beyond what government programs can offer. This type of trust allows the beneficiary to maintain their eligibility for crucial benefits like Medicaid, Supplemental Security Income (SSI), and other vital resources. Within the realm of Miami-Dade Florida Trust Agreement — Family Special Needs, there may be various subtypes or specific variations to cater to different circumstances. These may include: 1. Third-Party Family Special Needs Trust: This type of trust is established by family members or loved ones of an individual with special needs. It allows them to fund the trust with assets or investments for the benefit of the beneficiary while also protecting those assets from being counted as resources for government benefits eligibility purposes. 2. First-Party or Self-Settled Special Needs Trust: This specific trust is created using the assets owned by the individual with special needs themselves. It is commonly employed when the beneficiary receives a sudden influx of funds such as an inheritance, personal injury settlement, or other financial windfalls. By placing the funds into the trust, the individual can still maintain their eligibility for government assistance while utilizing the resources in a controlled manner. 3. Pooled Special Needs Trust: This type of trust is administered and managed by a nonprofit organization. It allows individuals with special needs to pool their resources together for investment purposes while still maintaining their eligibility for government benefits. The pooled trust provides professional management and accountability to ensure the funds are used to benefit the individual with disabilities. In Miami-Dade County, Florida, special attention is given to addressing the unique needs and legal requirements of individuals with disabilities through the Miami-Dade Florida Trust Agreement — Family Special Needs. By establishing a well-crafted trust agreement, families can secure the future of their loved ones with special needs, enhance their quality of life, and provide long-term financial stability while maintaining eligibility for critical government assistance programs.

Free preview