Queens New York Trust Agreement — Family Special Needs refers to a legal document created to protect and manage the assets of an individual with special needs residing in Queens, New York. This specialized trust agreement ensures that the individual's financial resources are properly handled to provide for their unique requirements and improve their overall quality of life. In Queens, there are several types of Trust Agreements — Family Special Needs that cater to the specific needs of individuals with disabilities or special needs. Some key types include: 1. Supplemental Needs Trust (SET): A Supplemental Needs Trust allows individuals with disabilities to receive government benefits while maintaining access to additional funds for various expenses. It helps cover costs that are beyond what government assistance programs provide, such as medical treatments, recreational activities, education, therapy, and personal care attendants. 2. Self-Settled Special Needs Trust: This type of trust allows individuals with disabilities to place their own assets into a trust, often referred to as a "payback trust." It gives them the ability to maintain eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI), while still having control over the funds within certain limits. 3. Third-Party Special Needs Trust: A Third-Party Special Needs Trust is established by a family member or loved one of an individual with special needs. It allows them to contribute assets for the care and support of the individual, without affecting their eligibility for government benefits. This type of trust is commonly used for estate planning purposes. 4. Pooled Trust: A Pooled Trust is a collective trust managed by a nonprofit organization, where funds from multiple individuals are pooled together for investment purposes. This type of trust is beneficial for individuals who may have smaller assets or lack suitable trustees. It offers professional management, cost efficiency, and flexibility in distributing funds based on the beneficiary's needs. The primary goal of these trust agreements is to safeguard the financial security of individuals with special needs, enabling them to access a higher quality of life, specialized care, and support services. Queens New York Trust Agreement — Family Special Needs provides a secure and legal mechanism to manage funds effectively while ensuring eligibility for government benefits and offering peace of mind to both the individual and their family.

Queens New York Trust Agreement - Family Special Needs

Description

How to fill out Queens New York Trust Agreement - Family Special Needs?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Queens Trust Agreement - Family Special Needs, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Queens Trust Agreement - Family Special Needs from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Queens Trust Agreement - Family Special Needs:

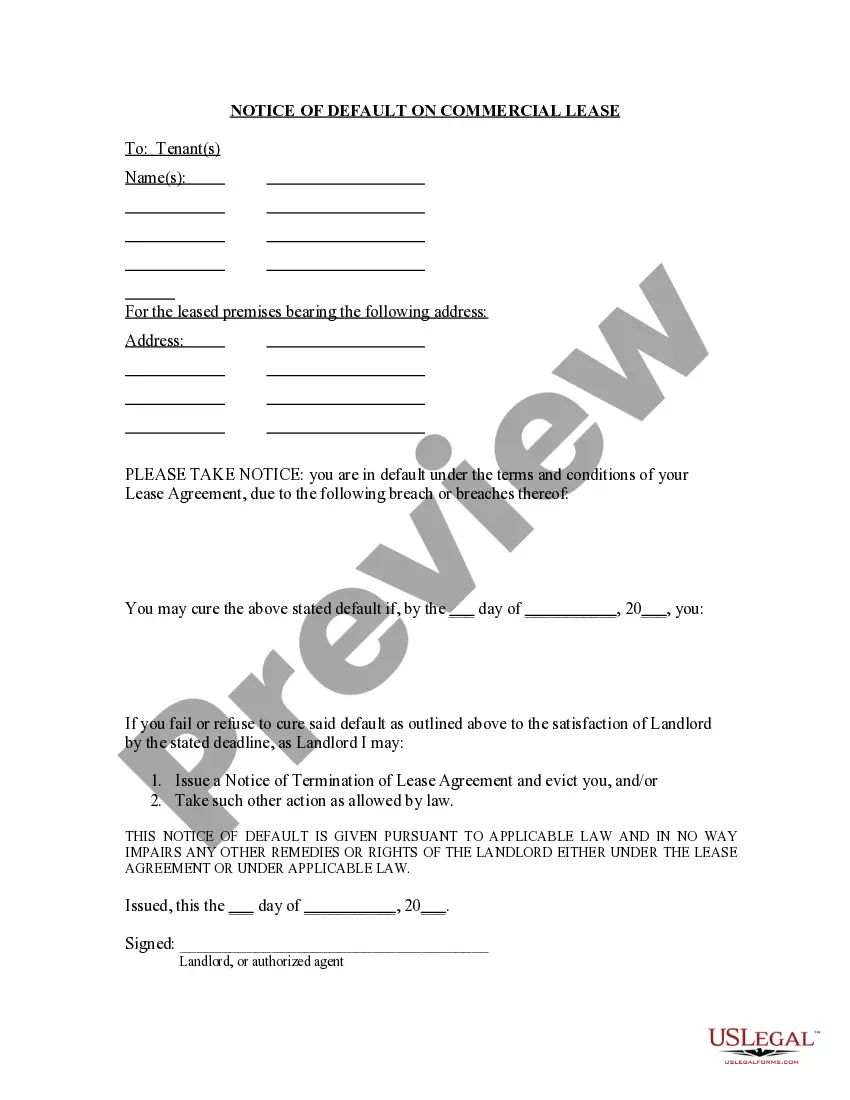

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!