The Suffolk New York Trust Agreement — Family Special Needs is a legally binding document created to ensure proper management and protection of assets for individuals with special needs. It aims to preserve the eligibility for government benefits like Medicaid and Supplemental Security Income (SSI) while providing for the individual's well-being. This trust agreement is specifically designed for families residing in Suffolk County, New York, who have loved ones with special needs. It allows these families to set aside funds and other assets for the long-term care and support of their special needs family member. There are different types of Suffolk New York Trust Agreement — Family Special Needs, including the following: 1. First-Party or "Self-Settled" Special Needs Trust: This type of trust is funded with the assets belonging to the individual with special needs themselves. It is often used when the individual receives a large sum of money through an inheritance, personal injury settlement, or other means. 2. Third-Party Special Needs Trust: This type of trust is established by someone other than the individual with special needs, usually a family member or loved one. It is created using the assets of the third party and does not include any assets owned by the individual with special needs. Third-party special needs trusts are often used when family members want to provide for the future needs of their loved one without jeopardizing their eligibility for government benefits. 3. Pooled Special Needs Trust: A pooled trust is managed by a nonprofit organization that pools the assets of multiple individuals with special needs for investment purposes. Each beneficiary has a separate account within a master trust agreement, and the funds are managed collectively. Pooled trusts are particularly beneficial for families who want professional management of the assets and wish to minimize administrative responsibilities. The Suffolk New York Trust Agreement — Family Special Needs outlines specific guidelines for how the trust funds should be used and distributed. These guidelines ensure that the assets are utilized solely for the benefit of the individual with special needs, supplementing rather than replacing government benefits. The trust agreement usually includes provisions for housing, medical care, therapy, education, transportation, and other essential services that enhance the quality of life for the special needs individual. By establishing a Suffolk New York Trust Agreement — Family Special Needs, families can have peace of mind knowing that their loved one's financial and care needs will be met in a way that effectively manages and protects their assets.

Suffolk New York Trust Agreement - Family Special Needs

Description

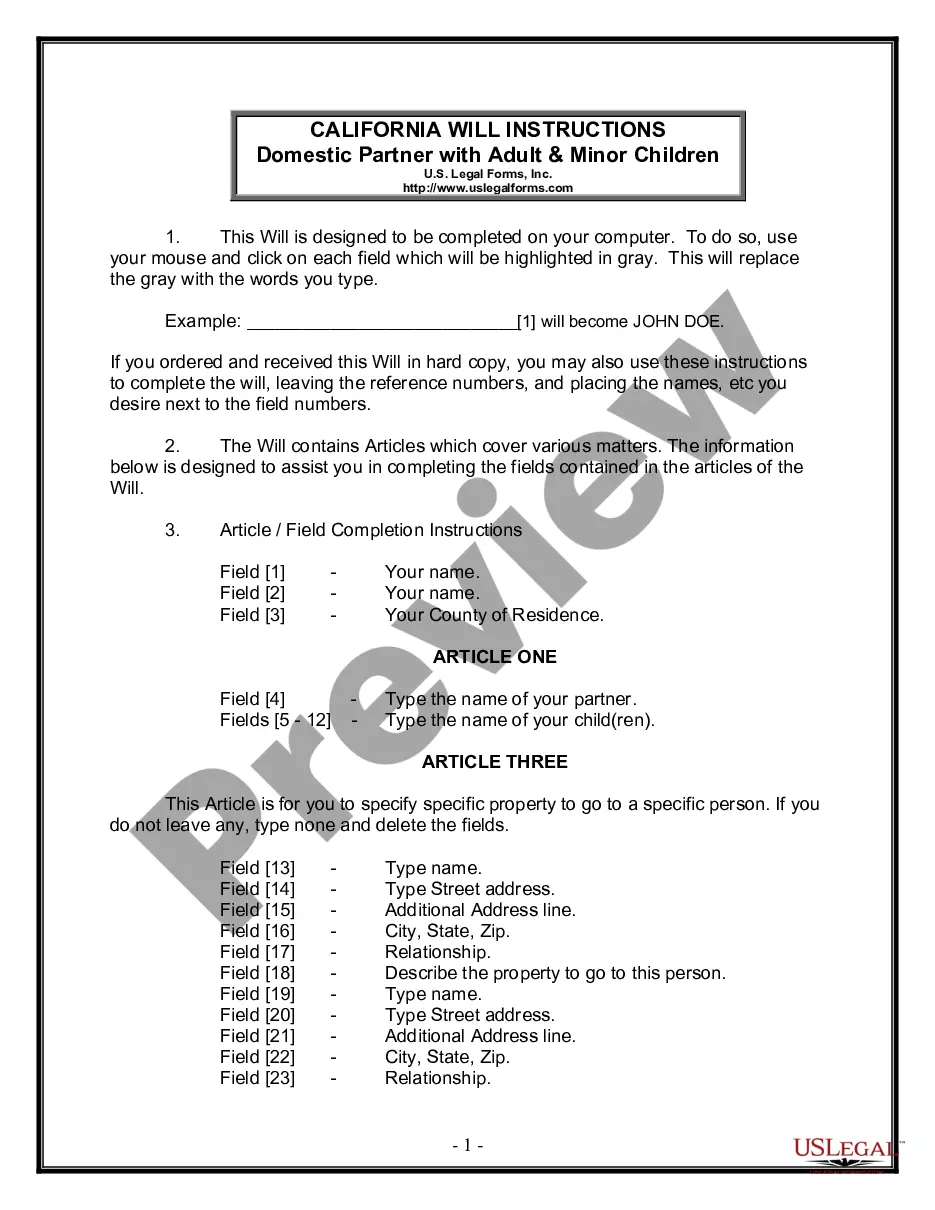

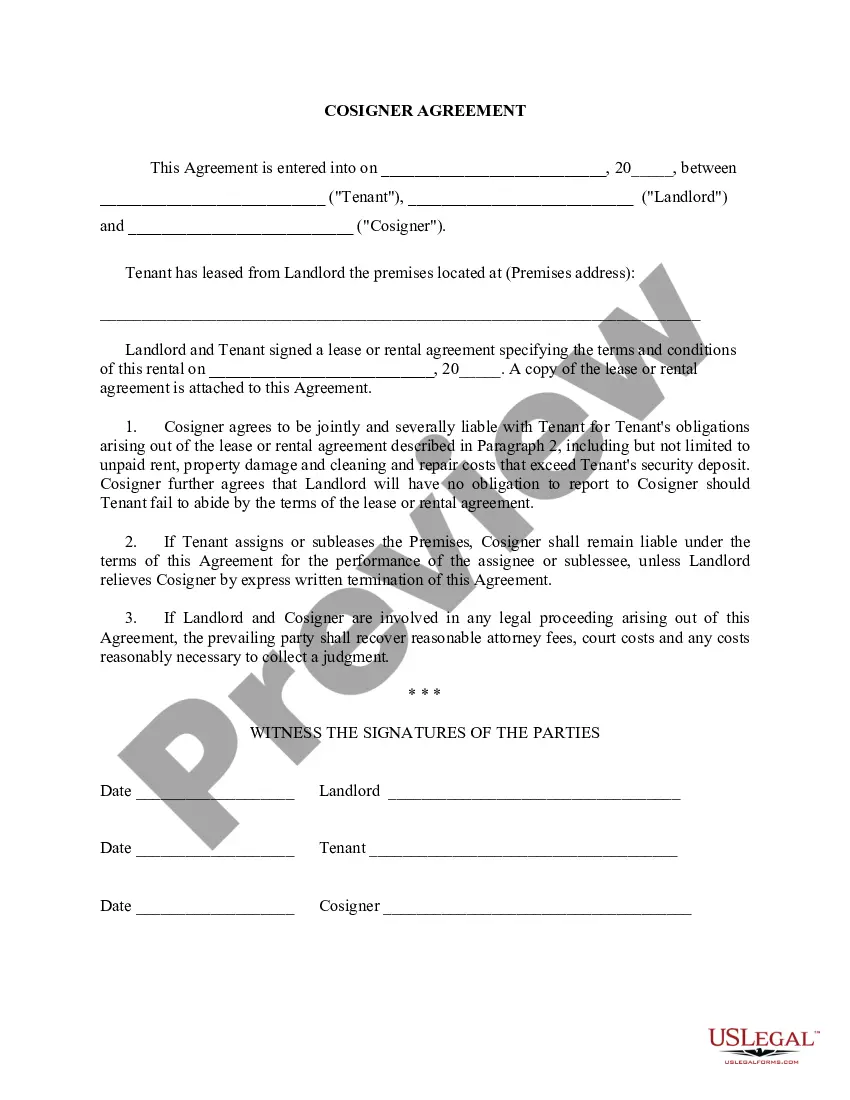

How to fill out Suffolk New York Trust Agreement - Family Special Needs?

Drafting papers for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Suffolk Trust Agreement - Family Special Needs without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Suffolk Trust Agreement - Family Special Needs by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Suffolk Trust Agreement - Family Special Needs:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!