Queens New York Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries is a legal document that outlines the terms and conditions of a trust in Queens, New York, where there are multiple trustees and beneficiaries involved. This type of trust agreement offers flexibility and control to the settler (the person creating the trust) by allowing them to revoke or modify the trust at any time during their lifetime. One of the main purposes of a revocable trust is to ensure the smooth and efficient transfer of assets to beneficiaries, while avoiding the potential complications of probate. By appointing multiple trustees, the settler can distribute responsibilities and ensure that the trust administration is carried out effectively. In Queens, New York, there are different types of trust agreements that fall under the category of Revocable — Multiple Trustees and Beneficiaries. These include: 1. Family Trust: A trust established to provide for the financial well-being of the settler's family members, such as children, grandchildren, or other loved ones. The multiple trustees can work together to manage the trust assets and make distributions as per the settler's instructions. 2. Charitable Trust: This type of trust agreement allows the settler to support charitable causes and organizations that hold significance to them. Multiple trustees can ensure that the trust assets are utilized in line with the settler's charitable intentions and goals. 3. Special Needs Trust: This trust agreement is designed to provide for the long-term financial care of a beneficiary with special needs. By appointing multiple trustees, the settler can ensure that the beneficiary's specific needs are met, and that the trust assets are appropriately managed. 4. Business Trust: In certain cases, a settler may establish a revocable trust to manage their business interests in Queens, New York. Multiple trustees, potentially including trusted business partners or family members, can oversee the operation and distributions of the trust assets related to the business. In summary, a Queens New York Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries is a versatile legal tool that allows individuals to create a trust that suits their specific needs while providing control and flexibility. Whether it's for the benefit of family members, charitable causes, individuals with special needs, or to manage business interests, such trust agreements can help streamline asset distribution and estate planning in Queens, New York.

Queens New York Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

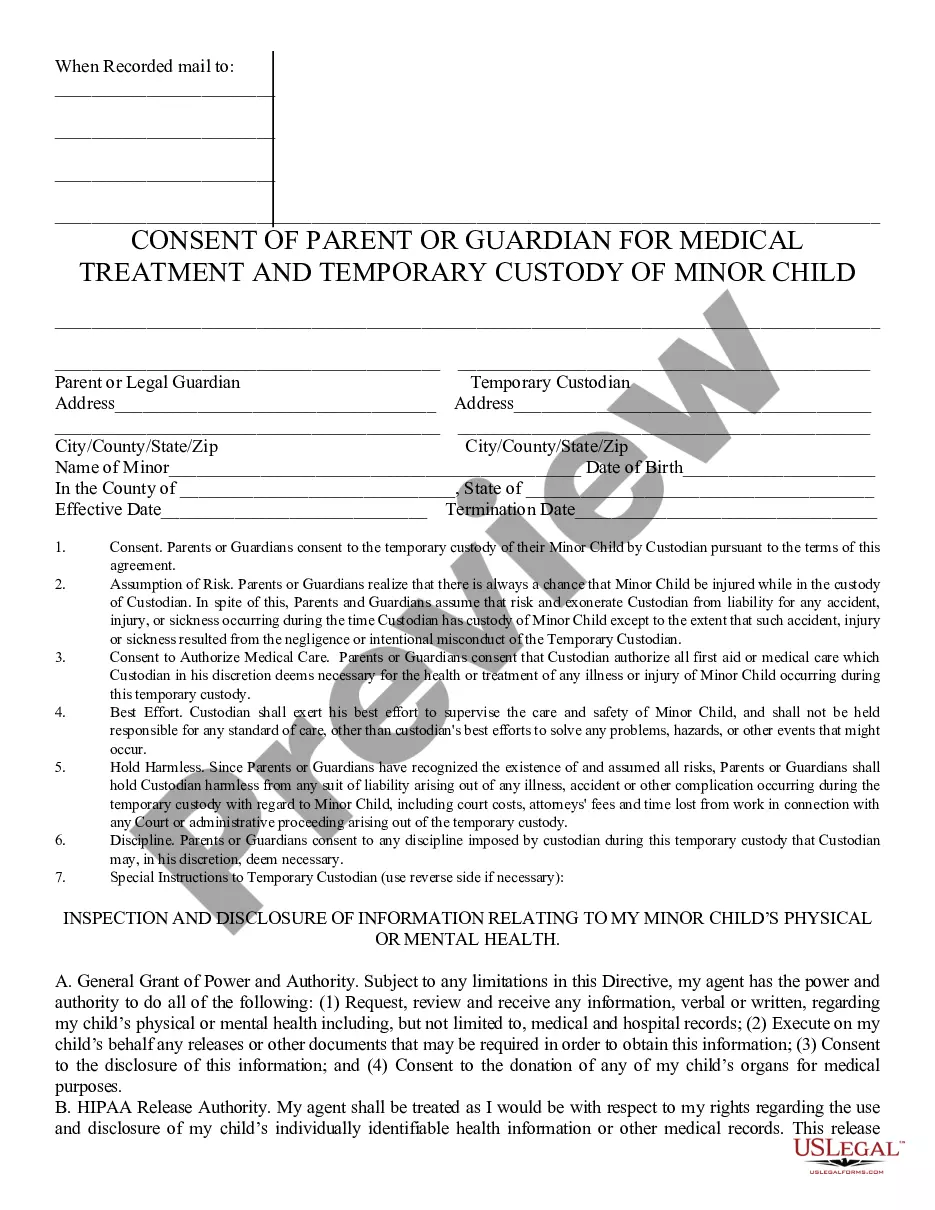

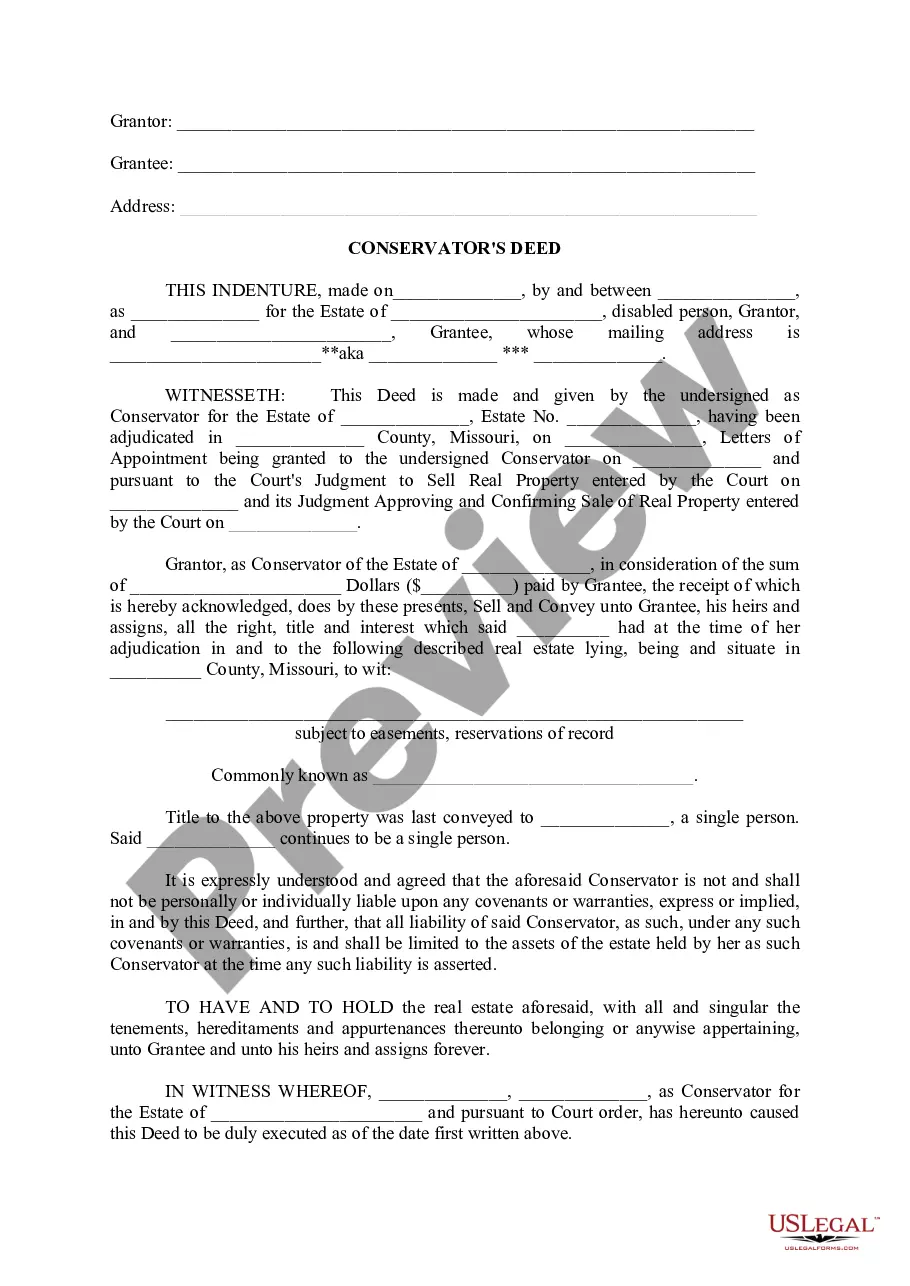

How to fill out Queens New York Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

Are you looking to quickly draft a legally-binding Queens Trust Agreement - Revocable - Multiple Trustees and Beneficiaries or probably any other form to manage your personal or corporate matters? You can select one of the two options: hire a professional to draft a legal document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Queens Trust Agreement - Revocable - Multiple Trustees and Beneficiaries and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Queens Trust Agreement - Revocable - Multiple Trustees and Beneficiaries is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Queens Trust Agreement - Revocable - Multiple Trustees and Beneficiaries template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!