A Mecklenburg North Carolina Trust Agreement is a legally binding document that establishes an irrevocable trust in Mecklenburg County, North Carolina. This type of trust agreement outlines the terms and conditions under which assets will be managed and distributed for the benefit of designated beneficiaries. An irrevocable trust is a powerful estate planning tool that is designed to provide asset protection, estate tax planning, and creditor protection. Once the trust agreement is created, it generally cannot be modified, changed, or revoked without the consent of all parties involved, including the beneficiaries. There are different types of Mecklenburg North Carolina Trust Agreements — Irrevocable, each serving different purposes based on the specific needs and goals of the granter. Some common types include: 1. Irrevocable Life Insurance Trust (IIT): This type of trust is commonly used to remove life insurance policies from the taxable estate, ensuring that the proceeds from the policy are exempt from estate taxes upon the granter's death. 2. Charitable Remainder Trust (CRT): A CRT allows the granter to make a charitable contribution while retaining an income stream from the trust for a specified period or for the rest of their life. 3. Special Needs Trust (SET): This type of trust is created for the benefit of a person with special needs, providing for their supplemental care and support without jeopardizing their eligibility for government assistance programs. 4. Granter Retained Annuity Trust (GREAT): A GREAT allows the granter to transfer assets to the trust while retaining a fixed annuity payment for a specified period. After the term, the remaining assets pass to the beneficiaries without incurring gift or estate taxes. 5. Qualified Personnel Residence Trust (PRT): A PRT is used to transfer a primary residence or vacation home out of the granter's estate at a discounted value while retaining the right to live in the property for a fixed period. It is essential to consult with an experienced estate planning attorney when considering a Mecklenburg North Carolina Trust Agreement — Irrevocable. They can guide individuals through the process, ensuring that the trust is created to meet their specific needs and goals while adhering to North Carolina's trust laws and regulations.

Mecklenburg North Carolina Trust Agreement - Irrevocable

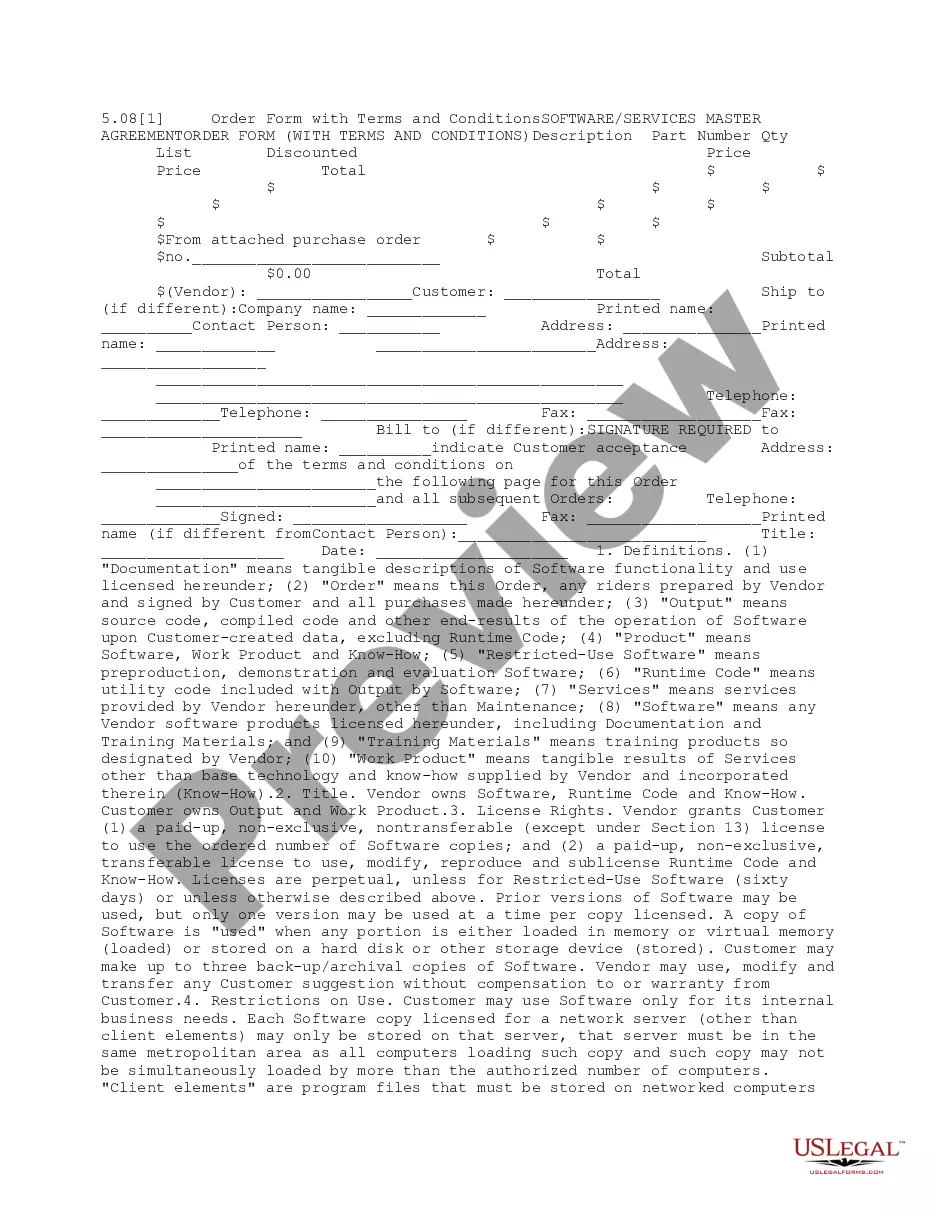

Description

How to fill out Mecklenburg North Carolina Trust Agreement - Irrevocable?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Mecklenburg Trust Agreement - Irrevocable, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how to purchase and download Mecklenburg Trust Agreement - Irrevocable.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar forms or start the search over to find the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Mecklenburg Trust Agreement - Irrevocable.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Mecklenburg Trust Agreement - Irrevocable, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you need to cope with an extremely difficult case, we advise getting a lawyer to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!