The Middlesex Massachusetts Revocable Trust Agreement Granteror as Beneficiary is a legal document that establishes a trust in Middlesex County, Massachusetts, where the granter also serves as the beneficiary of the trust. This agreement allows the granter to maintain control and access to their assets while providing a mechanism for their distribution upon their passing. This type of trust serves as a flexible estate planning tool for individuals residing in Middlesex County, Massachusetts. It offers several benefits, including asset protection, privacy, and the provision of detailed instructions for the management and distribution of assets upon the granter's death. There are several variations of the Middlesex Massachusetts Revocable Trust Agreement Granteror as Beneficiary, tailored to meet individual needs and circumstances. Some common types include: 1. Traditional Revocable Trust: This is the most basic form of a revocable trust, where the granter retains full control over their assets and may modify or revoke the trust at any time. 2. Irrevocable Living Trust: In contrast to a revocable trust, this type cannot be modified or revoked by the granter once it is established. It offers additional asset protection benefits and may have potential tax advantages. 3. Testamentary Trust: Unlike a living trust, this type is established through a will and only takes effect upon the granter's passing. It allows for the distribution of assets according to the granter's wishes while providing potential tax benefits. 4. Special Needs Trust: This trust is specifically designed to provide for the financial needs of individuals with disabilities. It ensures that they can receive public assistance benefits without jeopardizing their eligibility. 5. Charitable Remainder Trust: This type of trust allows the granter to donate assets to a charitable organization while still retaining an income stream from those assets during their lifetime. Upon the granter's death, the remaining assets are transferred to the designated charity. The Middlesex Massachusetts Revocable Trust Agreement Granteror as Beneficiary is a highly customizable legal tool used by individuals in Middlesex County, Massachusetts, to effectively manage their assets during their lifetime and ensure the proper distribution of those assets after their passing. It is essential to consult with a qualified attorney familiar with Massachusetts trust laws to create a trust agreement that best aligns with individual goals and circumstances.

Middlesex Massachusetts Revocable Trust Agreement - Grantor as Beneficiary

Description

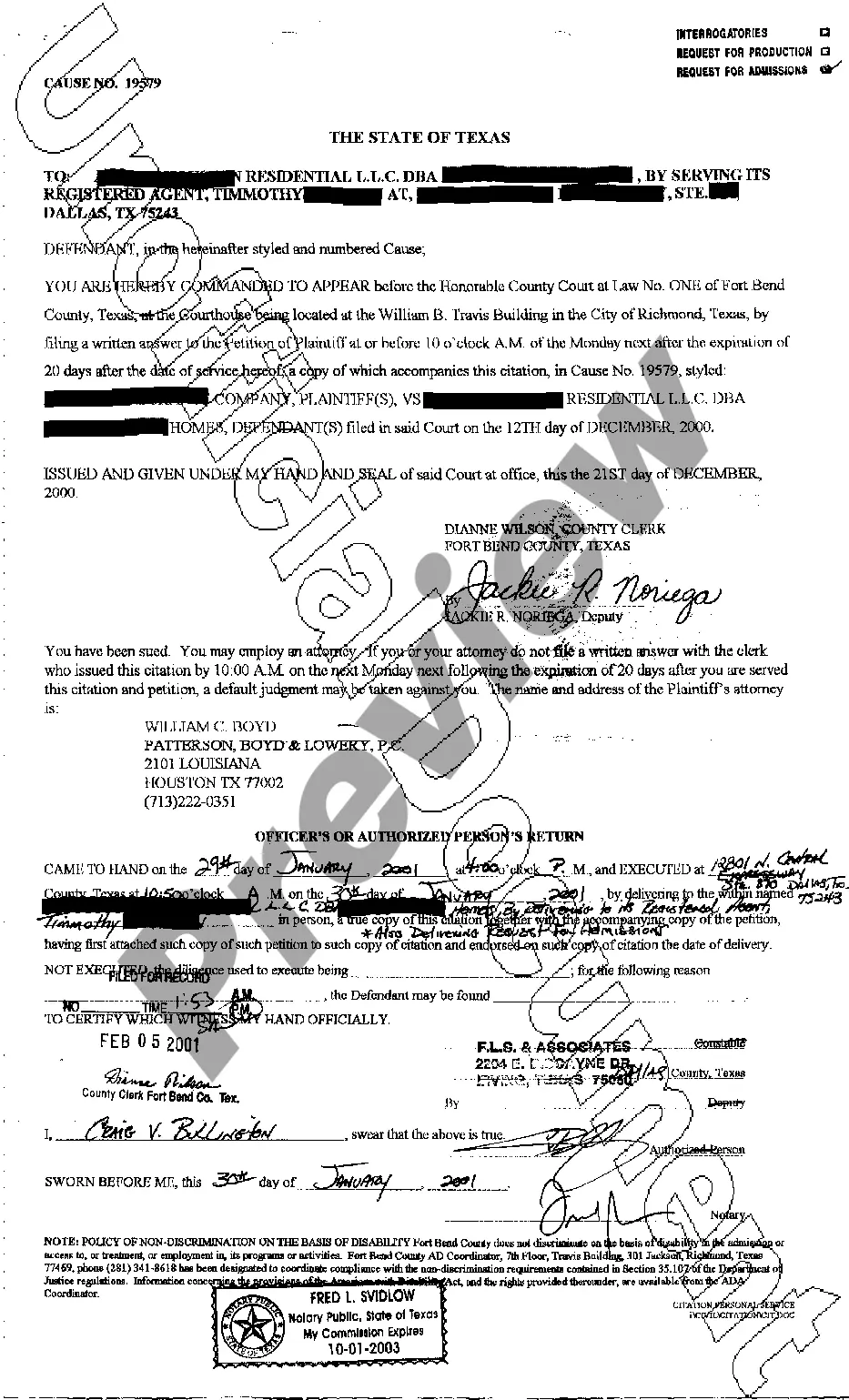

How to fill out Middlesex Massachusetts Revocable Trust Agreement - Grantor As Beneficiary?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Middlesex Revocable Trust Agreement - Grantor as Beneficiary, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the current version of the Middlesex Revocable Trust Agreement - Grantor as Beneficiary, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Revocable Trust Agreement - Grantor as Beneficiary:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Middlesex Revocable Trust Agreement - Grantor as Beneficiary and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Both the settlor and/or beneficiary can be a trustee, however if a beneficiary is a trustee it could lead to a conflict of interest especially when trustees have the power to decide by how much each beneficiary can benefit.

A grantor is the entity that establishes a trust and legally transfers control of those assets to a trustee, who manages it for one or more beneficiaries. In certain types of trusts, the grantor may also be the beneficiary, the trustee, or both.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary.

A revocable trust is created when an individual (the grantor) signs a trust agreement naming a person(s), a corporation (trust company or bank) or both as trustee to administer the trust. In many jurisdictions the grantor and the trustee can be the same person.

The simple answer is yes, a Trustee can also be a Trust beneficiary. In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary. Nearly every revocable, living Trust created in California starts with the settlor naming themselves as Trustee and beneficiary.

When making a will, people often ask whether an executor can also be a beneficiary. The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

In general, to benefit from all the advantages that trusts can give, the settlor, the trustee and the beneficiary are usually different people or groups of people. But they don't have to be. A settlor or trustee can also be a beneficiary of same trust.

A grantor is the entity that establishes a trust and legally transfers control of those assets to a trustee, who manages it for one or more beneficiaries. In certain types of trusts, the grantor may also be the beneficiary, the trustee, or both.

Both the settlor and/or beneficiary can be a trustee, however if a beneficiary is a trustee it could lead to a conflict of interest especially when trustees have the power to decide by how much each beneficiary can benefit.

It is a common misconception that an executor can not be a beneficiary of a will. An executor can be a beneficiary but it is important to ensure that he/she does not witness your will otherwise he/she will not be entitled to receive his/her legacy under the terms of the will.