The Clark Nevada Leaseback Provision is a clause commonly included in sales agreements that allows the seller to leaseback the property from the buyer for a specific period after the sale is finalized. This provision provides flexibility to the seller by allowing them to continue occupying the property while transitioning to a new residence or business location. Under the Clark Nevada Leaseback Provision, the terms and conditions of the leaseback are negotiated and agreed upon by both parties. This includes determining the duration of the leaseback period, the rental amount to be paid by the seller, and any other relevant terms such as maintenance responsibilities and insurance coverage. One type of Clark Nevada Leaseback Provision is the short-term leaseback. In this scenario, the seller requires temporary accommodation after the sale, typically due to a delay in finding a new property or completing the relocation process. The short-term leaseback provision allows the seller to continue residing or operating their business on the premises for a limited period, often a few weeks or months. Alternatively, there is the long-term leaseback provision. This type of leaseback is suitable when the seller needs an extended period to vacate the property. It may happen when they are waiting for a new property to be constructed, navigating a complex relocation process, or need additional time to fulfill obligations related to their business operations. The long-term leaseback provision typically lasts for several months or even years, offering more flexibility to the seller. The Clark Nevada Leaseback Provision offers benefits to both buyers and sellers. For sellers, it provides a smooth transition period, allowing them to organize their move at a convenient pace and potentially avoid the stress of finding temporary accommodations. Buyers can benefit from entering into a leaseback agreement as it generates rental income from the property they have purchased, which can help offset their mortgage payments or other costs associated with the property. In conclusion, the Clark Nevada Leaseback Provision in a sales agreement allows sellers to leaseback the property after the sale is completed. It offers short-term or long-term options, depending on the seller's requirements. This provision provides flexibility and convenience to both parties involved in the transaction.

Clark Nevada Leaseback Provision in Sales Agreement

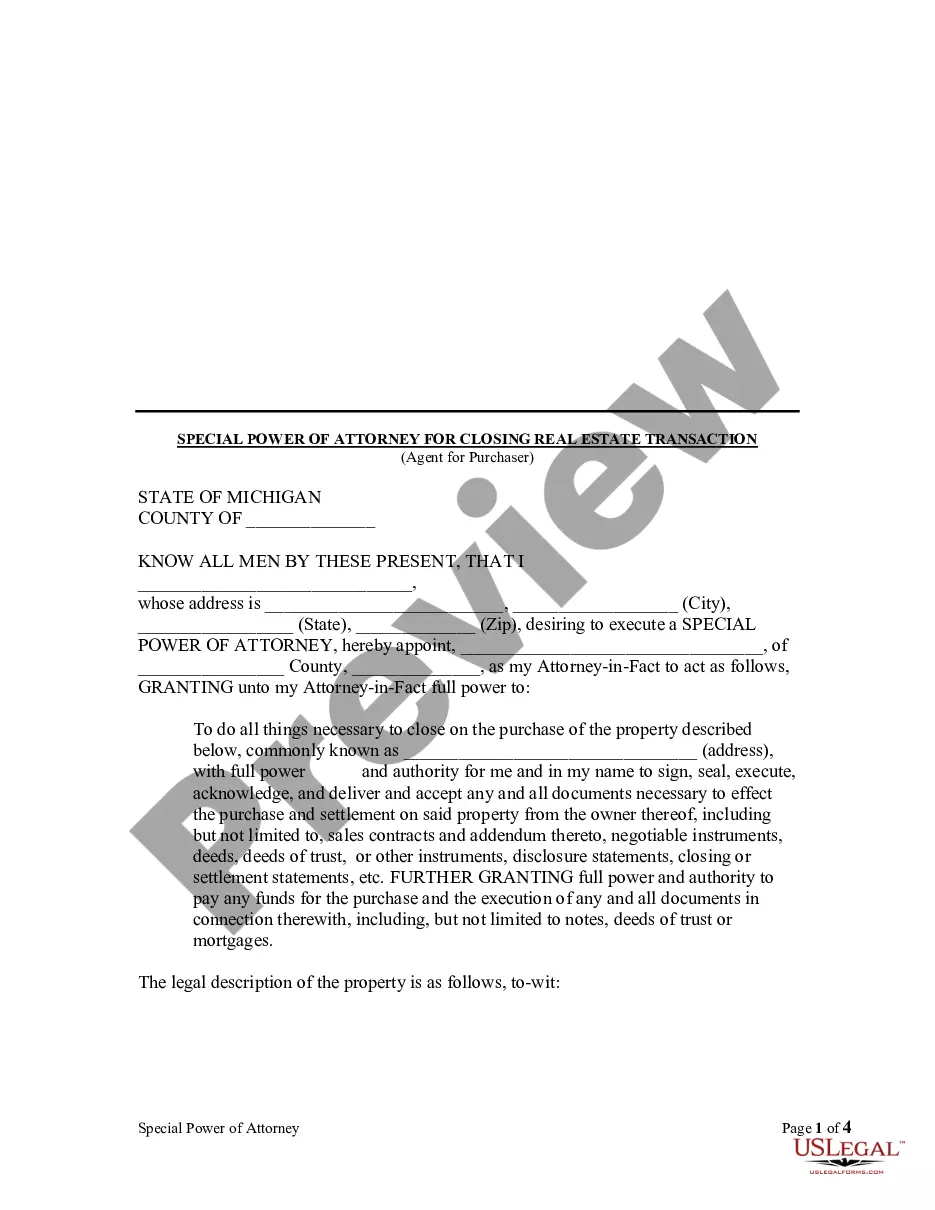

Description

How to fill out Clark Nevada Leaseback Provision In Sales Agreement?

Draftwing paperwork, like Clark Leaseback Provision in Sales Agreement, to manage your legal affairs is a difficult and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for various scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Clark Leaseback Provision in Sales Agreement form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Clark Leaseback Provision in Sales Agreement:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Clark Leaseback Provision in Sales Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!