The Clark Nevada Letter of Credit is a financial instrument that provides a guarantee of payment issued by a bank or financial institution on behalf of a buyer to a seller. This letter serves as a reassurance to the seller that they will receive payment for goods or services rendered, even if the buyer fails to fulfill their obligations. Clark Nevada Letter of Credit is one of the various types of letters of credit available in the financial market. It offers a secure and reliable method of ensuring payment between parties involved in international trade or business transactions. This type of letter of credit is widely recognized and accepted worldwide, which makes it an attractive option for both buyers and sellers. One notable feature of the Clark Nevada Letter of Credit is that it can be either revocable or irrevocable. A revocable letter of credit can be modified or canceled by the buyer or issuing bank without prior notification to the seller. On the other hand, an irrevocable letter of credit cannot be amended or revoked without the consent of all parties involved. Most Clark Nevada Letters of Credit are typically issued as irrevocable, providing a higher level of certainty and security for the seller. The Clark Nevada Letter of Credit also enables different payment methods, such as sight or time drafts. A sight draft requires immediate payment upon presentation, while a time draft allows for payment at a specified future date. Sellers often prefer sight drafts as they receive payment promptly, while buyers may opt for time drafts to gain additional time before making the payment. In addition, the Clark Nevada Letter of Credit can be further categorized based on whether it is backed by cash collateral or a line of credit. Cash collateralized letters of credit require the buyer to deposit funds equal to the letter of credit amount into an account, serving as a guarantee. On the other hand, a line of credit involves the buyer having a credit line with the issuing bank, allowing them to utilize the credit limit as collateral for the letter of credit. Overall, the Clark Nevada Letter of Credit is a crucial financial tool in facilitating secure international trade and ensuring payment certainty to sellers. It offers flexibility and protection to both buyers and sellers involved in various commercial transactions.

Clark Nevada Letter of Credit

Description

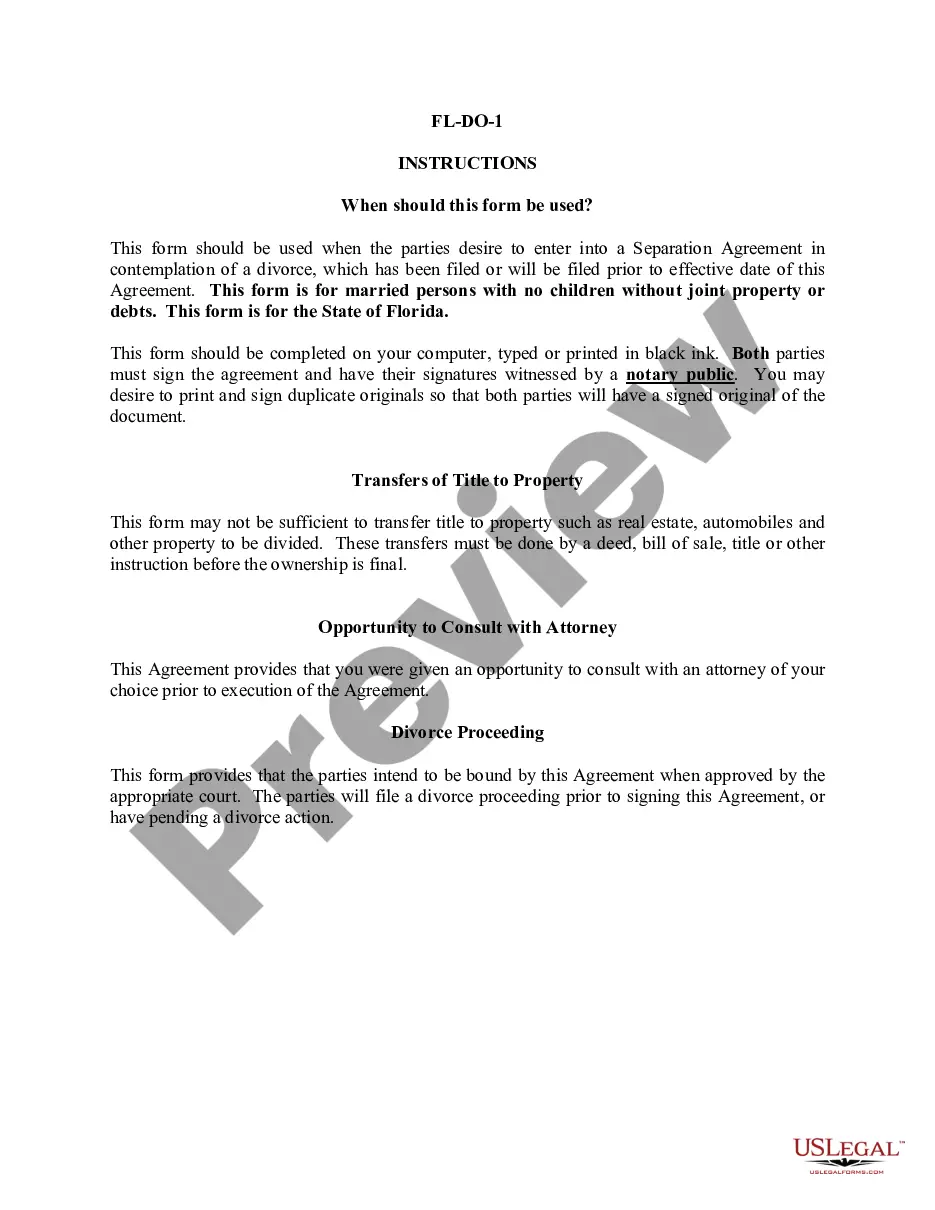

How to fill out Clark Nevada Letter Of Credit?

Do you need to quickly create a legally-binding Clark Letter of Credit or maybe any other form to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to write a valid paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant form templates, including Clark Letter of Credit and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Clark Letter of Credit is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were seeking by using the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Clark Letter of Credit template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the paperwork we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

As a type of advanced agreement for financing, a letter of credit enables a seller to determine the actual amount of money that will be received from the issuer of the letter of credit. A creditor may also use a letter of credit to ensure that the issuer of the letter will pay the creditor's drafts as agreed upon.

A confirmed letter of credit is a guarantee a borrower gets from a second bank in addition to the first letter of credit. The confirmed letter decreases the risk of default for the seller. By issuing the confirmed letter, the second bank promises to pay the seller if the first bank fails to do so.

Collateral Letter of Credit means any irrevocable unconditional Letter of Credit issued in the name of the Administrative Agent for the benefit of the Lenders in form and substance satisfactory to the Administrative Agent and drawn on a bank having a rating of at least AA by S&P and otherwise satisfactory to the

To get a letter of credit, contact your bank. You'll most likely need to work with an international trade department or commercial division. Not every institution offers letters of credit, but small banks and credit unions can often refer you to somebody who can accommodate your needs.

Transaction Payment Unlike a letter of credit, the seller receives immediate payment from a loan. A third party is not involved. Letters of credit were typically used before credit cards and traveler checks became everyday usage.

The most common contemporary letters of credit are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several others.

Letter of Credit Loan means a funding made by the Revolving Issuing Bank or any Revolving Lender pursuant to Section 2.2(f)(ii). Letter of Credit Loan a loan made by a Bank to or for the account of the Company pursuant to Section 2.13.

A letter of credit is essentially a financial contract between a bank, a bank's customer and a beneficiary. Generally issued by an importer's bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

A letter of credit, or "credit letter," is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.