Santa Clara, California, Letter of Credit: A Detailed Description of Its Types and Key Features In the bustling and vibrant city of Santa Clara, California, the letter of credit is a widely adopted financial instrument used in various trade and business transactions. A letter of credit serves as a guarantee from a financial institution to a seller, ensuring that the payment will be made to the seller if the terms and conditions specified in the document are met. This instrument plays a crucial role in facilitating smooth international and domestic trade, providing confidence to both buyers and sellers. Types of Santa Clara, California, Letter of Credit: 1. Revocable Letter of Credit: In this type of letter of credit, the buyer or the issuing bank has the authority to alter or cancel the letter of credit at any given time without prior notice. However, this type is not commonly used anymore due to its lack of security for the seller. 2. Irrevocable Letter of Credit: The most commonly used type of letter of credit, the irrevocable letter of credit offers a high level of security to sellers. Once issued, it cannot be modified or canceled without the consent of all parties involved, including the seller. This ensures that the seller will receive payment as long as the stated terms and conditions are met. 3. Standby Letter of Credit: This type of letter of credit serves as a guarantee of payment in case of default or non-performance by the buyer. It assures the seller that if the buyer fails to fulfill their obligations, the bank will step in and provide payment on their behalf. Standby letters of credit are often used to support contractual obligations, loans, or performance bonds. 4. Confirmed Letter of Credit: A confirmed letter of credit involves the participation of a second bank, usually an advising bank located in the seller's country, in addition to the issuing bank. The advising bank confirms its commitment to pay the seller, adding an extra layer of assurance. This type of letter of credit is particularly beneficial when the seller has doubts about the issuing bank's ability to honor the credit. Key Features of Santa Clara, California, Letter of Credit: 1. Flexibility and Security: A letter of credit provides flexibility for both buyers and sellers by establishing clear conditions for payment while offering security for the seller. It minimizes the risk of non-payment or non-performance, allowing parties to engage in trade with confidence. 2. Payment Assurance: The letter of credit ensures that the seller will receive payment as long as the terms and conditions stipulated within the document are met. This helps manage the risk associated with international transactions and fosters trust between parties. 3. International Trade Facilitation: Santa Clara, California, being a global hub for trade and commerce, heavily relies on letters of credit to facilitate international transactions. They eliminate geographic barriers, reduce payment delays, and streamline the documentation processes involved in global trade. 4. Streamlined Dispute Resolution: In case of disputes or discrepancies between the buyer and seller, a letter of credit provides a straightforward mechanism for resolution. The issuing bank examines the presented documents and determines their compliance with the agreed-upon terms, ensuring prompt resolution. In conclusion, the letter of credit is an integral part of Santa Clara, California's thriving trade ecosystem. Whether it's a revocable or irrevocable letter of credit, standby letter of credit, or confirmed letter of credit, these instruments offer security, flexibility, and assurance to buyers and sellers engaged in various trade transactions.

Santa Clara California Letter of Credit

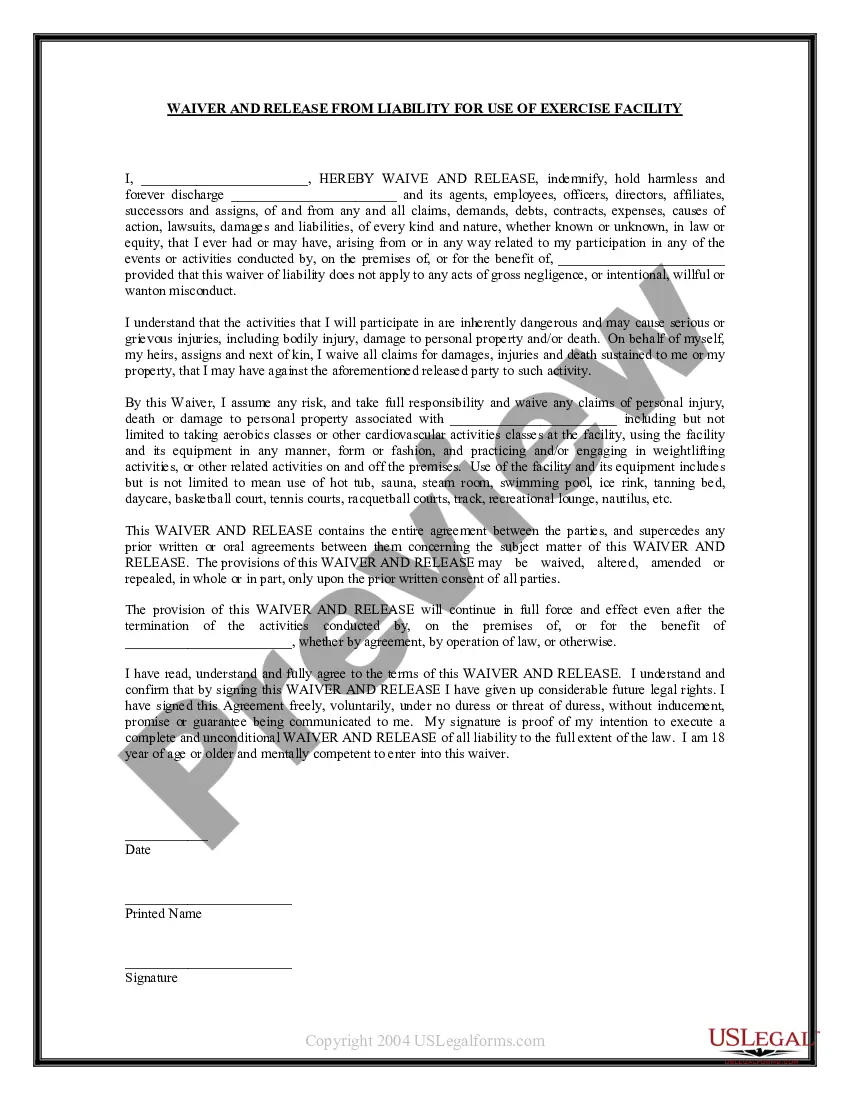

Description

How to fill out Santa Clara California Letter Of Credit?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Santa Clara Letter of Credit.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Santa Clara Letter of Credit will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Santa Clara Letter of Credit:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Santa Clara Letter of Credit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!