Chicago Illinois Agreement for Purchase of Business Assets from a Corporation is a legally binding document that outlines the terms and conditions for the acquisition of business assets from a corporation in the city of Chicago, Illinois. This agreement ensures that both the buyer and the seller are protected and their rights and obligations are clearly defined. It serves as a comprehensive understanding between the parties involved in the transaction. The Chicago Illinois Agreement for Purchase of Business Assets from a Corporation typically includes the following key elements: 1. Identification of Parties: The agreement begins by clearly identifying the buyer and the seller. It includes their legal names, addresses, and contact details. 2. Description of Assets: A detailed description of the assets being purchased is provided, including tangible assets such as inventory, equipment, real estate, and intangible assets like intellectual property, customer database, and goodwill. 3. Purchase Price and Payment Terms: The agreement specifies the agreed-upon purchase price for the business assets and outlines the payment terms, including any installments, down payments, or financing arrangements. 4. Due Diligence: This section states that the buyer has conducted thorough due diligence to assess the condition, value, and legality of the assets being purchased. It ensures that the buyer accepts the assets "as is" unless otherwise specified in the agreement. 5. Representations and Warranties: Both parties make certain representations and warranties to assure the accuracy and completeness of information provided. These may include statements related to the corporation's financial statements, tax filings, contracts, leases, and permits. 6. Closing Conditions and Delivery of Assets: This section outlines the conditions that must be met before the transaction is considered final and the assets are transferred. It includes requirements like obtaining necessary approvals, consents, and licenses. 7. Indemnification: The agreement defines the obligations of each party in case of any claims, damages, or liabilities arising from the purchase. It includes provisions for indemnification and limitation of liability. 8. Confidentiality and Non-Compete: This section ensures that both parties will maintain the confidentiality of any sensitive business information disclosed during the transaction and that the seller agrees to a non-compete clause for a specified period in the area of business being sold. Some different types of Chicago Illinois Agreement for Purchase of Business Assets from a Corporation include: 1. Stock Purchase Agreement: Instead of purchasing business assets, this agreement involves the purchase of the corporation's stock or shares. 2. Asset Purchase Agreement with Real Estate: This type of agreement includes the purchase of assets along with the associated real estate property. 3. Bulk Asset Sale Agreement: This agreement focuses on the sale of all or most of the business's assets in a single transaction, rather than individual assets. In conclusion, the Chicago Illinois Agreement for Purchase of Business Assets from a Corporation is a vital legal document that safeguards the interests of both the buyer and the seller during the acquisition of business assets. It ensures that all aspects of the transaction are clearly defined, agreed upon, and legally enforceable.

Chicago Illinois Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Chicago Illinois Agreement For Purchase Of Business Assets From A Corporation?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Chicago Agreement for Purchase of Business Assets from a Corporation without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Chicago Agreement for Purchase of Business Assets from a Corporation by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Chicago Agreement for Purchase of Business Assets from a Corporation:

- Look through the page you've opened and check if it has the sample you require.

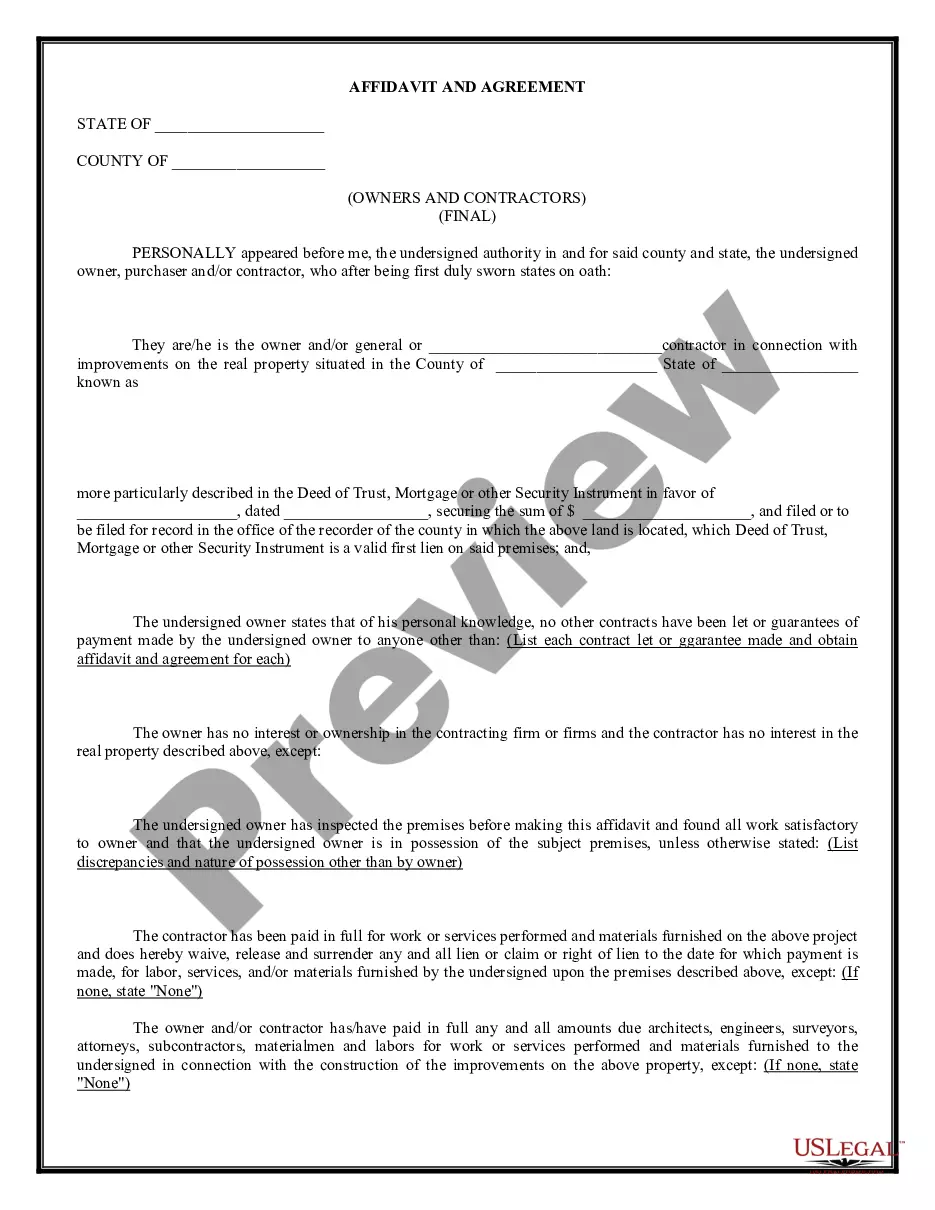

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!