The Hillsborough Florida Agreement for Purchase of Business Assets from a Corporation is a legally binding document that outlines the terms and conditions for the acquisition of business assets from a corporation in Hillsborough County, Florida. This agreement plays a significant role in facilitating the transfer of ownership, ensuring that both parties involved in the transaction have a clear understanding of their rights, responsibilities, and obligations. Keywords: Hillsborough Florida, Agreement for Purchase, Business Assets, Corporation, acquisition, transfer of ownership, rights, responsibilities, obligations. Types of Hillsborough Florida Agreement for Purchase of Business Assets from a Corporation: 1. Asset Purchase Agreement: This type of agreement focuses on the acquisition of specific assets of a corporation, such as equipment, inventory, real estate, intellectual property, or customer lists. 2. Stock Purchase Agreement: In this agreement, the purchaser acquires the ownership of the corporation by purchasing its outstanding shares of stock. This type of agreement involves the transfer of all business assets as a whole. 3. Merger Agreement: A merger agreement involves the consolidation of two or more corporations into one entity. As part of the merger, all business assets, including liabilities and obligations, are transferred to the surviving corporation. 4. Joint Venture Agreement: This agreement establishes a business arrangement between two or more corporations to jointly pursue a specific project or objective. Each corporation contributes business assets to the joint venture and shares profits, losses, and control according to predetermined terms. 5. Franchise Agreement: This agreement allows a corporation (franchisor) to grant the rights to another corporation (franchisee) to operate its business model, use its brand name, and access its assets, in exchange for franchise fees and royalties. In each type of agreement, the Hillsborough Florida Agreement for Purchase of Business Assets from a Corporation serves as a legal framework, ensuring that the transaction is conducted in compliance with local laws and regulations, protecting the interests of both parties involved. It covers essential elements such as purchase price, payment terms, representations and warranties, liabilities, closing conditions, and dispute resolution mechanisms. It is important that each party seeking to engage in the purchase of business assets from a corporation in Hillsborough County, Florida, thoroughly reviews and understands the specific agreement type that applies to their transaction, seeking legal counsel if necessary, to ensure a smooth and legally compliant acquisition process.

Hillsborough Florida Agreement for Purchase of Business Assets from a Corporation

Description

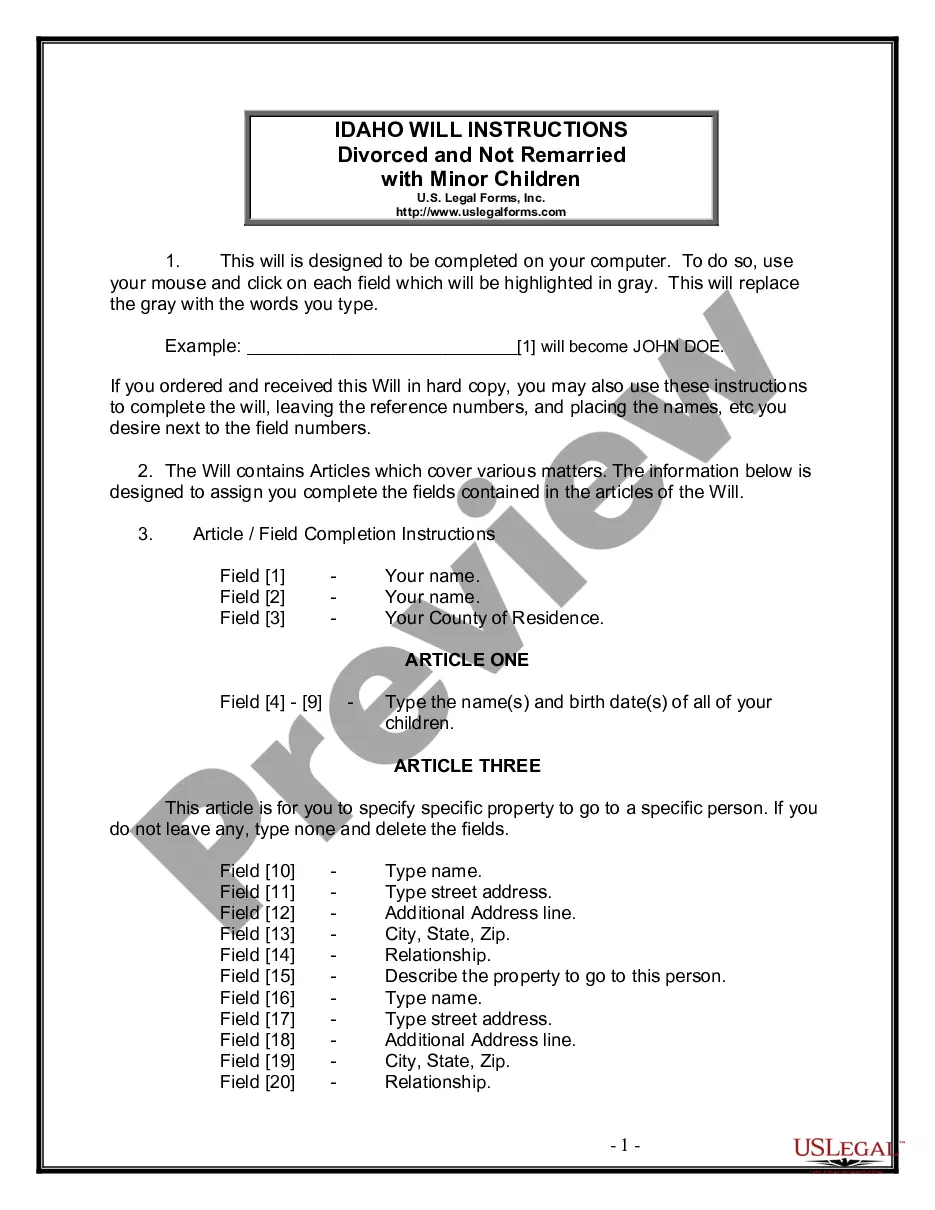

How to fill out Hillsborough Florida Agreement For Purchase Of Business Assets From A Corporation?

Creating forms, like Hillsborough Agreement for Purchase of Business Assets from a Corporation, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Hillsborough Agreement for Purchase of Business Assets from a Corporation form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Hillsborough Agreement for Purchase of Business Assets from a Corporation:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Hillsborough Agreement for Purchase of Business Assets from a Corporation isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our website and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!