Orange, California Shareholder and Corporation Agreement to Issue Additional Stock to a Third Party to Raise Capital In Orange, California, a shareholder and corporation agreement is a legally binding document that outlines the terms and conditions under which a corporation can issue additional stock to a third party in order to raise capital. This agreement is essential for maintaining transparency and protecting the rights and interests of both the existing shareholders and the corporation. The purpose of issuing additional stock is to secure funding for various business endeavors, such as expansion plans, research and development projects, or debt repayment. By offering shares to a third party, the corporation can generate funds without taking on additional debt or relying solely on internal resources. The third party, or investor, receives ownership in the company in exchange for their investment. The agreement typically covers several key aspects, including the number of shares to be issued, the price per share, any restrictions on the transfer of shares, and the rights and privileges associated with the newly issued shares. It ensures that the rights of existing shareholders are not diluted and protects their ownership interests. Different types of Orange, California shareholder and corporation agreements to issue additional stock to a third party to raise capital may include: 1. Common Stock Issue Agreement: This agreement governs the issuance of common stock to a third party investor. Common stockholders have voting rights, but their claims on the company's assets and earnings are subordinate to the claims of preferred shareholders. 2. Preferred Stock Issue Agreement: This agreement pertains to the issuance of preferred stock to a third party. Preferred stockholders have certain preferences over common stockholders, such as priority in receiving dividends and the right to be paid first in the event of liquidation. 3. Convertible Stock Issue Agreement: This type of agreement allows for the issuance of convertible stock, which can be converted into common or preferred shares at a later date. This provides flexibility to the investor and potentially increases the attractiveness of the investment opportunity. 4. Restricted Stock Issue Agreement: This agreement places restrictions on the transfer or sale of the newly issued shares for a specified period of time. This helps ensure that the investor maintains a long-term commitment to the company and aligns their interests with the corporation's goals. By having a well-drafted Orange, California shareholder and corporation agreement, both the corporation and the shareholders can have a clear understanding of their rights, responsibilities, and obligations when it comes to issuing additional stock to raise capital. This agreement protects the interests of all parties involved and promotes a harmonious and transparent business environment.

Orange California Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

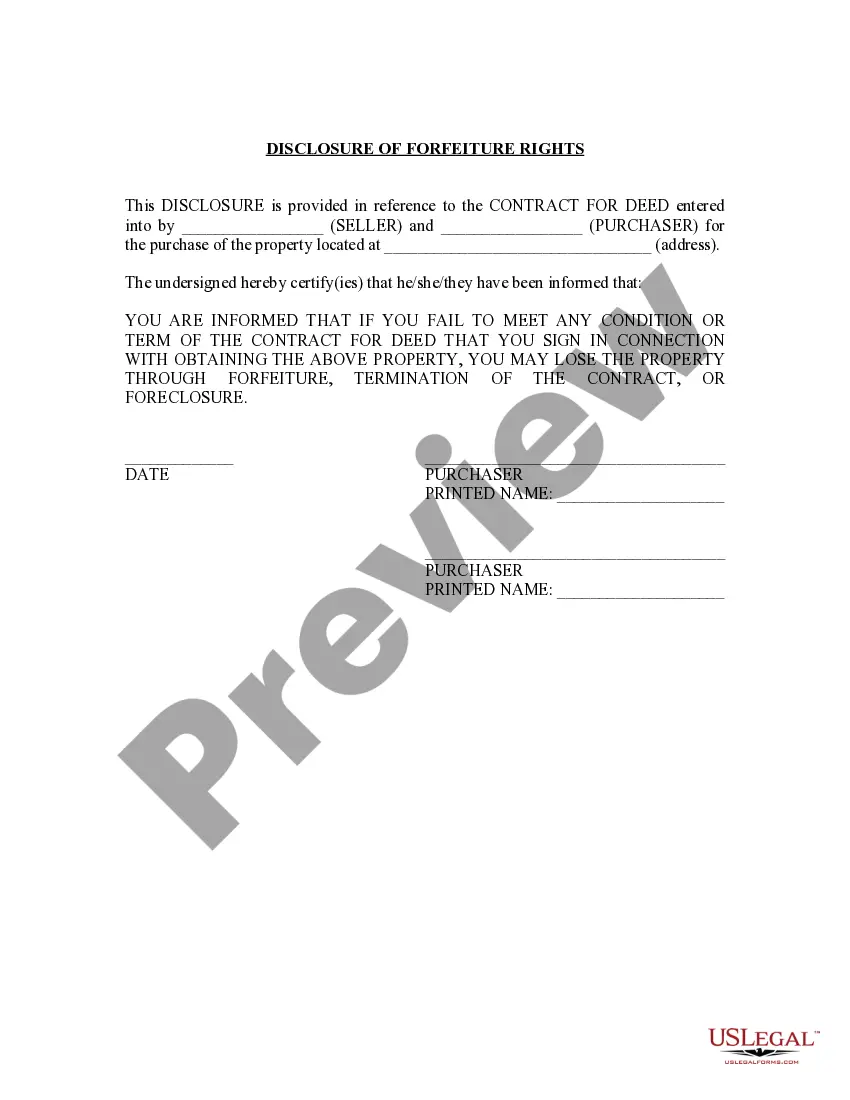

How to fill out Orange California Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Orange Shareholder and Corporation agreement to issue additional stock to a third party to raise capital, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the current version of the Orange Shareholder and Corporation agreement to issue additional stock to a third party to raise capital, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Shareholder and Corporation agreement to issue additional stock to a third party to raise capital:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Orange Shareholder and Corporation agreement to issue additional stock to a third party to raise capital and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

A company can raise capital by selling off ownership stakes in the form of shares to investors who become stockholders. This is known as equity funding. Private corporations can raise capital by offering equity stakes to family and friends or by going public through an initial public offering (IPO).

Corporations issue or sell shares of stock to raise capital to fund the business. The funds can be used to: Buy a company, such as a competitor or supplier.

Equity financing is basically the process of issuing and selling shares of stock to raise money. Investors who buy shares of a company become shareholders and can earn investment gains if the stock price rises in value or if the company pays a dividend.

Corporations issue stock to raise money for growth and expansion. To raise money, corporations will issue stock by selling off a percentage of profits in a company.

Share dilution happens when a company issues additional stock. Therefore, shareholders' ownership in the company is reduced, or diluted when these new shares are issued. Assume a small business has 10 shareholders and that each shareholder owns one share, or 10%, of the company.