San Diego, California is a vibrant coastal city renowned for its pleasant weather, stunning beaches, and a wealth of cultural attractions. Nestled on the Pacific Coast, it is the second-largest city in California and boasts a diverse population, thriving economy, and rich history. In terms of corporate matters, San Diego offers a conducive environment for businesses to thrive. One essential aspect of corporate governance is the Shareholder and Corporation Agreement, a legal document that outlines the relationship between shareholders and the corporation. This agreement serves as a blueprint for various corporate activities, including the issuance of additional stock to raise capital from a third party. When a corporation decides to issue additional stock to a third party for capital generation, several types of San Diego, California Shareholder and Corporation Agreements could be employed. These agreements vary depending on the specific details and requirements of the corporation and its shareholders. Some commonly known types include: 1. Authorized Share Agreement: This agreement sets the maximum number of shares the corporation can issue to third parties. It ensures that the corporation does not exceed its authorized share capital limit while raising capital through stock issuance. 2. Preemptive Rights Agreement: This agreement grants existing shareholders the right to purchase any newly issued shares before third parties are allowed to acquire them. By offering existing shareholders the first opportunity to buy more shares, the preemptive rights' agreement protects their ownership and allows them to maintain their proportional stake in the corporation. 3. Subscription Agreement: A subscription agreement is a contract between the corporation and the third party interested in purchasing additional shares. It includes terms and conditions for the transaction, such as the number of shares, purchase price, payment terms, and any other relevant details specific to raising capital through stock issuance. 4. Voting Rights Agreement: This agreement outlines the rights and privileges granted to shareholders regarding voting on matters impacting the corporation's stock issuance and capital raising. It may specify the voting thresholds required to approve the issuance of additional shares, ensuring transparency and shareholder involvement in such key decisions. 5. Consent Agreement: In certain situations, if a corporation plans to issue shares to a specific third party, a consent agreement may be required. This agreement involves obtaining the consent of existing shareholders to approve the issuance of additional stock to the chosen third party. Consent agreements ensure transparency and fairness in the process of raising capital through stock issuance. San Diego, California's corporate landscape offers numerous opportunities and options for businesses to navigate the intricacies of raising capital through the issuance of additional stock. The Shareholder and Corporation Agreements discussed above play a crucial role in ensuring the smooth execution of such capital-raising activities while safeguarding the interests of shareholders and the corporation alike.

San Diego California Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out San Diego California Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

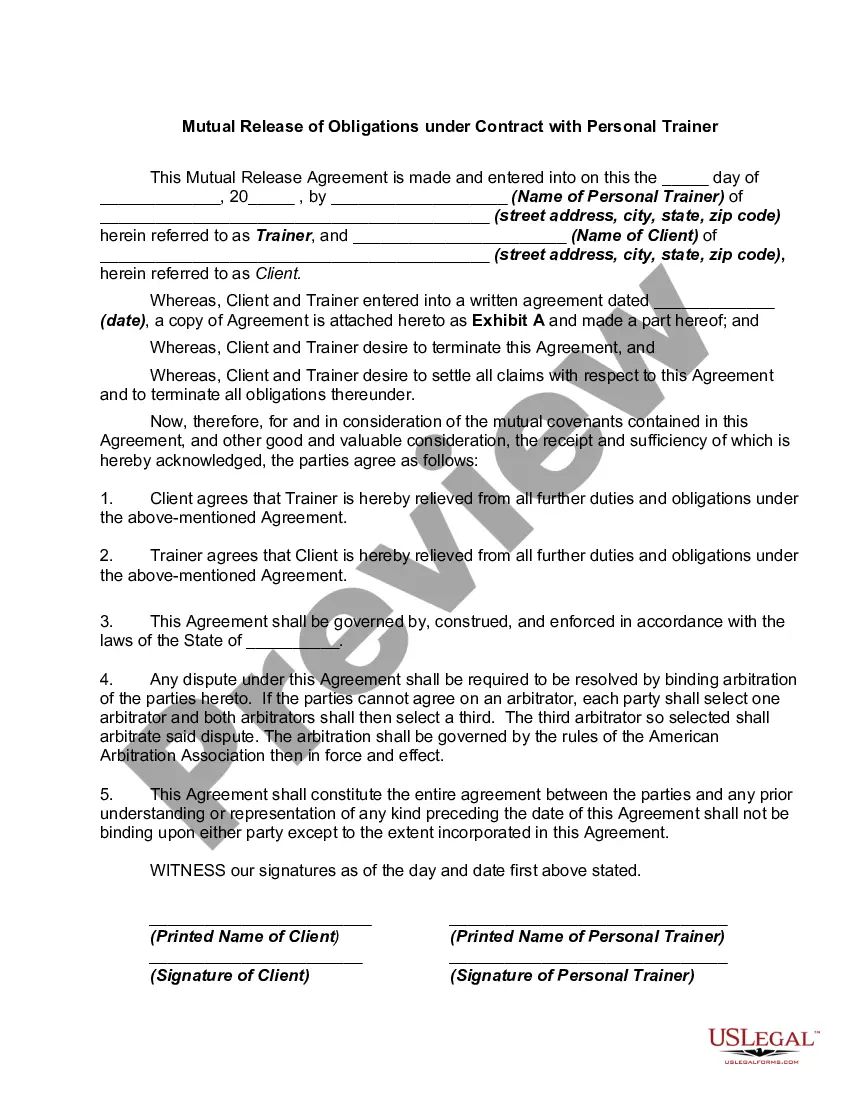

Preparing papers for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft San Diego Shareholder and Corporation agreement to issue additional stock to a third party to raise capital without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Diego Shareholder and Corporation agreement to issue additional stock to a third party to raise capital by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the San Diego Shareholder and Corporation agreement to issue additional stock to a third party to raise capital:

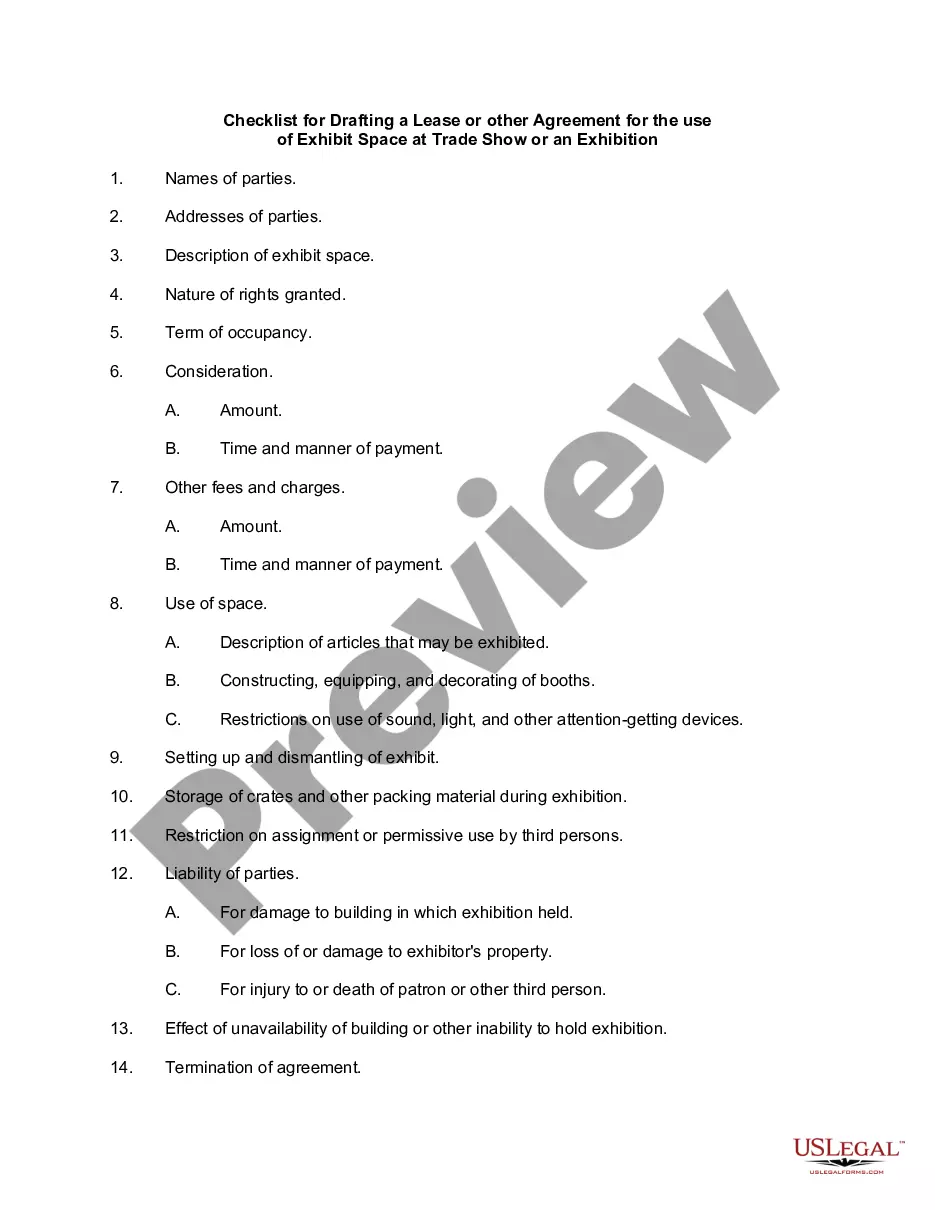

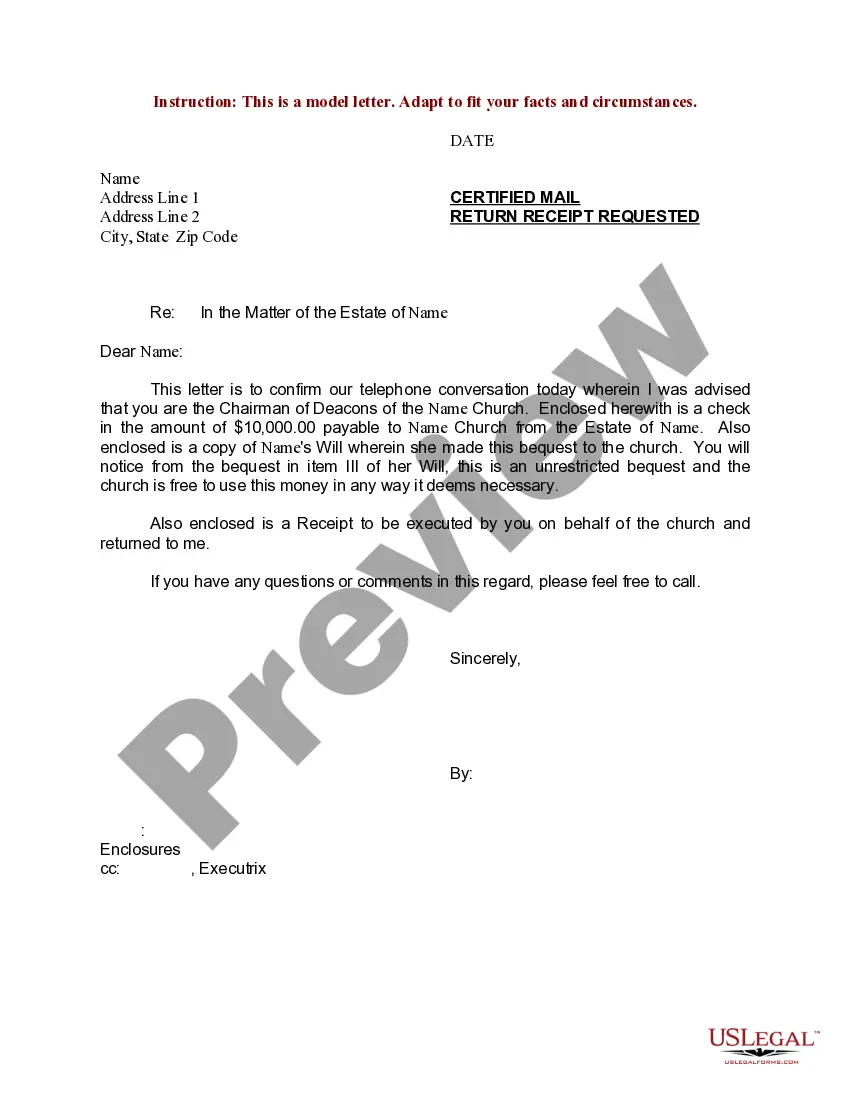

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

However, a company commonly has the right to increase the amount of stock it's authorized to issue through approval by its board of directors. Also, along with the right to issue more shares for sale, a company has the right to buy back existing shares from stockholders.

A corporation will most likely decide to issue additional shares of stock in order to raise additional capital. The benefit of raising additional capital is obviousmore capital for the corporation allows the company to grow.

New share issuance can also dilute a stock's value sometimes if a company values its new shares at below its stock's current market price. Such a deviation in valuation can happen in certain mergers and acquisitions in which an acquiring company offers its shares for the exchange of a target company's shares.

The number of authorized shares per company is assessed at the company's creation and can only be increased or decreased through a vote by the shareholders. If at the time of incorporation the documents state that 100 shares are authorized, then only 100 shares can be issued.

Equity financing is basically the process of issuing and selling shares of stock to raise money. Investors who buy shares of a company become shareholders and can earn investment gains if the stock price rises in value or if the company pays a dividend.

Equity Capital A company can raise capital by selling off ownership stakes in the form of shares to investors who become stockholders. This is known as equity funding. Private corporations can raise capital by offering equity stakes to family and friends or by going public through an initial public offering (IPO).

When companies issue additional shares, it increases the number of common stock being traded in the stock market. For existing investors, too many shares being issued can lead to share dilution. Share dilution occurs because the additional shares reduce the value of the existing shares for investors.

Firms can raise the financial capital they need to pay for such projects in four main ways: (1) from early-stage investors; (2) by reinvesting profits; (3) by borrowing through banks or bonds; and (4) by selling stock.

Corporations issue stock to raise money for growth and expansion. To raise money, corporations will issue stock by selling off a percentage of profits in a company.

Provided that the directors have the authority to allot shares, as determined by the company's Articles of Association, the Companies Act 2006 and any shareholder resolutions, a company can issue more shares.