Travis Texas Shareholder and Corporation Agreement: Issuing Additional Stock to Raise Capital When it comes to raising capital for a corporation, one of the common strategies is to issue additional stock to interested third parties. In Travis, Texas, shareholders and corporations can enter into specific agreements to facilitate this process. These agreements outline the terms, conditions, and legal obligations involved in issuing additional stock, ensuring transparency and protecting the interests of all parties involved. In such agreements, several relevant keywords come into play. These include "Travis, Texas," "shareholder and corporation agreement," "issuing additional stock," "raising capital," and "third party." By exploring these keywords, we can discuss the detailed aspects and various types of agreements that exist in this context. A Travis Texas Shareholder and Corporation Agreement related to issuing additional stock to raise capital typically includes the following key elements: 1. Purpose and Background: This section provides an overview of why the corporation intends to issue additional stock and raise capital, highlighting the company's growth plans, ongoing operations, or specific projects that require funds. It outlines the corporation's need for capital infusion and the shareholders' desire to maintain or enhance the value of their ownership interest. 2. Authorized Capital Stock: Here, the total authorized shares of the corporation are defined, including any existing common shares, preferred shares, or other classes of stock. This section also specifies the number of shares to be issued to the third party as a part of the capital-raising arrangement. 3. Sale of Additional Shares: This clause explains the terms and conditions under which the corporation can offer and sell additional shares to the third party. It includes information on the pricing, payment terms, and any restrictions or preferences associated with the newly issued shares. 4. Preemptive Rights: Shareholders' preemptive rights, if applicable, are mentioned here. Preemptive rights give existing shareholders the opportunity to purchase new shares before they are offered to outside parties. If preemptive rights exist, this section outlines the procedures and time frames within which shareholders can exercise these rights. 5. Voting and Control: This clause defines the impact of the new shares on the overall voting and control rights within the corporation. It addresses issues such as whether the third party acquiring the shares will have any significant influence or voting power and under what circumstances this may change. Different types of Travis Texas Shareholder and Corporation Agreements may include: 1. General Share Issuance Agreements: These agreements outline the general framework for issuing additional shares and raising capital, without specific conditions or limitations. 2. Specific Purpose Share Issuance Agreements: These agreements focus on a particular purpose for capital infusion. For example, a corporation launching a new product may issue additional shares solely for funding research and development or marketing campaigns. 3. Preferred Stock Issuance Agreements: In certain cases, corporations may issue preferred stock to a third party instead of common stock. These agreements address the specific terms and conditions of preferred stock offerings, such as dividend preferences or conversion rights. By clearly defining the terms and conditions for issuing additional stock to raise capital, Travis Texas Shareholder and Corporation Agreements ensure that shareholders, corporations, and third parties involved have a clear understanding of their rights and obligations. These agreements play an essential role in maintaining transparency, protecting interests, and fostering smooth capital-raising processes within the Travis, Texas business community.

Travis Texas Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

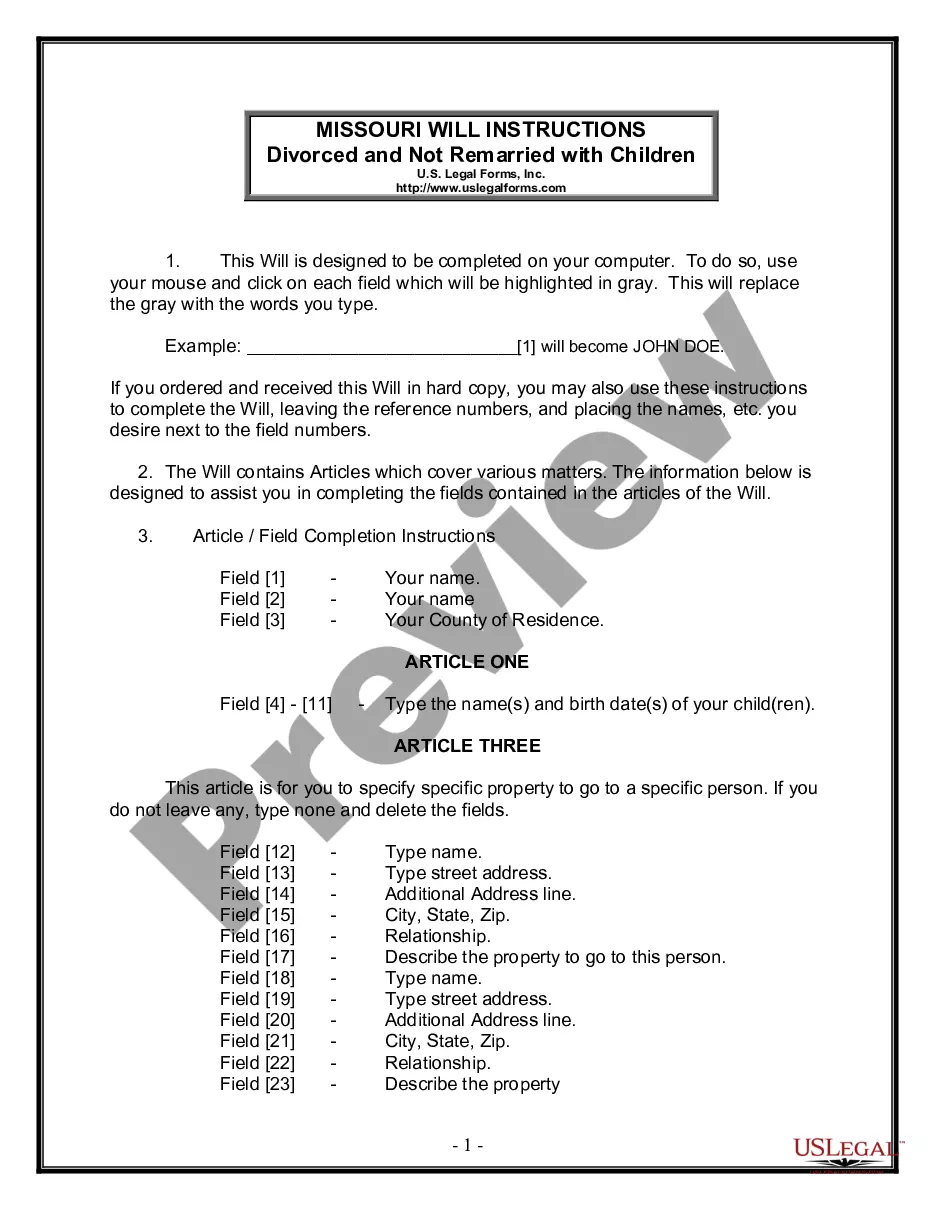

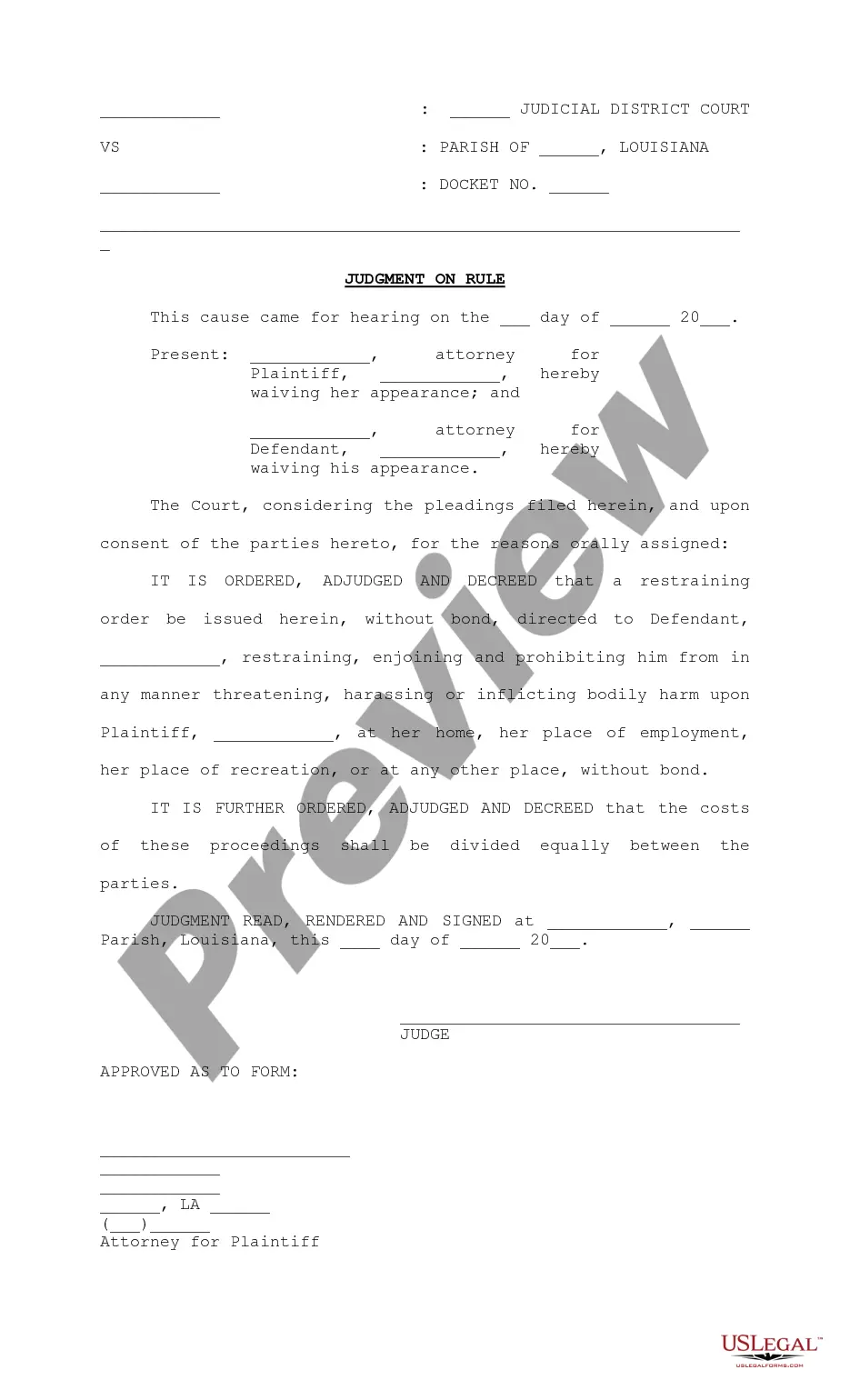

How to fill out Travis Texas Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Travis Shareholder and Corporation agreement to issue additional stock to a third party to raise capital without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Travis Shareholder and Corporation agreement to issue additional stock to a third party to raise capital by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Travis Shareholder and Corporation agreement to issue additional stock to a third party to raise capital:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

The directors (and/or shareholders) decide to create new shares in the company and give them to a new or existing shareholder....The company will also need to:issue a share certificate to the incoming shareholder;update its member register to reflect the share issuance; and.notify ASIC of the share issuance.31 July 2017

The procedure followed for Right issue of Shares is as follows:Notice of Board Meeting.Hold Board Meeting.Letter of Offer.Subscription Period of Acceptance.Form MGT-1.Accept Application Money.Second Board Meeting.Allotment of Shares.More items...

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

To issue shares in a company is to create new shares, and:All existing members are to agree to the issue of shares via a board meeting.You are to complete a return of allotment of shares via an SH01 form.Create board resolution, meeting minutes, and issue the share certificate(s) to the new shareholder.More items...?

Authority to allot new shares Directors of companies with more than one class of shares need to obtain express authority to allot from the company's shareholders. This is done by means of an ordinary resolution passed at a general meeting or using the 2006 Act written resolution procedure.

1 Provide the applicants with a form of application.2 Shares are allotted via board resolution.3 Issue share certificates to those who have been allotted shares.4 Complete a return of allotments via form SH01 to Companies House.5 Update the register of members and register of allotments.More items...?

Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder. Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.

To issue stock in a corporation, you can use a simple bill of sale. Stock is issued to fund the corporationin the Articles of Incorporation, the corporation sets the number of shares the corporation is authorized to issue. The corporation then decides how many shares of stock it will initially issue.

To issue stock in a corporation, you can use a simple bill of sale. Stock is issued to fund the corporationin the Articles of Incorporation, the corporation sets the number of shares the corporation is authorized to issue. The corporation then decides how many shares of stock it will initially issue.